Woodside Chief Meg O’Neill Resigns to Take on Role as BP CEO

On December 18, 2025, Woodside Energy confirmed that its CEO, Meg O’Neill, has resigned to become the next BP CEO. This is a major change in the global energy world. BP, one of the biggest oil companies on earth, chose O’Neill to lead its future.

She will start as BP’s chief executive on April 1, 2026. O’Neill leaves Woodside at a time when energy markets face big challenges. BP also shifts its strategy after years of focus on green energy.

Her new role makes her the first external CEO in BP’s long history. Investors and analysts are watching closely. This move could reshape BP’s plans and affect global energy trends.

Who Is Meg O’Neill? A Strategic Profile of the New BP CEO

Meg O’Neill built her reputation in big oil and LNG. She worked at ExxonMobil early in her career. She joined Woodside and became CEO in 2021. At Woodside, she led the merger with BHP’s petroleum assets. She also pushed Woodside into U.S. LNG and large project delivery. Her track record centers on deals and execution. BP’s board clearly valued that mix of operational skill and deal experience when making the hire.

Why BP Replaced Its CEO Now?

BP’s finances and stock have lagged peers this year. The company reported weaker profits earlier in 2025 and faced investor pressure. Activist investors and the board signalled a need for a sharper focus on returns. BP’s recent leadership churn and strategic U-turns raised doubts about direction. Bringing in O’Neill sends a message: management wants a leader who can restore operational discipline and lift returns.

What Meg O’Neill’s Appointment Means for BP’s Future Strategy

Expect a greater tilt toward oil and gas assets and faster cash delivery. O’Neill’s record at Woodside shows comfort with large upstream projects and LNG. She is less associated with heavy renewable expansion. BP has already signalled cutbacks to some renewable plans this year. Under O’Neill, capital may flow faster into high-return oil and gas investments. That may speed near-term earnings but complicate long-term net-zero commitments.

How BP and Woodside Shares Responded?

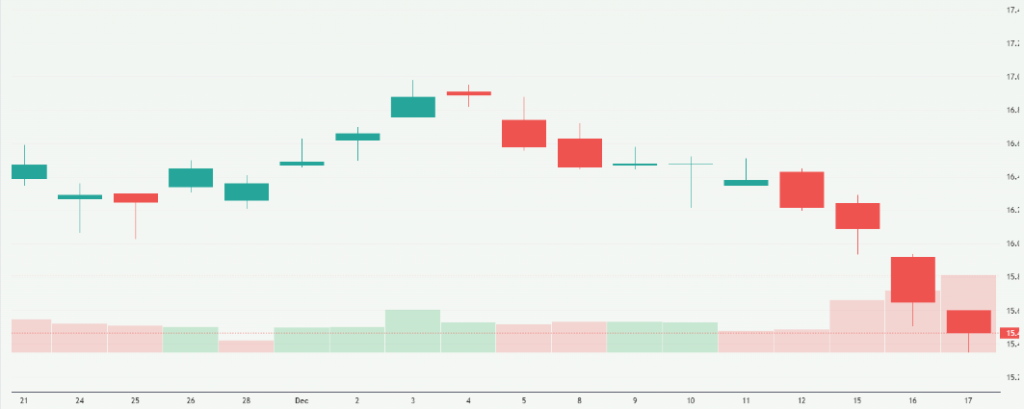

Markets moved quickly after the news on December 17-18, 2025. BP ADRs rose in U.S. trading, reversing some recent weakness. The lift reflected investor relief that BP chose an operator with a proven track record.

Woodside shares fell as the group lost its chief architect. Traders flagged the risk of near-term disruption at Woodside while a leadership plan is set. These moves suggest investors see the appointment as material for both companies.

Impact on Woodside Energy: Leadership Vacuum or New Opportunity?

Woodside moved fast to fill the gap. The board named Liz Westcott as acting CEO immediately after O’Neill’s resignation. That step aims to steady projects and reassure contractors. Still, the company now faces a search for a permanent leader.

Key projects at Scarborough, Sangomar, and Louisiana LNG need steady oversight. A prolonged vacancy could slow final investment decisions or shake partner confidence. On balance, Woodside risks short-term disruption but retains strong project momentum.

Global Energy Sector Implications: A Power Shift in Oil & Gas Leadership

This hire signals a wider trend. Major oil firms now prize leaders who can marry fossil-fuel know-how with transition credibility. O’Neill’s move from an LNG-heavy peer to a supermajor highlights that point. The appointment also underscores how boards weigh profitability vs. green ambition. Other majors have similarly shifted strategy in 2025, balancing returns and transition goals. Expect more outside hires or seasoned upstream operators to get serious consideration for top roles.

Challenges Facing Meg O’Neill as BP CEO

O’Neill inherits several hard problems. BP must restore investor confidence without alienating climate-conscious stakeholders. The company needs to execute cost cuts and complete asset sales. It must also manage geopolitical risk across production regions. Finally, BP must show clear early wins in profit and cash flow to justify the strategic pivot. Success will depend on fast, visible results and careful stakeholder management.

BP New CEO: What Investors Should Watch Next?

Watch BP’s next strategy update and any capital-allocation signals. Early signs will include project approvals, asset sale timing, and changes to dividend or buyback plans. Also track executive hires around finance and upstream operations.

Analysts will parse O’Neill’s first public comments when she assumes the role on April 1, 2026. Investors should also monitor Woodside’s choice for a permanent CEO and any changes to project timing. For detailed stock research, some investors will run the news through an AI stock research analysis tool alongside traditional models.

Final Take: A Defining Leadership Moment for BP

Meg O’Neill’s move is historic. She becomes BP’s first external CEO and the first woman to lead one of the top five oil majors. The decision marks a tactical shift toward operational focus and near-term returns. It also raises questions about how big oil balances short-term profits with long-term climate goals. The next six to twelve months will reveal whether this gamble restores BP’s standing or merely reprices risk for investors and partners.

Frequently Asked Questions (FAQs)

Meg O’Neill resigned on December 18, 2025, after BP selected her as its next CEO, following board decisions to shift leadership and strengthen operational focus.

Meg O’Neill will officially take over as BP CEO on April 1, 2026, after completing transition duties and regulatory approvals announced in December 2025.

BP may focus more on disciplined spending, oil and gas efficiency, and project execution, while maintaining energy transition goals under Meg O’Neill’s leadership, based on her past experience.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.