Adani Group Stocks Gain as SEBI Rejects Part of Hindenburg Claims

Adani Group stocks are back in the spotlight. This week, SEBI, India’s market regulator, dismissed parts of Hindenburg’s explosive claims. That report, released in early 2023, had shaken investor trust and wiped billions from Adani’s market value. Now, with sentiment improving, investors are once again speculating on potential opportunities such as an Adani buyout and renewed market momentum.

We see the impact directly in the stock market. Shares of Adani Enterprises, Adani Ports, and Adani Green Energy climbed after the news. Traders welcomed clarity. Long-term investors see this as a signal that not every charge holds weight. Confidence, though still fragile, is returning step by step.

The story is bigger than a stock bounce. It is about how one of India’s largest conglomerates is reshaping its future. The Adani Group is not slowing down. Its buyout plans in energy, infrastructure, and logistics show a strong appetite for growth.

We must ask: Is this the turning point? Investors are watching closely. SEBI’s stance has lifted a cloud, but risks remain. What happens next may decide whether Adani can rebuild trust and keep its bold expansion on track.

SEBI’s Ruling and Key Rejections

SEBI’s investigation focused on two major types of allegations raised in the Hindenburg report. First was whether some transactions between Adani companies and firms like Adicorp, Milestone Tradelinks, and Rehvar Infrastructure were “related-party transactions.” Second was whether there was misuse of funds or diversion in those deals.

After reviewing records, SEBI found that those transactions did not violate disclosure norms or accounting requirements. It said they could not be called related-party transactions under the rules that existed at the time.

SEBI also looked into whether any fund was siphoned or misused. The regulator concluded all loans were repaid. It found no evidence that funds were used for wrongful purposes.

Finally, SEBI disposed of the proceedings in these two cases. It declared no liability, no penalties. The allegations were essentially not established in these specific charges.

Adani Group Stock Market Performance

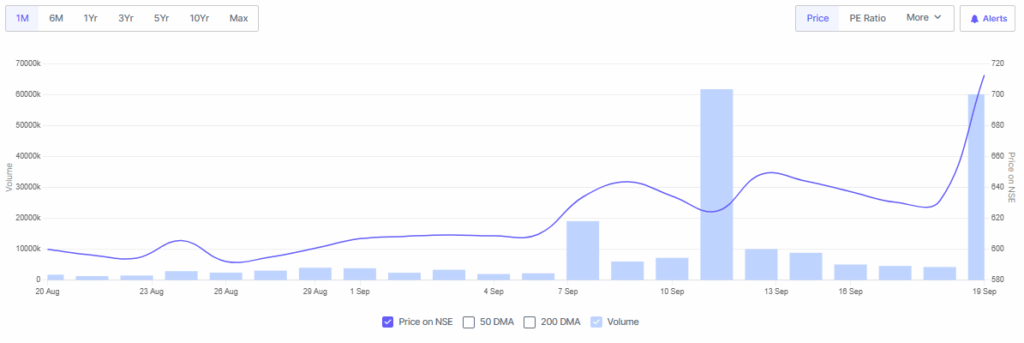

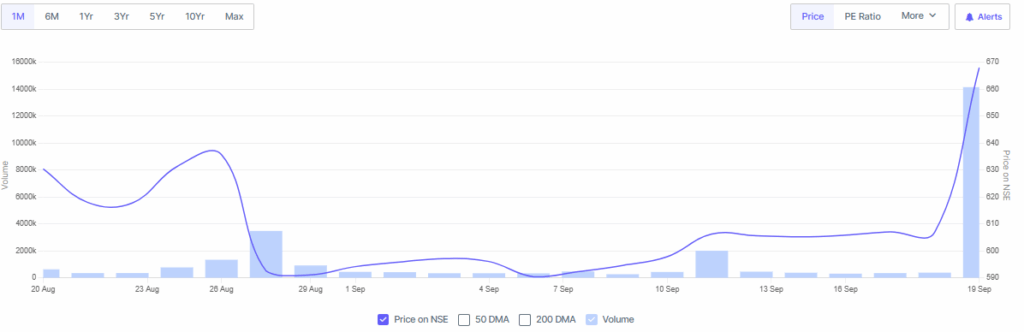

Once SEBI’s ruling came out, the market reacted fast and sharply. Shares of several Adani companies surged. Adani Power rose nearly 7-8%. Adani Total Gas led with about an 8-10% jump. Enterprises, Ports, Green Energy, and Energy Solutions also saw gains in the range of 3-5%.

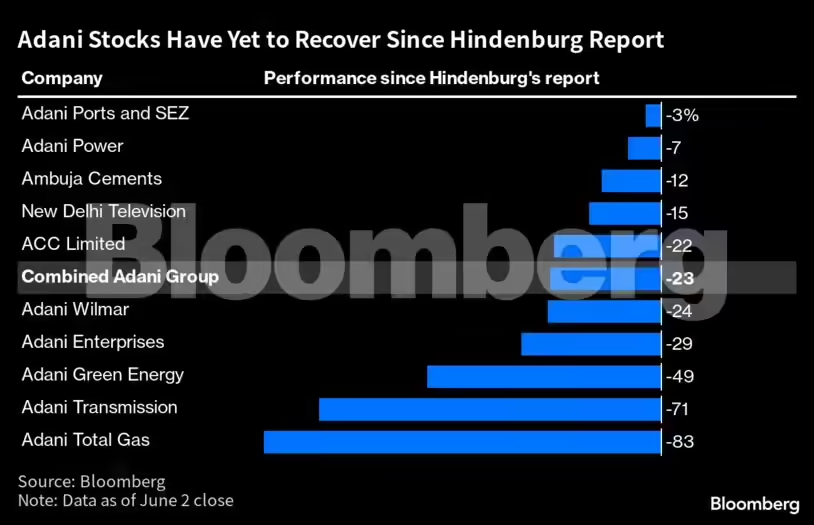

Even with the rebound, most Adani stocks are still below their pre-Hindenburg levels. Adani Enterprises remains about 25-30% lower than before the report dropped. Some other group firms are down between 20-80% in comparison.

Trading volumes rose. Institutional investors showed renewed interest. Analysts raised or revised targets upwards for several group stocks.

Adani Buyout Strategies in Focus

Adani Group has kept moving even amid controversies. One plan involves expanding its cement business. A major bet is on ports and international logistics. APSEZ (Adani Ports & SEZ) acquired the North Queensland Export Terminal (NQXT) via a non-cash transaction. That boosts its global cargo capacity and expands its international terminal portfolio.

Green energy, infrastructure, and fertilizer/agriculture sectors remain in its roadmap. Adani group companies are also raising financing globally to drive these buyouts and growth initiatives.

Market Sentiment and Investor Reactions

Investors breathed a sigh of relief after SEBI’s order. The decision removed a major risk factor. Many saw regulatory uncertainty drop significantly.

Short-term traders drove gains. Some institutional investors cautioned that not all issues are closed yet, since several other SEBI orders (22 more) are still pending.

Brokerage houses updated their price targets. For example, Motilal Oswal and Prabhudas Lilladher see solid upside in Adani Ports. Ventura and others pointed to potential 30-50% gains in selected stocks if growth continues and risk stays controlled.

Implications for Indian Markets & Regulatory Landscape

This SEBI ruling holds broader meaning beyond Adani. It signals the maturity of India’s regulatory oversight. Market watchers see that SEBI followed legal norms even when under the global spotlight.

Confidence in India’s equity markets is likely to improve. Global funds often worry about corporate governance and disclosure. SEBI’s clear order may reduce perceived risks in these areas.

It may also push for more clarity in rules around related-party transactions. The definition, timing of amendments, and disclosure norms may get sharper or more detailed.

Adani Buyout: Risks and Challenges Ahead

One major risk is that not all allegations are closed. While SEBI disposed of two cases, others remain pending. Investors still watch closely.

Adani’s debt load and capital requirements are high. For ambitious buyouts and infrastructure projects, funding and execution remain hard. Rising input costs, interest rates, and supply chain issues could bite.

Regulation abroad also matters. Some allegations persist in foreign jurisdictions. Trust must be rebuilt not just in India, but globally. Finally, markets tend to “sell the news.” Some gains may be short-lived if expectations become overblown.

Bottom Line

Adani Group has gained a strong boost after SEBI dismissed parts of Hindenburg’s claims, but the journey is far from over. Stocks have rebounded, and fresh buyout plans highlight the group’s bold growth drive.

Yet, risks remain with high debt, pending cases, and global scrutiny still in play. For investors, this moment signals renewed confidence but also a reminder to watch execution and governance closely. The ruling may mark a turning point, but only consistent delivery will rebuild lasting trust in Adani’s market story.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.