AI Chatbots: The New Co-Pilot for Financial Advisory Services

The world of financial services is changing fast. Investors want quicker answers, deeper insights, and support that feels personal. Advisory firms want smart tools that reduce workload and increase accuracy. This is why the rise of the AI chatbot for financial advisors is becoming one of the biggest upgrades in the finance world today.

Enterprises across the globe are now shifting to AI-powered advisory tools that act as a co-pilot for their team, their clients, and their long-term market strategy. Among the leading platforms in this space, Meyka is standing out as a trusted partner for enterprise-level finance teams that want speed, intelligence, and scale.

In this detailed blog, we explore how AI chatbots are reshaping financial advisory services, why enterprises cannot afford to ignore this shift, and how Meyka’s enterprise solutions offer powerful benefits for modern financial firms.

Why Are AI Chatbots Becoming a Co-Pilot for Advisory Firms

The finance world is full of data. Markets move quickly, investor behavior changes daily, and risk factors keep evolving. Financial advisors need a tool that works with them, supports them, and lifts their performance. This is where AI chatbots come in.

An AI chatbot gives advisors instant structured insights, smooth workflows, and real-time responses for clients. It helps remove manual research hours and brings advanced market intelligence into one clear conversation.

Why do financial teams now rely on AI chatbots?

They save time, reduce errors, and support better investment decisions. With AI, advisors do not need to scroll through long reports or switch tools. The answers come fast and in simple language.

This shift is not just helpful; it is becoming essential for global competitiveness.

How an AI Chatbot for Financial Advisors Supports Enterprise Scaling

Enterprises need systems that can grow with them. A single advisor can manage only a handful of clients, but a smart AI tool can support hundreds. It gives the same quality of response to every user, which keeps the advisory service consistent.

A modern AI chatbot for financial advisors can handle many needs at once. It assists with market research, asset insights, portfolio summaries, and risk explanations in clear and friendly language. This is why many firms now see AI as their new co-pilot instead of just a digital tool.

What Makes an AI Co-Pilot Different from a Basic Chatbot

A normal chatbot gives fixed answers. An AI co-pilot like Meyka understands context, learns preferences, and delivers insights like a real financial partner.

It processes large datasets, news, earnings reports, and research documents. It can also help with predictive insights that support strategic decisions. This gives advisors more confidence and more time to focus on high-value client work.

Why Enterprises Are Choosing Meyka for AI Advisory Support

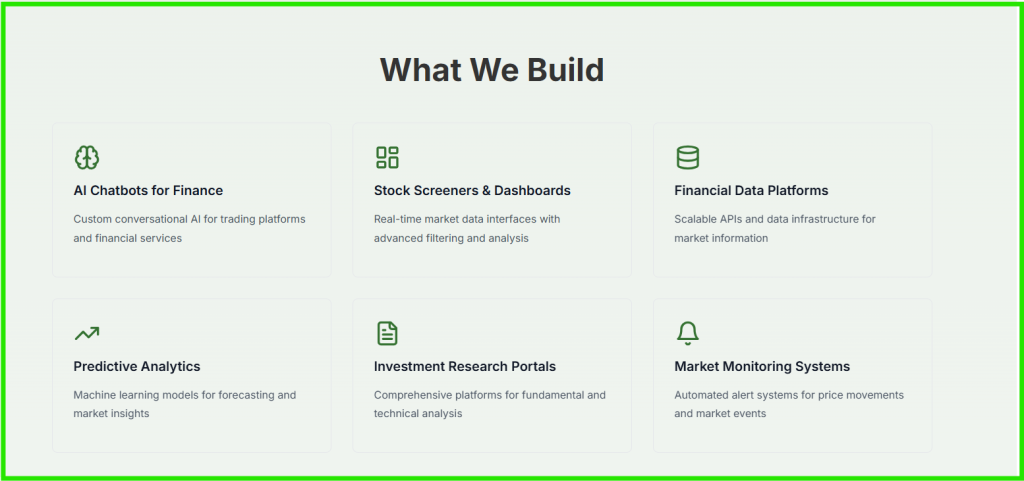

Meyka is not just an AI chatbot. It is a powerful enterprise-grade platform designed to help financial teams grow faster with clear and smart insights. Meyka is built to support advisors, researchers, wealth managers, and institutional investors.

Using Meyka’s enterprise service, firms can bring automation, advanced analytics, and natural language intelligence to their daily financial workflows.

Here is what makes Meyka a top choice for financial enterprises.

Meyka’s AI Chatbot for Financial Advisors: How It Transforms Daily Advisory Work

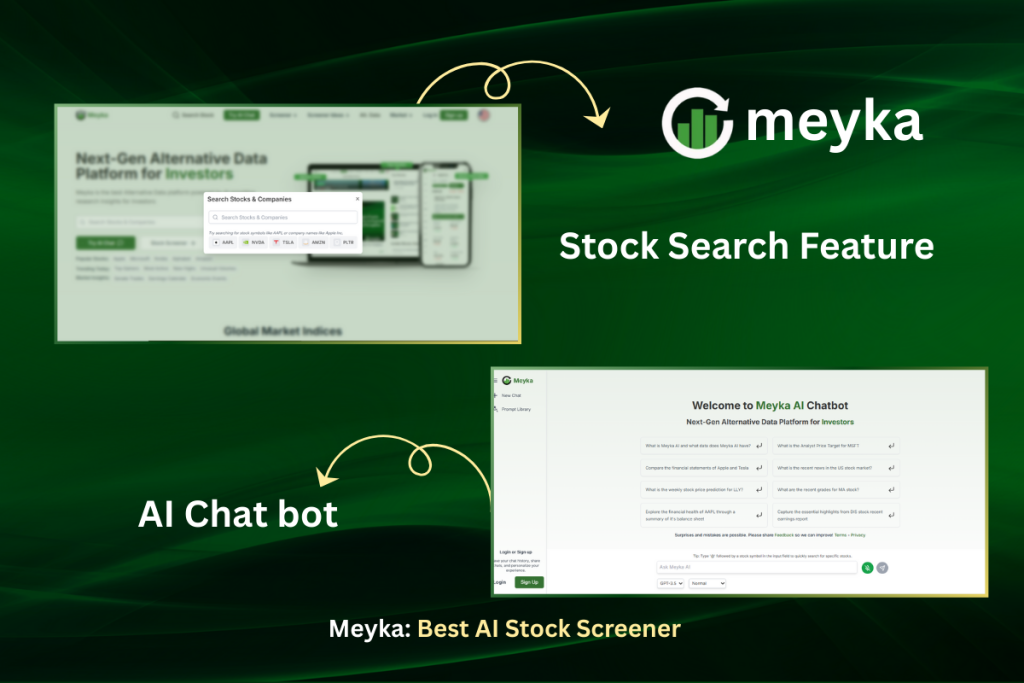

Meyka understands financial language deeply. It processes market movements, company reports, global economic trends, and stock performance within seconds. This makes it easier for advisors to get the insights they need without long research hours.

Meyka’s Key Capabilities Include

- Bold and simple insights that make it easy to understand complex market data.

- Fast analysis of stocks, sectors, and global indices.

- Smart reasoning that helps advisors explain risks and opportunities.

Advisors can rely on Meyka as a partner that simplifies heavy tasks and helps them make decisions faster.

Can an AI chatbot support accurate market research

Yes, because it can read and understand vast amounts of data. Meyka supports platforms that need AI Stock research for large investment teams. It delivers instant breakdowns of company performance, past trends, and sector health.

This gives enterprise clients a strong edge when building portfolios or reviewing market predictions.

The Rising Market Opportunity for AI in Financial Services

The global market for AI in finance continues to grow each year. With more investors moving to digital channels, advisory firms need tools that scale smoothly.

Enterprises are now investing in automation, risk analytics, and smart research tools. AI-powered chatbots fit into this demand perfectly because they offer low operational cost, high clarity, and instant delivery of insights.

Why is the AI advisory market growing so quickly

- Investors want faster help.

- Advisors need research support.

- Enterprises need automation to grow.

This combination has created a huge opportunity that companies like Meyka are capturing.

Meyka’s Enterprise AI Tools and Their Real Business Impact

Meyka is built for enterprise scale. It offers secure, reliable, and compliant solutions that support large advisory teams and investment groups.

Here are some of the core strengths.

1. Enhanced Decision Support

Meyka reads financial datasets and gives simple summaries and forecasts. This helps even complex investment teams make decisions with clarity.

2. Faster Client Communication

Advisors can get client answers instantly with simple explanations. This improves response time and builds trust.

3. Market Intelligence at a Glance

With quick access to AI Stock Analysis, Meyka helps teams understand how a stock is moving, why it is moving, and what risks exist.

How does Meyka help reduce operational costs

- Meyka removes hours of manual research.

- It reduces repetitive client questions.

- It eases the load on analysts and advisors.

This gives enterprises a smoother, more profitable operation.

How Enterprise Investors Benefit from Meyka’s AI Chatbot

Financial advisors, hedge funds, banks, and fintech companies all benefit from AI support.

Benefits for Enterprise Clients

- Better accuracy with data

- Faster report generation

- Real-time market tracking

- Simple explanations for clients

- Improved productivity across teams

These advantages make Meyka a long-term partner for enterprise growth.

Exploring Meyka’s Platform and Services for Financial Firms

Meyka offers dedicated enterprise services with secure integrations, custom features, and scalable systems.

You can explore the platform here

The platform is built to support large teams that need reliable data and clear financial intelligence.

Key service features include

- Custom AI models

- Real-time data understanding

- Smooth integration with team systems

- Dedicated enterprise support

- Clear and human-friendly insights

Does Meyka Support Client-Facing Chatbots

Meyka can serve both internal teams and external clients. Firms can use it for portfolio explanations, market updates, and risk summaries. This improves service quality and reduces client waiting time.

AI Chatbots Are Becoming a Must-Have for Global Finance Firms

The market is moving fast. Advisory firms that adopt AI now get a strong competitive edge. Clients are choosing firms that offer quick answers with reliable insights.

This is why AI is now considered a co-pilot instead of a tool.

And platforms like Meyka are leading this transformation with trust, accuracy, and enterprise reliability.

Future of AI Chatbots in Financial Advisory Services

The next years will see more firms shifting to AI-powered platforms. Risk assessment will improve. Client conversations will get smoother. Market insights will be personalized.

Why Meyka leads this future

- Its understanding of financial language

- It’s strong AI models

- It’sa a simple user experience

- Its enterprise support tools

This makes Meyka a smart partner for firms preparing for the future of AI-enhanced financial advisory work.

What Should Enterprises Do Now

- They should start integrating AI into their daily operations.

- They should give teams the tools they need to work smarter.

- They should explore platforms like Meyka that offer safe and reliable enterprise-grade intelligence.

Conclusion

AI is no longer a futuristic tool. It is the new co-pilot for financial advisors, researchers, and enterprise investment teams. With fast insights, clear explanations, and smooth communication, AI is changing how advisory firms work every day.

Among all solutions, Meyka stands out by offering simple, friendly, and powerful financial intelligence that supports enterprise growth. It helps teams work faster, make better decisions, and offer clients the high-quality experience they expect.

Firms that adopt Meyka today will be ready for the future of financial advisory services.

FAQ’S

AI chatbots help financial advisors with fast data analysis, personalized client insights, and automated workflows. They reduce manual tasks and improve client engagement. Advisors use them to save time and offer better financial guidance.

AI chatbots cannot replace human advisors because they lack emotion, trust building, and deep judgment. They work as support tools. The best results come from combining human advisors with AI assistance.

Yes, most enterprise-level AI chatbots use strong encryption and strict compliance frameworks. They follow industry regulations. This keeps client data protected and reduces security risks.

Financial firms invest in AI chatbots to cut costs, speed up client service, and scale advisory operations. Chatbots also improve accuracy. They help advisors serve more clients with less effort.

Advisors should look for real-time analytics, portfolio insights, and secure integrations. They should also check for personalization tools and automation features. These make the chatbot more effective in advisory workflows.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.