AMD Stock Dips 5%: Analysis & Market Reaction

AMD Stock fell by 5 percent in recent trading, surprising some investors despite the company reporting strong quarterly earnings. The decline highlights the complex dynamics in the semiconductor sector and market reactions to both performance and broader economic trends.

Why did this happen, even after positive earnings? Analysts suggest that investors are looking beyond immediate earnings results and are focusing on future growth, competition, and supply chain pressures.

AMD Stock Performance Overview

AMD Stock is a key player in the semiconductor industry, competing with companies like Intel, NVIDIA, Broadcom, and Marvell Technology. The recent dip follows a period of strong performance fueled by high demand for chips used in PCs, data centers, and gaming consoles.

Despite reporting record revenue and beating analyst expectations, AMD Stock fell, which may seem counterintuitive. This reaction shows how market sentiment and future projections can heavily influence stock prices.

Market Reaction and Investor Sentiment

Investors reacted strongly on social media to the 5 percent dip in AMD Stock. For example, the financial commentator on Twitter noted:

“AMD just dropped 5 percent after earnings. Markets love growth, but fear higher costs and competition.”

Other market watchers emphasized that short-term investors might be taking profits, causing temporary downward pressure on the stock.

Why the AMD Stock Fell Despite Strong Earnings

Several factors contributed to the decline in AMD Stock:

- Analysts highlighted concerns over future guidance and margin pressure in upcoming quarters.

- Supply chain issues remain for certain chips, affecting production and delivery timelines.

- Investors may have anticipated growth in AI and data center chips, and some projections were slightly lower than expected.

This scenario raises the question: Is AMD’s long-term potential affected, or is this just a short-term market adjustment? Most experts believe it is a temporary reaction to cautious guidance rather than weak fundamentals.

Competition and Industry Dynamics

AMD Stock operates in a highly competitive sector with fast-moving technology trends. Its competitors, including NVIDIA, Intel, and Marvell Technology, also saw stock fluctuations, reflecting industry-wide sentiment.

According to a recent market analysis:

“Semiconductor stocks are volatile, and AMD’s dip is a sign of broader market recalibration. Investors need to watch industry trends closely.”

The chip industry is heavily influenced by consumer demand, AI adoption, and corporate technology spending. Any change in these factors can affect stock prices quickly.

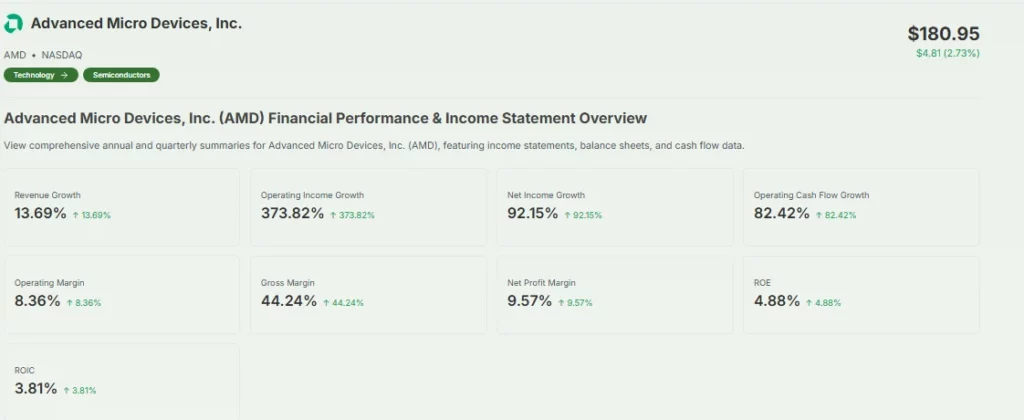

Earnings Highlights and Financial Performance

In the latest earnings report, AMD announced:

- Record quarterly revenue, exceeding $6 billion

- Strong demand in gaming CPUs and GPUs

- Growth in data center chips supporting cloud computing and AI applications

Despite these strong numbers, AMD Stock dipped, reflecting investor focus on future guidance rather than past performance. Analysts note that even high earnings cannot fully offset concerns about competition, production costs, and market saturation.

Social Media and Market Buzz

Social media has played a role in amplifying market sentiment around AMD Stock. Investors and analysts frequently share opinions on platforms like Twitter, discussing price dips, potential rebounds, and long-term growth opportunities.

For instance, a market observer tweeted:

“AMD’s 5 percent dip after earnings shows the market reacts more to expectations than results. Long-term growth remains strong.”

Videos on YouTube have also analyzed the situation, with experts breaking down earnings, competition, and market trends:

This combination of social media and expert commentary influences both retail and institutional investors.

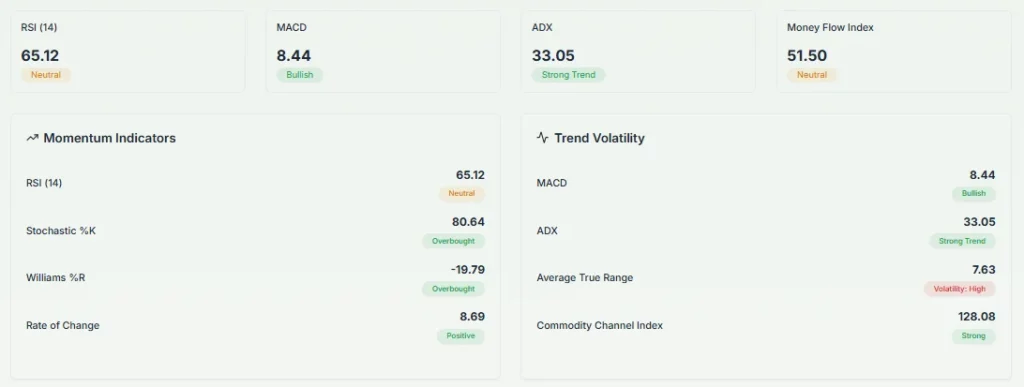

Technical Analysis and Short-Term Outlook

From a technical perspective, AMD Stock recently approached key support levels, indicating potential stabilization. Analysts suggest monitoring the following indicators:

- Moving averages and trend lines for potential rebounds

- Volume analysis to track investor interest

- Relative strength index to gauge overbought or oversold conditions

Many investors are considering this dip as a potential buying opportunity, especially given AMD’s position in AI and data center markets.

Long-Term Potential and Strategic Moves

Despite short-term volatility, AMD’s long-term growth remains promising. The company is investing in next-generation chips, artificial intelligence solutions, and data center technology. These initiatives could boost revenue and profitability in the coming years.

Investors ask: Should I buy AMD Stock now or wait for further dips? Experts suggest evaluating long-term fundamentals, market position, and industry trends rather than reacting solely to short-term price movements.

Conclusion

AMD Stock dipped 5 percent after a strong earnings report, driven by market sentiment, competition, and future guidance concerns. While short-term volatility may continue, the company’s strategic investments in AI, gaming, and data centers offer promising long-term growth.

Investors should watch market trends, competitor performance, and upcoming earnings for better insights. The combination of social media commentary, technical analysis, and financial fundamentals makes AMD Stock a key player to watch in the semiconductor market.

FAQ’S

AMD stock is dropping due to investor concerns about future guidance, competition with NVIDIA and Intel, and margin pressures despite strong earnings.

Currently, AMD stock shows mixed signals; short-term sentiment is slightly bearish due to the dip, but long-term outlook remains bullish because of AI and data center growth.

Reaching $1000 is unlikely in the near future, but with long-term growth in AI and semiconductors, some analysts believe it could happen over a decade.

AMD is considered fairly valued by most analysts, though some believe it is slightly overvalued compared to peers due to high expectations in the AI sector.

Many investors are choosing to hold AMD stock because of its strong position in AI chips and gaming, despite current volatility.

The highest price of AMD stock so far was around $227 in March 2024 before the recent dip.

AMD reaching a $1 trillion market cap would require massive growth in AI, gaming, and data centers. While not immediate, it is possible over the long term.

Analysts’ average target price for AMD stock ranges between $180 and $200 depending on earnings and AI growth potential.

According to Zacks, AMD is often rated as a “Buy” or “Strong Buy” due to growth in high-performance computing and AI demand.

Some analysts argue that Nvidia is overvalued compared to fundamentals, but its dominance in AI GPUs keeps investor demand high.

AMD is not deeply undervalued but may be slightly undervalued compared to Nvidia, especially given its AI and data center opportunities.

The largest shareholders of AMD are institutional investors like Vanguard Group and BlackRock, which collectively hold billions of dollars in AMD shares.

Disclaimer

This content is for informational purposes only and is not financial advice. Always conduct your research.