Samsung to end SATA SSD production as it pivots to AI memory, leaker says

Samsung may be preparing to stop making SATA solid-state drives (SSDs) by 2026, according to a recent leak from a well-known hardware source. This would mark a big change for one of the world’s largest storage makers. SATA SSDs like the popular 870 EVO series have long been favoured for everyday laptops, older desktops, and budget builds because they are cheaper and simpler to use. But demand for these older drives has been falling as faster NVMe SSDs take over.

At the same time, Samsung and other chip makers are pushing hard into AI-focused memory and storage technologies that power massive data centres and generative AI systems. If the leak proves true, it shows how the rise of AI isn’t just changing software, it’s reshaping the very products tech companies choose to build first.

What the leak claims: timeline, scope, and products affected

A prominent hardware leaker said Samsung plans to stop making SATA SSDs in 2026. The claim surfaced publicly on December 15, 2025. The leak points especially to the consumer EVO line, including long-running 2.5-inch models. The tipster says Samsung could announce the move around CES 2026. This would be a phased cut, not an immediate shutdown. Existing stock would still sell. Support or firmware updates for current drives would likely continue for a time.

Why has SATA fallen from priority?

SATA drives are older tech. They use a slower interface than NVMe. Consumer demand now favors speed and smaller form factors. PC makers and OEMs also prefer NVMe for new builds. Profit margins on cheap SATA parts have shrunk. Asian competitors supply low-cost NAND at tight prices. For Samsung, the volume game of SATA no longer matches margins from higher-end memory products.

Samsung’s AI memory pivot: what’s at stake

Samsung is investing heavily in AI memory. The firm showcased HBM and other AI-oriented roadmaps at FMS 2025. HBM4, custom HBM stacks, and Z-NAND-based storage were highlighted. These parts sell into data centers and AI acceleration systems. They command higher prices than commodity SATA SSDs. Samsung’s shift aims to capture long contracts with hyperscalers. That yields steadier revenue and better margins.

Competitive landscape driving the change

Rivals also race into AI memory. SK Hynix and Micron are expanding HBM and AI DRAM supply. Nvidia’s booming demand for HBM in GPUs puts pressure on the whole supply chain. Memory makers now face a clear choice: serve AI clients or compete in low-margin consumer markets. Samsung’s move would push more SATA demand onto smaller brands. It would also intensify competition among the remaining commodity suppliers.

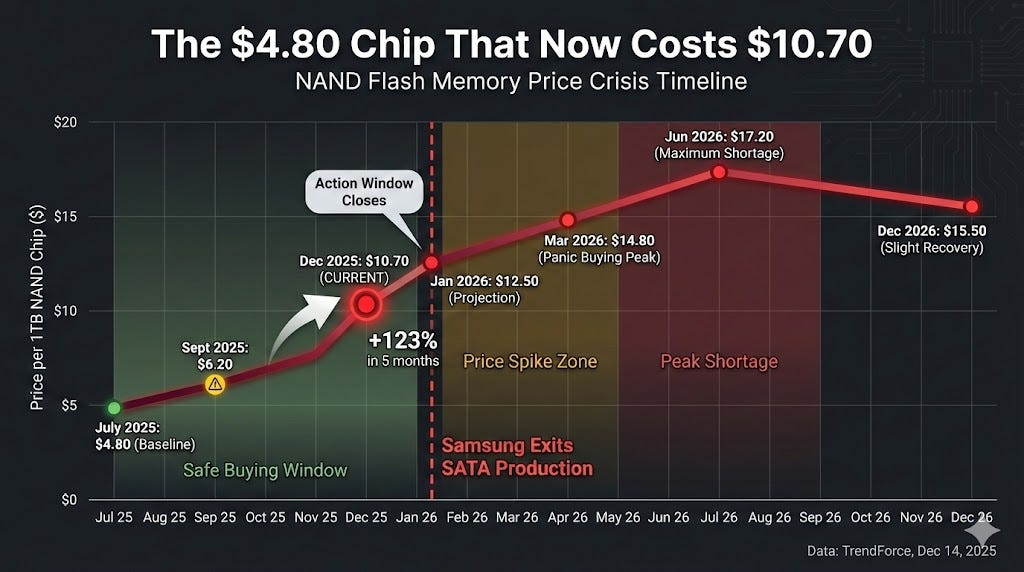

Short-term market effects and pricing pressure

A Samsung withdrawal could tighten global SSD supply. Analysts warn of price pressure lasting up to 18 months. Distributors may see reduced inventory for both SATA and some NVMe SKUs. Some buyers might hoard stock, which would sharpen the squeeze. Expect short-term price rises for entry-level SSDs, and possible ripple effects for budget laptops and refurbished systems.

What does this mean for consumers and PC builders?

Budget shoppers may feel the impact first. Entry-level SATA models could become costlier or less common. For older desktops and laptops, spare parts could thin out. Upgrading to NVMe is the practical path, but not always cheap. For low-power or legacy builds that still accept SATA, choices will shrink. Shoppers should check local stock and price trends before buying big batches.

Enterprise and OEM consequences

Large system builders will adapt quickly. Data centers already favor NVMe and new memory classes like CXL-attached storage. But many enterprise systems still use SATA in backup arrays or legacy servers. OEMs may rework SKUs or change suppliers.

Some server makers could accelerate NVMe rollouts to avoid future supply risk. For environments that cannot switch, procurement contracts may include longer lead times and price-adjustment clauses.

Is this the end of SATA SSDs?

Samsung’s leaving would be symbolic. Other manufacturers will still make SATA drives. Demand will not vanish overnight. Legacy systems and cost-sensitive markets will keep SATA alive for years. However, the departure of a major brand marks a turning point. It signals the industry has moved from gradual migration to a faster structural shift. SATA becomes a niche, not the default.

The bigger picture: Samsung’s long-term semiconductor strategy

Samsung’s strategy favors high-value memory and advanced packaging. The company needs capacity for HBM, advanced DRAM, and specialized NAND. These areas feed AI servers, GPUs, and hyperscaler contracts. Cutting low-margin consumer lines frees wafer capacity and investment dollars. This is part of a broader rebalancing seen across the sector in 2025. The goal is clear: align manufacturing with where AI spending is concentrated.

Final Words

The leak dated December 15, 2025, highlights a potential strategic pivot at Samsung. If confirmed, the move would speed the shift from legacy consumer storage to AI-grade memory. Short-term pain for SATA buyers and system builders is likely. Long term, the industry will gain more capacity for AI infrastructure. Buyers and procurement teams should monitor official announcements around CES 2026 and plan inventory and upgrades accordingly.

Frequently Asked Questions (FAQs)

Reports from a hardware leaker on December 15, 2025, say Samsung may stop SATA SSD production. The company has not confirmed it, so the plan should be treated as unverified.

According to the leak shared on December 15, 2025, Samsung could phase out SATA SSDs in 2026. No exact shutdown date is known, and timelines may still change.

Buying now may make sense for older PCs that need SATA drives. As of December 2025, prices are stable, but future supply limits could affect availability.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.