Advance Agrolife IPO GMP Trends as Subscription Deadline Nears

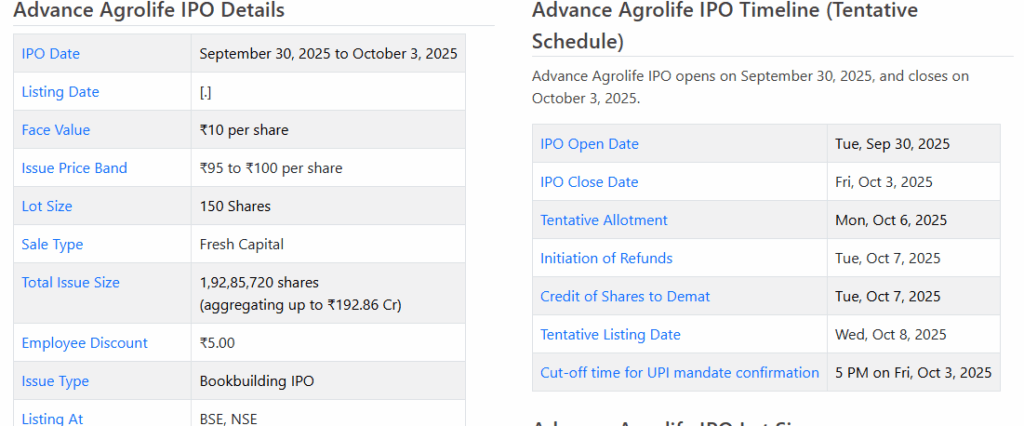

Advance Agrolife is in the spotlight this week. The company launched its ₹193-crore IPO on September 30, 2025, and the issue will close on October 3, 2025. With a price band fixed at ₹95-100 per share, many of us are watching closely to see how investors respond before the deadline.

We often hear about the Grey Market Premium (GMP) when IPOs are live. It works like an early signal of how shares may perform once listed. For Advance Agrolife, the GMP has been hovering around ₹15, which hints at a possible listing near ₹115. That’s about a 15% jump over the issue price.

But GMP is not everything. It changes fast and depends on the market mood. What really matters is how investors subscribe and how strong the demand is across retail, institutional, and high-net-worth categories. As we move into the final hours of bidding, Advance Agrolife’s IPO gives us a real-time view of both excitement and caution in India’s primary market.

What does the IPO offer? The Basics

Advance Agrolife opened its IPO on September 30, 2025. The offer closes on October 3, 2025. It is a fresh issue of about 1.93 crore shares. The price band is ₹95-₹100 per share. The company aims to raise roughly ₹192.86-₹193 crore. The IPO is planned to list on both the BSE and NSE, with tentative listing dates mentioned by some outlets in early October 2025. Lot size is 150 shares per lot. These facts set the frame for how investors judge value and demand.

GMP: What is Signaling Now?

The grey market premium (GMP) is a crude early signal of listing demand. It shows how much buyers are willing to pay for unlisted shares above the issue price. For Advance Agrolife, the GMP has been reported near ₹15 on the final day of the offer. That points to an expected listing price close to ₹115, roughly 15% above the top of the band. GMP is fast to change. It can rise or fall on small news or trader moods. Treat it as a hint, not a guarantee.

Subscription Trends as Deadline Nears

Demand picked up quickly after the IPO opened. On Day 2, the book showed around 1.87x subscriptions. By Day 3, various market reports showed the issue racing ahead with multiple subscriptions. Different sources gave different snapshots.

Some reported 6.5x on the third day. Others showed figures above 8x-9x at points during the final day. This spread happens because exchanges update continuously, and media capture different cut-off times. Overall, however, the trend is clear: investor appetite strengthened as the deadline approached.

Who is Applying?

Interest came from retail investors, non-institutional investors (NIIs), and qualified institutional buyers (QIBs). Reports noted strong retail demand and very high NII bids. Some updates recorded retail subscription multiples above 5x, and NII demand running in double digits, at times above 20x. QIB interest was present but more moderate in early snapshots. Heavy retail and NII demand often fuels higher GMPs, since these segments chase listing gains and short-term returns.

Drivers Behind the Grey Market and Subscription Strength

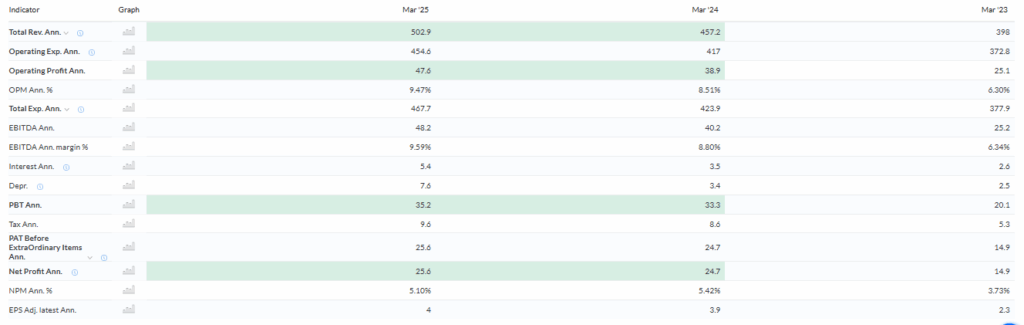

Several factors pushed demand. First, the agrochemical sector has steady end-market linkages. Crop cycles and farm spending drive longer-term sales. Second, Advance Agrolife’s product mix and recent financials attracted attention in FY25. Third, the small issue size (under ₹200 crore) makes allocations more meaningful for investors chasing allotment gains.

Media chatter and broker notes also amplified interest. Traders using quick screening tools, including an AI stock research analysis tool, helped identify the IPO as a candidate for short-term interest. Finally, active grey-market brokers spread early price expectations, nudging retail demand higher.

Risks and Cautionary Points

GMP and early subscription do not equal long-term value. GMP can be driven by speculation. A high GMP often leads to buyers paying a premium only to see prices correct after listing. Sector risks exist, too. Agrochemical makers face regulatory shifts, raw material cost swings, and export market changes.

Valuation at listing may still be high if the market price jumps. Also, small IPOs can see volatile moves on low post-listing volumes. Investors should read the prospectus and check financials before relying on GMP or subscription hype.

What to Watch After Subscription Closes?

Key dates to track are allotment and listing. The allotment outcome will show how likely retail investors are to get shares. The listing day will reveal whether the GMP matches real market demand. Watch first-day volume and price action. If the stock gaps up with strong volume, GMP signals are validated. If volume is thin and price drifts lower, the GMP may have been speculative. Also watch post-listing news about margins, orders, or regulatory events; any such news can swing the stock sharply.

Final Take

Advance Agrolife’s IPO drew solid interest as bids surged before the October 3, 2025, close. The grey market set an early tone with a ≈₹15 premium. That suggests a likely listing pop if market conditions hold. At the same time, the GMP is not a substitute for careful study. Short-term gains can evaporate. Focus on allotment results, listing price, and the company’s long-term prospects before making investment choices.

Frequently Asked Questions (FAQs)

The Advance Agrolife IPO opened on September 30, 2025. Its price band is ₹95-₹100 per share. The minimum lot size fixed for investors is 150 shares.

By October 3, 2025, the IPO was subscribed about 6.5 times. Investors applied for over 8.8 crore shares against 1.35 crore shares offered in the issue.

On October 3, 2025, the grey market premium stood around ₹15. This suggests a possible listing price near ₹115, but GMP only gives an early, informal signal.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.