AMD Stock Jumps 23% as OpenAI Eyes Major Investment

On October 6, 2025, AMD stunned markets when its stock leapt over 23% after news broke of a major deal with OpenAI. We saw an immediate surge in investor optimism. This event goes beyond a typical merger. It hints at a shift in the balance of power in the AI hardware world.

In simple terms, OpenAI will lean on AMD’s chips to build its next-generation computing backbone. In return, AMD gains not just revenue but credibility in AI. For both sides, this is a high-stakes bet. We are entering a moment where chip design, AI scale, and corporate alliances all converge.

Let’s explore how AMD’s surprise rally came to be. We dig into what OpenAI needs. We look at how this changes the fight between AMD, Nvidia, and others. And we ask: Does this deal mark a turning point in AI infrastructure?

Background: AMD’s Position in the Chip Market

Advanced Micro Devices has grown from a PC chipmaker into a major player in AI hardware. The company closed gaps with rivals by improving GPU design and investing in data-center accelerators. AMD’s Instinct line targets large AI models and cloud providers. Nvidia still leads the market in AI GPUs. AMD’s recent roadmaps, though, show faster performance gains and stronger software support for AI workloads. These gains set the stage for big commercial deals.

OpenAI’s Growing Hardware Needs

OpenAI has pushed model size and compute needs higher in 2024-2025. Training and serving advanced models now require massive, reliable GPU fleets. Relying on a single supplier creates supply and price risk. OpenAI has therefore diversified sources, developed its own silicon in parts, and sought multiple partners to scale safely. The company’s public moves in October 2025 reflected that strategy.

The Announcement and Market Reaction

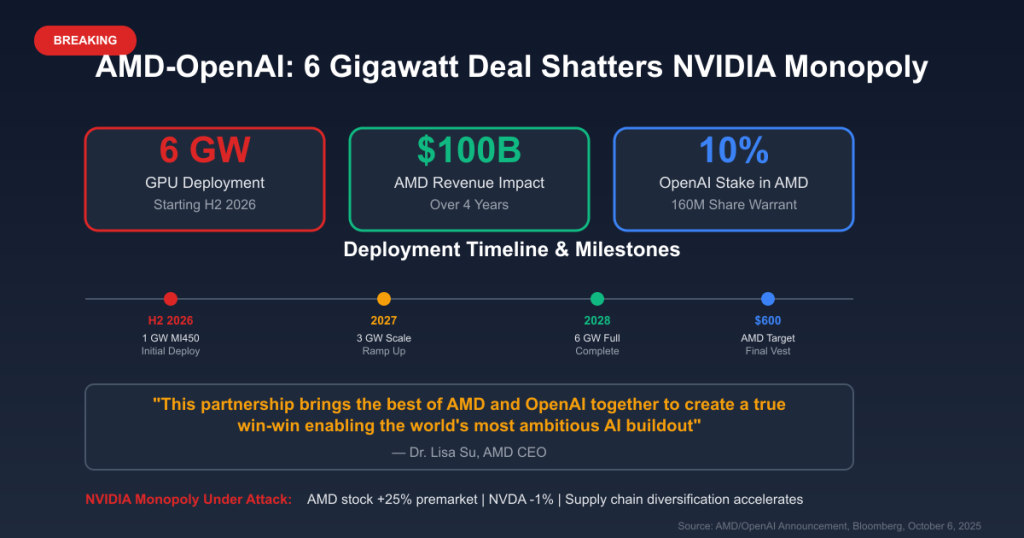

On October 6, 2025, AMD announced a multi-year deal to supply AI chips to OpenAI. The pact calls for AMD’s next-generation MI450 chips and covers large-scale deployments that begin in 2026. The stock reaction was dramatic. AMD stock jumped more than 23% in premarket trading after the news. Market volatility followed as traders and institutions adjusted positions.

Deal Structure and Key Terms

The agreement gives OpenAI an option to acquire up to about 10% of AMD through warrants. Those warrants could allow OpenAI to buy up to 160 million shares at $0.01 each if milestones are met. The deal anticipates the delivery of MI450 chips and specific performance targets. OpenAI will start with a 1-gigawatt deployment in the second half of 2026, scaling to multiple gigawatts over time. AMD described the relationship as a multi-year supply and co-development tie-up.

Strategic Benefits for AMD

The contract promises immediate revenue and a strong signal to the market. AMD expects the deal to open significant business with hyperscalers and cloud providers. Executives said the partnership could drive tens of billions in revenue and send a long-term growth signal to investors. The association with OpenAI also boosts AMD’s credibility in an AI market long dominated by Nvidia. Strong commercial wins like this can accelerate AMD’s roadmap and attract more software and systems partners.

Strategic Benefits for OpenAI

OpenAI gains supply diversity and bargaining power. A secondary major supplier reduces the company’s exposure to single-vendor constraints. The option to acquire AMD stock aligns long-term interests. Access to MI450 silicon also helps OpenAI optimize software and system stacks for specific workloads. The deal gives OpenAI flexibility to manage costs and latency for global deployments.

Industry Impact: Competition Heats Up

The pact forces a re-evaluation across the AI hardware space. Nvidia faces a stronger competitive threat in future procurement cycles. Cloud providers and data-center operators may use the news to negotiate better terms.

Chipmakers such as Intel and Arm licensees will likely accelerate their AI silicon plans. The move could push prices, supply dynamics, and development roadmaps in new directions. Observers expect more strategic alliances between AI firms and chipmakers after October 6, 2025.

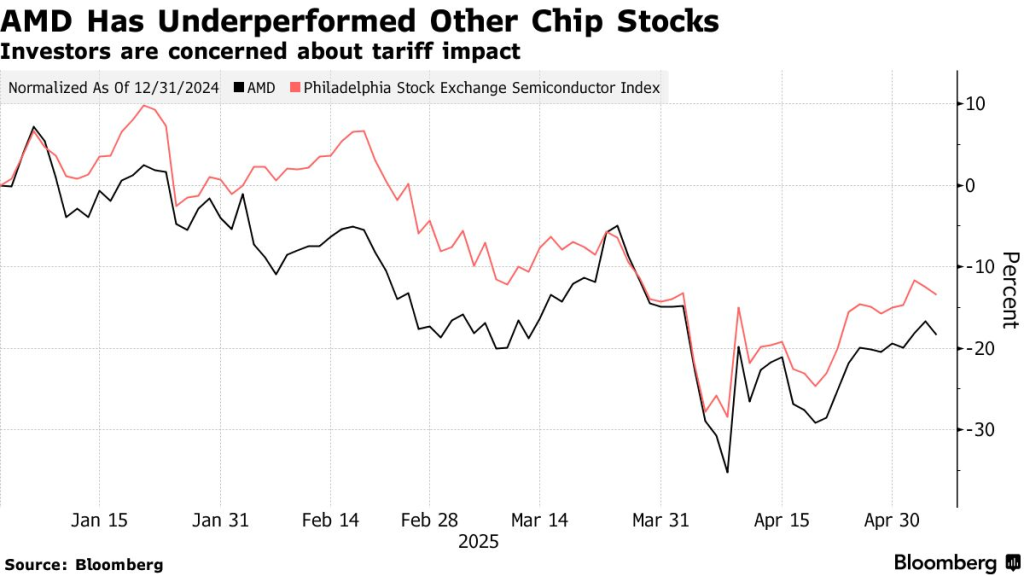

Financial Perspective: Stock, Analysts, and Risks

Investors reacted fast. AMD’s premarket surge erased short positions and reset price targets for some analysts. Several firms raised forward revenue and earnings forecasts after reading the deal’s scale.

At the same time, caution appeared: the warrants and milestone structure mean the upside is contingent on execution. Key risks include supply chain bottlenecks, delays in the MI450 ramp, and potential regulatory scrutiny of large tech-chip alliances. Using an AI stock research analysis tool, some models reweighted the probability of upside scenarios but kept risk premia for execution uncertainty.

Technical and Execution Challenges

Supplying gigawatts of AI compute is not only about chips. It requires data-center design, power provisioning, cooling, interconnects, and software stacks. AMD must ensure driver and library parity so models run efficiently on MI450 hardware.

OpenAI must validate performance and integration, and ensure its software leverages the chips without major rework. Both companies face tight timelines to meet 2026 deployment goals. Any delay could erode the partnership’s market credibility.

Broader Implications for the AI ecosystem

If successful, the deal could lower costs for AI compute over time. More suppliers often encourage competitive pricing and faster innovation. Startups and research labs might gain better access to acceleration hardware.

The deal could also spur specialized chip designs for large language models, inference at scale, and mixed workloads. However, the concentration of demand among a few suppliers remains a vulnerability for the whole ecosystem.

Challenges, Uncertainties, and What to Watch Next?

Key items to monitor are milestone progress, MI450 performance benchmarks, and supply commitments in 2026. Regulators might review the equity option terms and any preferential supply clauses.

Competitors’ responses to new products, pricing moves, or alliances will also shape outcomes. Finally, watch OpenAI’s capital strategy. Large hardware commitments require funding plans; any funding gaps could change the deal’s economics.

Closing Thoughts

The OpenAI-AMD agreement, announced on October 6, 2025, marks a major shift in AI infrastructure partnerships. The deal offers big opportunities. It also poses real execution risks. Markets have priced in hope and potential. The coming 12-18 months will show whether the partnership delivers on its promise and reshapes the AI chip landscape.

Frequently Asked Questions (FAQs)

On October 6, 2025, the AMD stock rose 23% after announcing a big chip deal with OpenAI. Investors saw it as a major step into the growing AI market.

OpenAI, on October 6, 2025, gained access to AMD’s new AI chips and a chance to buy up to 10% of AMD shares if performance goals are achieved.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.