Amanta Healthcare Share Price Jumps 7% on Strong NSE Debut

Amanta Healthcare made a strong entry into the stock market this week. The company’s shares debuted on the NSE with a 7% jump, catching the attention of investors across India. This impressive start shows the market’s growing confidence in the healthcare sector and in Amanta’s growth story. We see that investors are excited about the company’s potential and its long-term plans in pharmaceuticals and healthcare products.

Going public is a major step for any company. For Amanta Healthcare, this move not only raises funds but also strengthens its brand presence in a competitive industry. The IPO attracted a wide range of investors, from retail buyers to big institutional players, showing broad market interest. We can say that the first-day surge reflects positive sentiment and optimism about the company’s future.

Let’s explore how Amanta Healthcare performed on its NSE debut. We will look at the details of the IPO, investor response, and what this means for the company and the healthcare market.

Background of Amanta Healthcare

Amanta Healthcare, founded in 1994 and based in Ahmedabad, Gujarat, focuses on making sterile liquid medicines and medical devices. The company is known for producing high-quality injectables for both India and international markets. Over time, it has added more healthcare products, making it an important player in the pharmaceutical sector.

Going public is a major step for Amanta Healthcare. Listing on the stock market will help the company raise funds for expansion. It plans to set up new manufacturing units in Gujarat. This will increase production and meet the rising demand for its products.

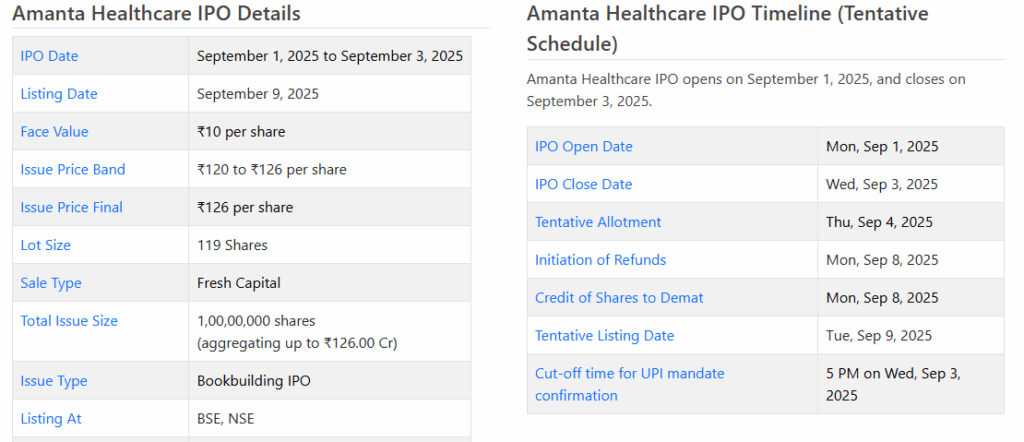

Amanta Healthcare IPO Details

Amanta Healthcare launched its Initial Public Offering (IPO) with a price band of ₹120-₹126 per share. The company aimed to raise around ₹126 crore through 1 crore fresh equity shares. The IPO was open from September 1 to September 3, 2025.

Investor response was very strong. The IPO was subscribed 82.61 times in total. Non-Institutional Investors (NIIs) led the demand with 209.42 times subscription, followed by Qualified Institutional Buyers (QIBs) at 35.86 times and Retail Individual Investors (RIIs) at 54.98 times. This shows high confidence in Amanta Healthcare and the pharmaceutical sector’s future growth.

NSE Debut Performance

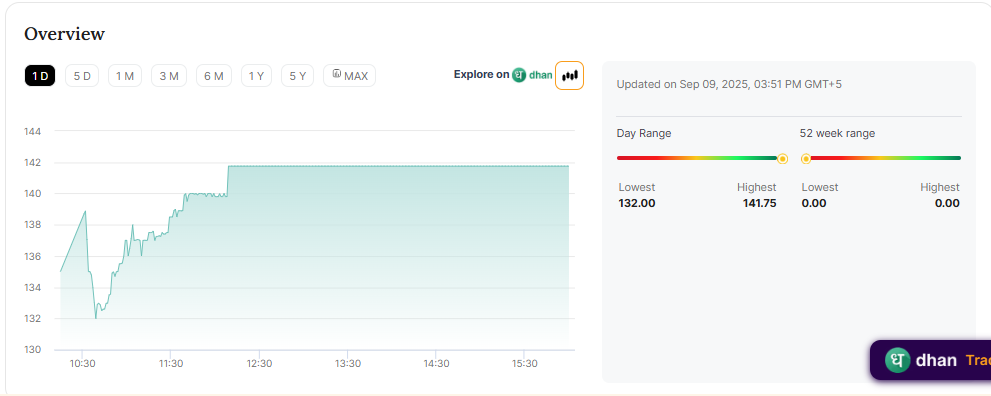

On September 9, 2025, Amanta Healthcare made its debut on the National Stock Exchange (NSE) at ₹135 per share, reflecting a 7.14% premium over the issue price of ₹126. The Bombay Stock Exchange (BSE) also saw a positive listing, with shares opening at ₹134, up 6.35% from the issue price.

The stock’s performance on debut was in line with market expectations, as indicated by the Grey Market Premium (GMP) of ₹9 per share before listing. The strong opening reflects investor optimism and trust in the company’s prospects.

Investor Response and Market Implications

The strong subscription and good listing show that the market trusts Amanta Healthcare. The company’s focus on sterile injectables and its expansion plans have impressed investors. Listing at a premium indicates that the market expects steady growth and profits.

However, some analysts warn that the stock’s current Price-to-Earnings (P/E) ratio of about 46.6x for FY25 may reflect high expectations for future growth. Investors should carefully consider these factors and their own risk tolerance before investing.

Challenges and Risks

Despite the strong debut, Amanta Healthcare faces several challenges. The pharmaceutical industry is highly competitive, with numerous players vying for market share. Additionally, regulatory hurdles and pricing pressures can impact profitability. The company’s ability to scale operations and maintain product quality will be crucial in sustaining growth.

Investors should also be mindful of market volatility, which can affect stock performance. While the initial listing has been positive, long-term success will depend on Amanta Healthcare’s strategic initiatives and the broader economic environment.

Wrap Up

Amanta Healthcare’s strong IPO and market debut mark an important stage in its growth. The money raised will help expand production and reach more markets.

Although the initial response was positive, the company’s future success will rely on how well it executes its plans and adapts to market changes. Investors should watch the company closely and weigh both opportunities and risks in the pharmaceutical sector. Amanta Healthcare’s journey after the IPO will show its ability to grow and continue providing quality healthcare products.

Frequently Asked Questions (FAQs)

Amanta Healthcare’s IPO, held from September 1-3, 2025, was very popular. Overall, it was subscribed to 82.61 times. Non-institutional, retail, and institutional investors all showed strong interest.

On September 9, 2025, Amanta Healthcare listed on NSE at ₹135 per share, a 7.14% rise from the ₹126 issue price. BSE listing opened at ₹134, showing a positive market response.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.