Vedanta Shares Rally 9% in Five Sessions Following NCLT Nod to Demerger Plan

On December 16, 2025, Vedanta Ltd’s shares gained strong traction in the stock market after a key legal win. The National Company Law Tribunal (NCLT) in Mumbai approved the company’s long-awaited demerger plan. This decision clears the way for Vedanta to split its large business into several focused units.

In the five sessions after the NCLT ruling, Vedanta shares climbed about 9%, showing that investors saw the move as positive news. Many traders think the split will help unlock value and make the company easier to manage. This boost also came at a time when broader markets were mixed, highlighting the strength of this specific news.

This jump is more than a short-term blip. It reflects growing confidence that Vedanta’s restructuring can improve focus, capital access, and shareholder returns. In this article, we explore what this rally means for investors and what lies ahead.

Vedanta Shares Jump 9% in Five Sessions: Market Snapshot

The National Company Law Tribunal (NCLT), Mumbai Bench, gave formal approval to Vedanta’s demerger plan on December 16, 2025. This legal green light triggered a rally in the stock. Shares rose about 9% over the five trading sessions following the ruling, as market participants digested the news. The jump came even while broader market trends were mixed, showing investor focus on company-specific catalysts.

The Vedanta Demerger Plan: What Is Being Split

The approved plan splits Vedanta into five sector-focused companies. The main verticals will include aluminium, power, oil & gas (energy), iron & steel, and a base-metals or holding entity that retains key investments such as Hindustan Zinc. The split was first proposed in 2023 and later revised to the current five-unit model. The company aims to complete the restructuring by March 31, 2026. The design seeks clearer lines of business and simpler capital allocation for each unit.

Why the NCLT Nod Matters for Investors?

NCLT approval removes a major legal hurdle. This allows the company to transition from planning to execution. It also reduces regulatory uncertainty that had deterred some investors. The tribunal’s decision means plans agreed with lenders and shareholders can now proceed. For many holders, the nod signals that management can implement the value-unlock strategy without further court delays.

Market Reaction: Who Bought and Why

Institutional funds and short-term traders reacted first. Trading volumes rose as funds rebalanced portfolios to reflect the new structure. Retail investors followed, driven by media coverage and analyst notes. Some market participants viewed the move as a trigger for improved price discovery in individual businesses. Others treated it as an opportunity for event-driven trades ahead of listing milestones for the demerged units.

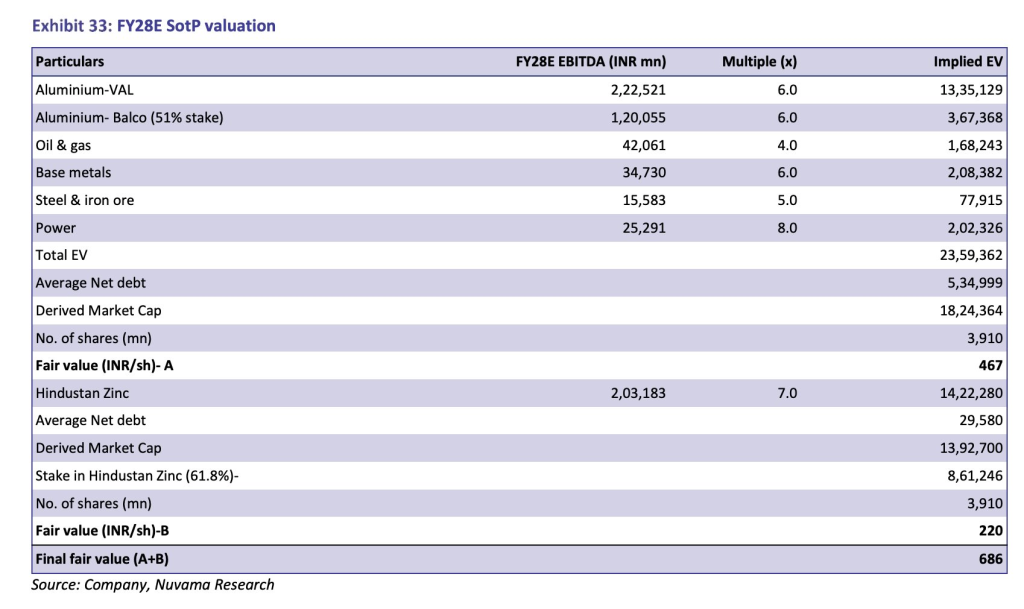

Value Unlock Potential: The Sum-of-the-Parts Case

A demerger can reveal hidden value. Standalone companies often attract higher valuation multiples than conglomerates. Metals and mining units can trade at better earnings multiples when separated from capital-intensive oil or power assets.

Analysts point to a sum-of-the-parts valuation where the parts together could be worth more than the consolidated whole. This underpins investor optimism about future rerating. Historical Indian demergers show similar patterns, though outcomes vary with execution.

Impact on Shareholders: Entitlements and Mechanics

Under the plan, shareholders of Vedanta will receive shares in the demerged companies. Regulatory filings indicate a straightforward entitlement ratio: for each Vedanta share, shareholders will receive corresponding shares in the new units. This preserves ownership while shifting exposure into sector-specific plays. Tax treatment and listing logistics depend on final approvals and the record date set by the company. Investors should watch official circulars for exact allotment dates.

Debt, Cash Flow, and Balance Sheet Reset

Debt allocation is a core concern. Reuters reported Vedanta’s consolidated debt at about ₹259.38 billion as of September 2025. The demerger will require a detailed allocation of liabilities across the new entities. Creditors and rating agencies will track how much debt each unit carries. Units with steady cash flow, such as zinc and base metals, could support higher leverage. Heavy capital segments like oil and large power projects may face tighter scrutiny until they show independent cash generation.

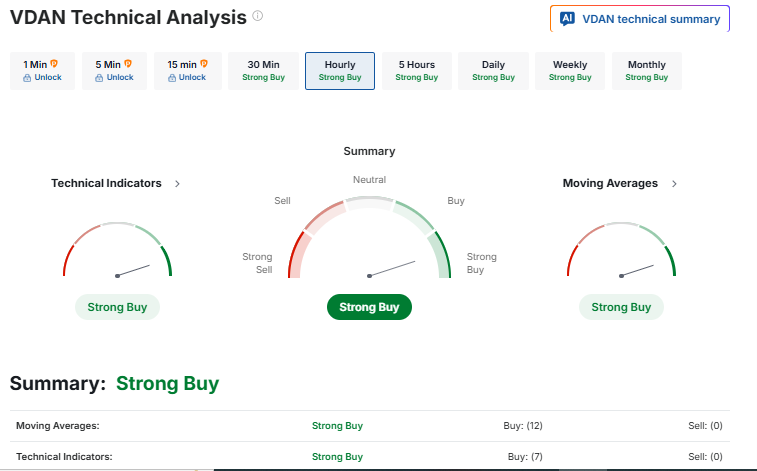

Technical View After the 9% Rally

Technically, the stock broke short-term resistance after the NCLT verdict. Momentum indicators flipped positive on intraday charts. Price action showed one-day spikes followed by consolidation, which often signals accumulation. Traders should watch key support near the pre-ruling lows and resistance at the new 52-week highs. Volume patterns will indicate if moves are sustainable or just headline-driven jumps.

Risks That Could Temper the Rally

Several risks remain. First, execution risk persists until the demerged units achieve independent listings and governance structures. Second, regulatory objections may reappear; for instance, the Ministry of Petroleum had earlier raised concerns about parts of the plan.

Third, commodity volatility can swing earnings for metals and oil units. Fourth, the final debt apportionment could strain weaker units. Investors should not assume the current rally removes these structural risks.

What’s Next for Vedanta Shares After NCLT Approval?

Key dates include the record date for share entitlements and the timeline toward listing of the demerged companies. The firm has targeted March 31, 2026, for completion, but market watchers will track intermediate regulatory filings, creditor clearances, and listing approvals.

Quarterly earnings that include the transition commentary will also shape sentiment. Analyst updates and filings on operational separation will be critical for valuation reassessments.

Investor Takeaway: Is the Vedanta Share Rally Sustainable?

The NCLT approval is a major step. Short-term gains reflect relief and event-driven buying. Long-term gains depend on execution. If the split produces clearer businesses and disciplined capital allocation, valuations may rise. If execution stalls or debt burdens persist, the initial optimism could fade.

For informed decisions, monitor official filings, track debt allocation, and stay up-to-date on key updates. Use an AI stock research analysis tool to scan filings and analyst notes quickly, but validate model outputs with the primary documents and regulator disclosures.

Frequently Asked Questions (FAQs)

Vedanta shares rose 9% after the NCLT approved its demerger plan on December 16, 2025. Investors see it as positive news that may unlock value and improve business focus.

The demerger splits Vedanta into five separate companies for metals, oil, power, and other units. It aims to make businesses simpler, focused, and easier for investors to value.

Vedanta plans to complete the demerger by March 31, 2026. The process includes legal approvals, share distribution to investors, and listing of the new separate companies.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.