Stock Market Chatbot API: Top Tools for Stock Analysis and Grading

Global stock markets generate millions of data points every second. Prices move fast. News breaks faster. For most investors, keeping up is no longer easy. This is where stock market chatbot APIs are changing the game.

In the past, investors relied on manual screeners and long reports. Today, AI-powered chatbots can analyze stocks in real time. They answer questions in plain language. They also grade stocks based on data, trends, and risk. This shift is not just about speed. It is about clarity.

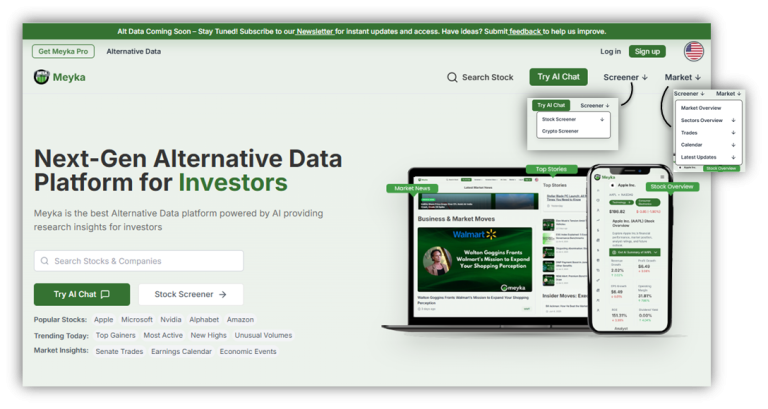

A stock market chatbot API works behind the scenes. It connects market data with AI logic. The result is simple insights instead of complex tables. Platforms like Meyka use this approach to turn raw market information into easy-to-read analysis. This helps both new and experienced investors.

As markets grow more complex, investors want tools that explain, not confuse. Stock chatbot APIs are becoming that bridge.

What Is a Stock Market Chatbot API?

A stock market chatbot API is a tool developers use to bring market data and financial intelligence into apps. It connects raw price feeds, company fundamentals, and other market signals with software that can talk in simple language. These APIs power chatbots on websites, mobile apps, and research tools that answer queries like “Is this stock overvalued?” or “What are the latest earnings figures?” in plain terms instead of raw numbers.

The API does the heavy lifting of retrieving data, processing it, and returning structured insights that can be displayed directly to users. Chatbot APIs have become key in fintech because they can combine real-time data with conversational responses that guide investment decisions. Their rise reflects deeper trends in finance toward accessible, data-driven investing intelligence delivered instantly.

These tools are not just static data servers; they bring analytics, context, and interpretation to investors and developers alike.

Core Capabilities of an Advanced Stock Market Chatbot API

Modern stock market chatbot APIs do more than fetch prices. They blend multiple layers of analysis to deliver meaningful insights that help users understand markets with less effort.

First, these APIs combine fundamental data about company performance like earnings, revenue, and profit margins with technical indicators such as moving averages and relative strength index (RSI). Fundamental data shows how a company is doing financially, while technical indicators reveal recent price trends that can signal market sentiment. Together, this blend helps users see both where a stock has been and where it might go.

Advanced APIs also support real-time data access. This means they pull market updates as they happen, so users get answers based on the latest prices and news rather than outdated figures. Some also add news feeds and sentiment scores that show how markets may react to events like earnings or macro shifts.

In platforms powered by these APIs, stock grading goes beyond labels. Grades become weighted scores based on standardized logic that considers value, growth, risk, and trend strength. This structured output helps users quickly compare instruments without scanning spreadsheets.

Meyka Stock Market Chatbot API & Analysis Platform

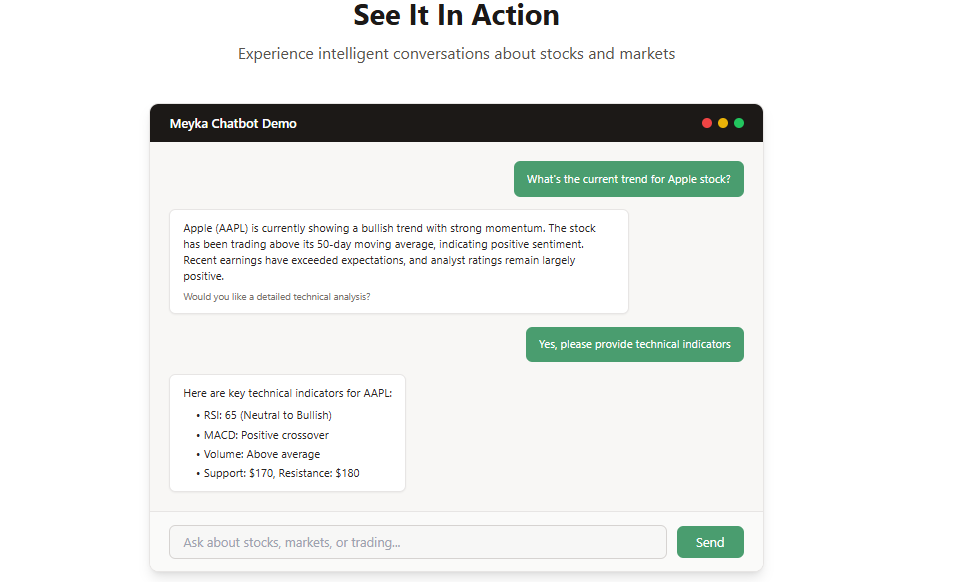

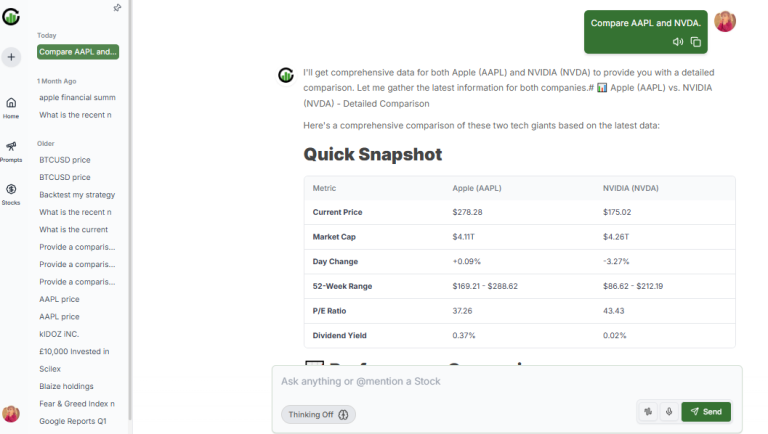

Meyka stands out as a modern AI-powered stock analysis platform and chatbot API that combines data with conversational finance tools. At its core, the API lets developers integrate real-time stock insights into their apps by using intelligent responses that users can understand. It supports natural language queries about trends, technical indicators, and fundamentals, all delivered quickly.

What sets Meyka apart is its real-time analysis and contextual answers. For example, asking about a company’s technical health returns current RSI, MACD crossover signals, and support/resistance levels all in plain language. This makes it useful for financial apps, news platforms, and education tools that want to deliver actionable stock insights without manual charts.

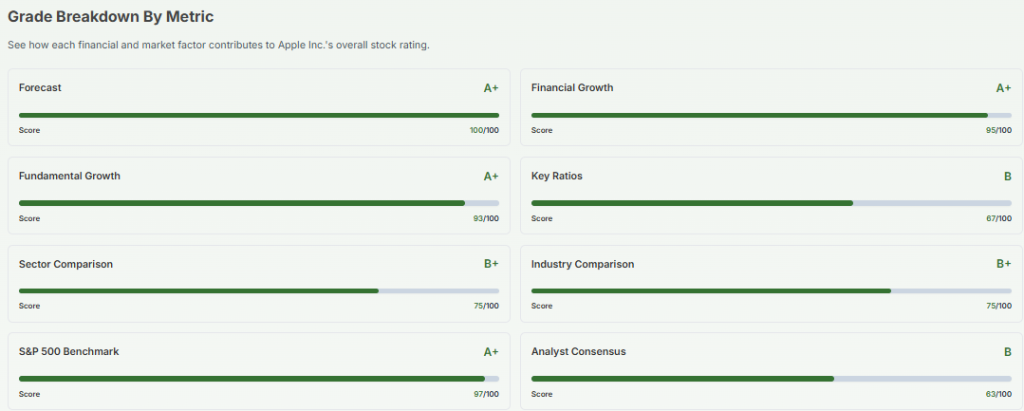

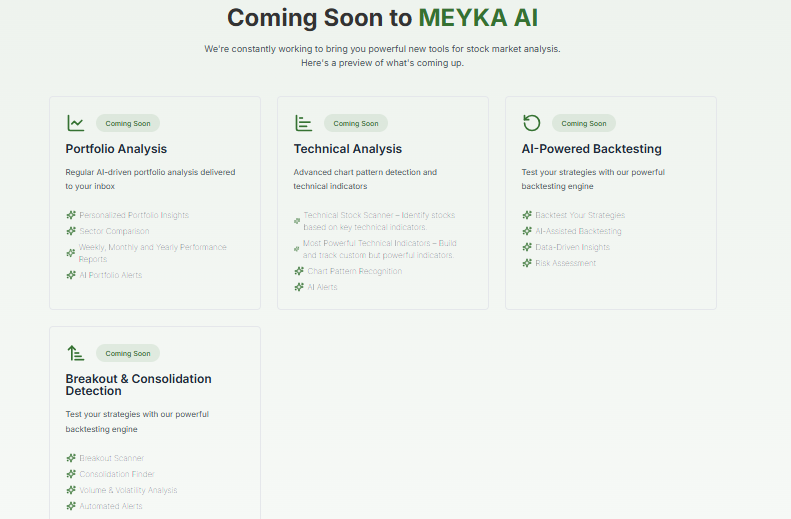

Meyka also supports deeper research tasks like stock screening and strategy backtesting. It can rank stocks using a proprietary grading algorithm from A+ to F. This grading helps users quickly gauge whether a stock is strong, fair, or weak based on multiple metrics pulled from real-time and historical data. The API’s design means developers can build intelligent interactions that go beyond fixed filters toward dynamic market understanding.

Top Stock Market Chatbot APIs Powering Analysis Platforms (2025)

OpenAI-Based Financial Chatbot APIs

APIs built on AI models like GPT deliver natural conversations about markets. They’re good at interpreting user questions and explaining data in simple terms. However, they usually need an external market data feed, like from Alpha Vantage or Polygon, to answer with real market facts. These APIs make the interaction feel human while still delivering data-driven responses.

Alpha Vantage API

Alpha Vantage is one of the most widely used stock data APIs today. It provides both real-time and historical data for stocks, forex, and crypto markets. It also includes built-in technical indicators such as RSI, MACD, and moving averages that help analysis engines calculate trends and signals. This makes it useful for building stock grading models that combine price movement with trend strength.

Alpha Vantage’s documentation covers a wide range of endpoints that allow developers to pull time series price data, fundamental metrics, and even economic indicators, all of which can feed into grading logic.

Finnhub API

Finnhub provides global market data via a flexible API that includes real-time quotes, company fundamentals, economic data, and news. It supports both free and paid plans with predictable JSON responses that are easy to integrate into applications. Many developers use Finnhub because it covers multiple asset classes and supports real-time feeds straight from exchanges.

This rich data makes Finnhub ideal for multi-factor analysis models, where trends, financial health, and macro signals all play a role in scoring stocks.

Polygon.io API

Polygon.io offers institutional-grade market data with real-time and historical access. Its API features live trades, quote feeds, and aggregated price bars that help developers build high-accuracy tools for analysis and grading.

Polygon also recently added news and sentiment layers through partnerships, amplifying its value to any platform delivering AI or algorithmic insights. Developers often choose Polygon when they need large volumes of clean, normalized data without manual reconciliation.

How Stock Grading Works Inside Platforms Like Meyka

Stock grading turns raw numbers into simple signals that users can understand. It typically involves three layers:

Data collection gathers prices, financial metrics, news sentiment, and macro indicators. Scoring logic then assigns weights to these inputs: growth performance, value score, trend momentum, and risk. The final output is a clear grade or signal that ranges from strong buys to weak holds. Good grading explains why a stock received that score, not just what the score is.

This structured approach helps users make sense of complex data without deep technical analysis.

Real-World Use Cases of Stock Market Chatbot APIs

Modern APIs power tools that replace static screeners and long reports. They help financial news sites automatically grade stocks, allow brokerage platforms to suggest actionable insights, and assist learning apps in explaining market moves. Even individual traders use these APIs to build custom dashboards and alerts that trigger when key trends change.

Choosing the Right Stock Chatbot API for Your Platform

Picking the right API depends on several factors: market coverage, data freshness, cost, and support for grading logic and natural language responses. Some APIs focus on raw data, while others add interpretation layers. Strong documentation and intuitive responses make integration smoother and reduce development time.

Stock Market Chatbot APIs vs Traditional Stock Screeners

Traditional screeners filter stocks by fixed criteria. API-driven chatbots can answer natural questions like “Which tech stocks beat earnings this quarter?” or “What shifted market sentiment today?” This conversational layer, combined with real-time data sets modern tools stand apart.

Wrap Up

Stock market chatbot APIs are reshaping how investors understand and analyze markets. They turn fast-moving data into clear insights, grades, and explanations. This shift reduces noise and saves time. Platforms like Meyka show how AI can simplify stock research without losing depth. As markets grow more complex, tools that explain trends in plain language will matter more than ever. Chatbot APIs are no longer optional. They are becoming a core part of modern stock analysis and decision-making.

Frequently Asked Questions (FAQs)

A stock market chatbot API is used to deliver real-time stock data, analysis, and insights through chat interfaces. It helps simplify complex market information.

AI stock chatbot APIs analyze stocks using live data, indicators, and financial metrics. Accuracy depends on data quality, model design, and transparent grading logic.

There is no single best API in 2025. Platforms like Meyka, Alpha Vantage, Finnhub, and Polygon.io lead based on real-time data, analysis depth, and integration flexibility.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.