30 Year Mortgage Rates Outlook After Latest Fed Rate Cut

The Federal Reserve’s recent rate cut has pushed 30 Year Mortgage Rates back into the headlines. Homeowners and buyers want to know what it means for payments and refinancing. The Fed trimmed its policy rate by a quarter point on September 17, 2025, a move aimed at cushioning a softer jobs picture, and that decision rippled through bond markets and mortgage pricing.

30 Year Mortgage Rates: the Fed decision in brief

The Federal Open Market Committee lowered the federal funds rate by 25 basis points, and Fed Chair Jerome Powell described the move as risk management to address downside risks to employment. He warned that inflation remains above the two percent target, so future cuts will be data-driven and cautious.

30 Year Mortgage Rates: Short-Term Market Reaction

Why do mortgage rates move after Fed decisions? Mortgage rates are set by longer-term market forces, especially 10-year Treasury yields and mortgage-backed security markets, not the Fed funds rate directly.

Still, Fed signals change investor demand and yield curves, which quickly affect mortgage pricing. In the week before the cut, 30-year averages fell as markets priced easing, then moved as traders digested Powell’s remarks and Treasury yields shifted.

Freddie Mac’s weekly survey put the 30-year fixed average near 6.35 percent in mid-September, down from higher readings earlier in the year. Some daily indices tracked by market sites showed short-lived prints near 6.13 percent before intraday moves pushed rates slightly higher after the Fed news.

Those swings reflect market repricing, lender pipelines, and hedging costs that affect retail offers.

30 Year Mortgage Rates: what this means for homeowners and buyers

Affordability improves when mortgage rates fall, because monthly payments on a standard loan shrink. For a typical mortgage, dropping from about 6.9 percent to 6.3 percent can cut monthly payments by several hundred dollars, which may encourage more buyers to re-enter the market. Lower rates also spike refinance activity; the MBA reported a large weekly jump in refinance applications as homeowners rushed to lock in better terms.

Should you refinance now? If your rate is meaningfully above current offers, refinancing can pay off, but closing costs, how long you plan to stay in the home, and the new loan term matter. Use a break-even calculator, compare lender quotes, and discuss timing with your mortgage adviser before locking a rate.

30 Year Mortgage Rates: expert views and Powell’s message

What did Jerome Powell emphasize? Powell said the cut addressed growing risks to employment, but he stressed that inflation remains elevated, so policy will remain data dependent.

That tone suggests the Fed may cut further, but only if inflation and jobs data move in the right direction. Economists noted the Fed penciled in additional easing, yet warned timing will hinge on upcoming CPI and payroll prints.

You can watch Powell’s full press conference to hear the nuance of his remarks; the Fed’s live stream and major network coverage carry the full video.

30 Year Mortgage Rates: Risks That Could Push Rates Up

There are clear risks that could keep 30 Year Mortgage Rates from falling much further. If inflation heats up again, or if global demand for U S Treasuries weakens, Treasury yields could rise and pull mortgage rates with them.

Lender hedging costs can widen in volatile markets, making consumer rates slower to fall than headline Treasury moves.

Finally, a tight housing supply could push prices higher as lower rates draw more buyers, which reduces the net affordability benefit.

30 Year Mortgage Rates: the data and headline noise

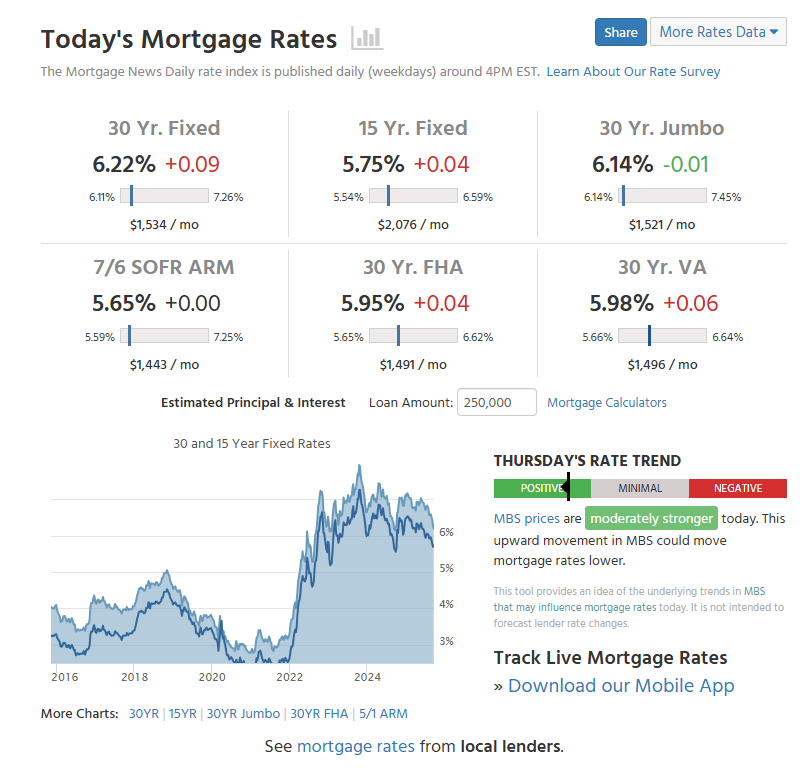

Market watchers saw mixed signals on announcement day. Mortgage industry trackers flagged short-term swings, and Mortgage News Daily even noted intraday readings that briefly dipped then rose, illustrating how headline risk creates noisy daily numbers even as weekly averages trend downward. Follow weekly Freddie Mac updates and the MBA application indexes to see firmer trends.

Key data to watch for the next few weeks include: Treasury yields, weekly jobless claims, monthly CPI and PPI prints, and MBA mortgage application flow. These indicators will drive whether 30 Year Mortgage Rates drift lower gradually, or bounce back.

30 Year Mortgage Rates: global and investor impacts

U S rate moves ripple globally. Lower U S yields can shift international capital flows, affect currency values, and change relative returns for global investors.

For overseas buyers of U S real estate, slightly lower mortgage rates reduce local financing costs, but currency risk and local rules still dominate decisions. Global investors will watch Fed guidance closely because it shapes cross-border demand for assets.

30 Year Mortgage Rates: action steps for borrowers

If you are a homeowner, check your current rate and remaining balance, then gather quotes from several lenders. If refinancing, calculate your breakeven point to see if savings cover closing costs within your expected ownership horizon.

For buyers, get pre-approval and be ready to act quickly if lower rates stir more competition in your local market. Mortgage brokers and financial advisers can help model scenarios and provide a clearer picture.

Quick takeaways

- Short term: 30 Year Mortgage Rates are in the low six percent range, but daily readings can be volatile.

- Refinance: activity surged after the cut, so shop rates and weigh costs carefully.

- Housing market: modest rate relief may lift buyer demand, monitor local supply and price trends closely.

A sample market signal, via social media

Mortgage News Daily captured the intraday swings in a post, noting some daily indexes briefly showed lower 30-year averages before markets shifted after the Fed news. Tweets like that show how short-term noise can distract from the bigger trend.

Conclusion

The Fed’s quarter-point cut gives some relief to buyers and homeowners, and 30 Year Mortgage Rates have eased from summer highs. If inflation cools and the Fed follows through on a modest easing path, mortgage rates can move lower slowly, which helps affordability and fuels refinancing.

Still, expect volatility, and base any decision to refinance or buy on your personal timeline, costs, and local market conditions. Watch Freddie Mac weekly rates, Treasury yields, and the MBA indexes for clearer signals, and talk to a mortgage professional before you commit.

FAQ’S

When the Fed cuts rates, borrowing costs usually fall. This can push 30 Year Mortgage Rates lower, though the effect is not always immediate.

Yes, rate cuts often lower 30 Year Mortgage Rates, but markets, inflation, and Treasury yields also play a role in how much they drop.

A Fed rate cut can make new mortgages cheaper and refinancing more attractive, helping borrowers lock in lower 30 Year Mortgage Rates.

After the recent Fed move, the average 30 Year Mortgage Rates sit around 6.3 percent, though daily numbers vary slightly by lender.

A quarter point Fed cut can lower 30 Year Mortgage Rates by a few tenths of a percent, reducing monthly payments by hundreds over time.

Not always. Lower Fed rates ease borrowing, but if cuts signal economic trouble, housing markets may still face uncertainty despite cheaper 30 Year Mortgage Rates.

Forecasts suggest 30 Year Mortgage Rates could hover near 6 percent by August 2025, but actual levels depend on inflation and Fed actions.

If 30 Year Mortgage Rates fall, housing affordability improves, refinancing demand rises, and buyer competition in the real estate market usually increases.

Disclaimer

This is for information only, not financial advice. Always do your research.