US Software Firm Freshworks Eyes AI-Focused Acquisitions With $800M Cash, AI in focus

On December 17, 2025, Freshworks eyes, made a bold move that grabbed attention in the tech world. The U.S. software firm said it is planning to use more than $800 million in cash to hunt for new companies to buy.

This is not just any plan. Freshworks wants to focus on artificial intelligence (AI) and related software that can help businesses work smarter. AI is growing fast. Many tech companies are adding it to their products or buying smaller AI firms to stay ahead. Freshworks is now in that race too.

The idea is simple. Instead of only building new tech inside the company, Freshworks may buy outside teams, tools, or platforms that already have smart AI features. This could speed up its products and give customers more powerful tools. It also shows how much the company believes AI will shape the future of business software.

Why Freshworks Is Talking About Acquisitions Now?

The Freshworks eyes moved quickly in December 2025. The company told investors it has more than $800 million in cash and marketable securities. Management said it is actively speaking with targets across the U.S., Europe, Israel, and India. The timing is not random.

Demand for AI in customer service and IT operations rose sharply through 2025. That trend put pressure on mid-market SaaS firms to add AI features fast. Buying small AI or employee-experience firms can be faster than building from scratch.

Freshworks already showed strong momentum in 2025 revenue forecasts. Its new push signals a move from organic feature work toward capability buys that can be integrated quickly into its product suite.

Breaking Down the $800M Cash War Chest

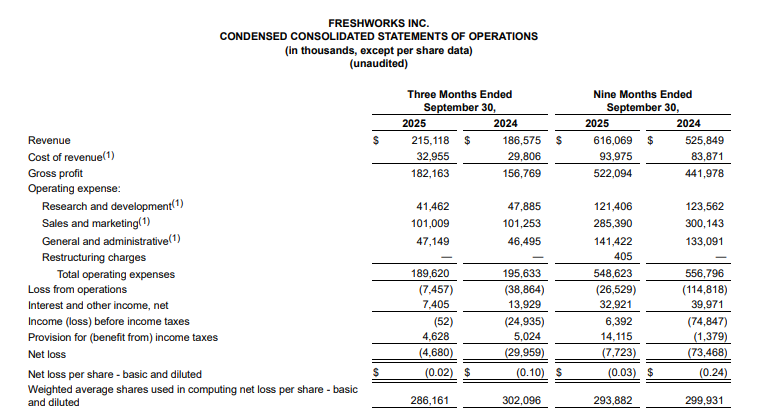

The cash figure is specific. Freshworks reported about $813.2 million in liquid assets. That gives the company room for selective deals. Past purchases show the playbook. Freshworks closed the Device42 deal in 2024 and moved to buy incident-management firm FireHydrant in December 2025. Those buys were practical. They added features that plug into existing products.

The size of the war chest does not mean giant headline deals. It suggests room for several targeted acquisitions. These would likely be small to mid-sized firms that bring focused AI capabilities and engineering teams that can fold into Freshworks’ India-heavy R&D base.

What “AI-Focused Acquisitions” Really Means for Freshworks Eyes?

AI-focused deals rarely mean buying huge foundation-model labs. Freshworks’ likely targets are applied AI firms. Think conversational AI start-ups, automation platforms, and tools that make agents faster. The goal is embedded intelligence inside Freshdesk, Freshservice, and related products.

Freshworks needs tech that improves ticket routing, automates routine tasks, and powers better chat responses. It also seeks teams with product DNA who can move quickly. In short, the buys should shorten the time to market for features customers actually use. Market research shows vendors are favoring agentic and conversational AI that integrates with existing workflows, exactly the kind of capability Freshworks needs.

Freshworks Eyes vs Big Tech: A Different AI Playbook

The Freshworks eyes cannot compete head-to-head with giants on a model scale. The play is different. Big firms often invest in large models and cloud scale. Freshworks can win through focused product integrations. Its customers want reliable tools that reduce support costs and improve response times.

A mid-market focus allows lower price points and simpler deployment. Freshworks can pair lightweight AI features with a tight product UX. That gives immediate ROI for customers. This approach avoids chasing the most hyped AI use cases and targets everyday business gains instead.

AI as a Margin Expander, Not Just a Growth Tool

AI can cut costs and raise margins. Automated routing and smarter knowledge retrieval reduce support headcount needs. Faster resolution improves customer satisfaction and retention. That supports upsell and higher lifetime value. Freshworks’ recent quarters show improving operating cash flow and free cash flow margins.

Embedding AI into core workflows is a path to better unit economics. Investors care about that. A focus on profitability-driven AI can deliver results faster than broad, brand-building AI experiments. Analysis using an AI tool supports the case that practical automation yields measurable margin gains inside customer service platforms.

Risks and Integration Challenges Investors are Watching

Acquiring AI startups carries real risk. Small teams can struggle to fit a product-led, cloud SaaS culture. Integration of models and data pipelines can be harder than expected. Valuations for AI startups also rose in 2024-25, which raises the risk of overpaying. Data privacy and regulatory rules add complexity, especially with cross-border deals.

Freshworks says it prefers targets that can be integrated with its India engineering base. That reduces some integration cost. Still, turning acquisitions into cohesive product features will demand clear roadmaps and disciplined execution.

What This Means for Freshworks Stock and Long-Term Valuation

The market will judge deals by outcomes. Announcing deal interest can boost attention, but valuation moves when revenue and margins follow. AI-led M&A could re-rate the multiple if the deals expand the addressable market and raise gross margins.

On the other hand, a string of costly, poorly integrated purchases could weigh on confidence. Analysts will look for transparent targets, clear integration plans, and metrics that show improved retention and ARPU. Freshworks’ forecast of double-digit revenue growth through the next several years sets a high bar. Executing well is the only way to meet that bar and justify any valuation premium.

Freshworks Eyes: The Bigger Picture in AI-Driven SaaS

Freshworks is part of a larger trend. 2025 saw a jump in M&A activity driven by firms buying AI capabilities. Smaller AI vendors are natural targets for incumbents that need to add features fast. The customer-experience and ITSM segments are especially active.

Consolidation helps established SaaS players fill product gaps and capture tech talent. For startups, the current market offers exit paths that reward focused, deployable AI tools. For customers, consolidation can mean more integrated solutions, but also less choice. The net effect will be fewer, stronger platform vendors that embed AI into core workflows.

Conclusion: Buying Capabilities, Not Headlines

Freshworks’ $800M cash signal is strategic. The company aims to buy tested AI features and talent. The goal is practical product improvements that help customers now. Execution will matter more than announcements. If deals add clear value, Freshworks could strengthen its mid-market lead. If not, investors may grow cautious. The coming months will show whether these moves translate into durable growth and better margins.

Frequently Asked Questions (FAQs)

Freshworks plans AI deals to add smart features faster. On December 17, 2025, it said AI can improve support tools, automate tasks, and meet rising customer demand.

As of December 2025, Freshworks reported over $800 million in cash and liquid assets. This gives flexibility to fund small, targeted acquisitions without hurting daily operations.

AI may improve chat replies, ticket routing, and workflow speed. These updates aim to cut costs, raise efficiency, and help customers solve issues faster across Freshworks platforms.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.