Amex Raises Platinum Card Fee to $895 With New Perks

The Amex Platinum Card just became more expensive, and the new design matters to many travelers and spenders. Amex is raising the annual fee to $895, while adding larger hotel, dining, and lifestyle credits. The change reshapes how cardholders will calculate the card’s value.

Amex raises the Platinum fee, and what changes

American Express announced a $200 increase for both the consumer and business Platinum Cards, up from $695 to $895. New headline benefits include a $400 Resy dining credit, a $600 hotel credit issued semiannually, new lifestyle credits such as Lululemon and Oura Ring offers, and upgrades to the Amex app to help track benefits.

New accounts are subject to the updated fee now, and renewals are phased for existing members.

Amex new perks in plain terms

Amex says the refreshed card can deliver over $3,500 in annual value through statement credits and partner perks, if you use them. Highlights are semiannual hotel credits, expanded digital entertainment credits, Uber One benefits, and a stronger focus on dining.

Amex also introduced a limited edition mirrored card finish as a design option. These are meant to make the premium fee feel like a subscription for curated experiences.

Why did Amex raise the Platinum fee?

Amex points to rising costs, investments in lounges and travel services, and a desire to win affluent customers with curated perks. Analysts add that inflation, higher operating costs, and competition in the premium card space factored into the decision.

The company is pushing value toward curated hotel and dining experiences, rather than across-the-board points boosts.

Why did cardholders notice quickly?

Cards like the Platinum often change through leaks and press previews. Travel writers and forum users posted early summaries of the refreshed credits and fee timing.

For example, a travel writer posted the key headlines on X, noting the fee hike and headline credits, a fast way this news reached consumers.

Another user on X reacted with a mix of excitement and skepticism, reflecting the broad public response.

What are the practical details?

New cardmembers applying after the announcement face the $895 fee immediately, while existing cardmembers generally see the higher fee at their next renewal, with dates staggered into early 2026.

Enrollment may be required for some credits, and some statement credits post quarterly or semiannually, so timing matters when planning to capture full value. Business Platinum also gained business-focused credits such as Dell and Adobe statement credits.

Amex, Amex Gold and competitors

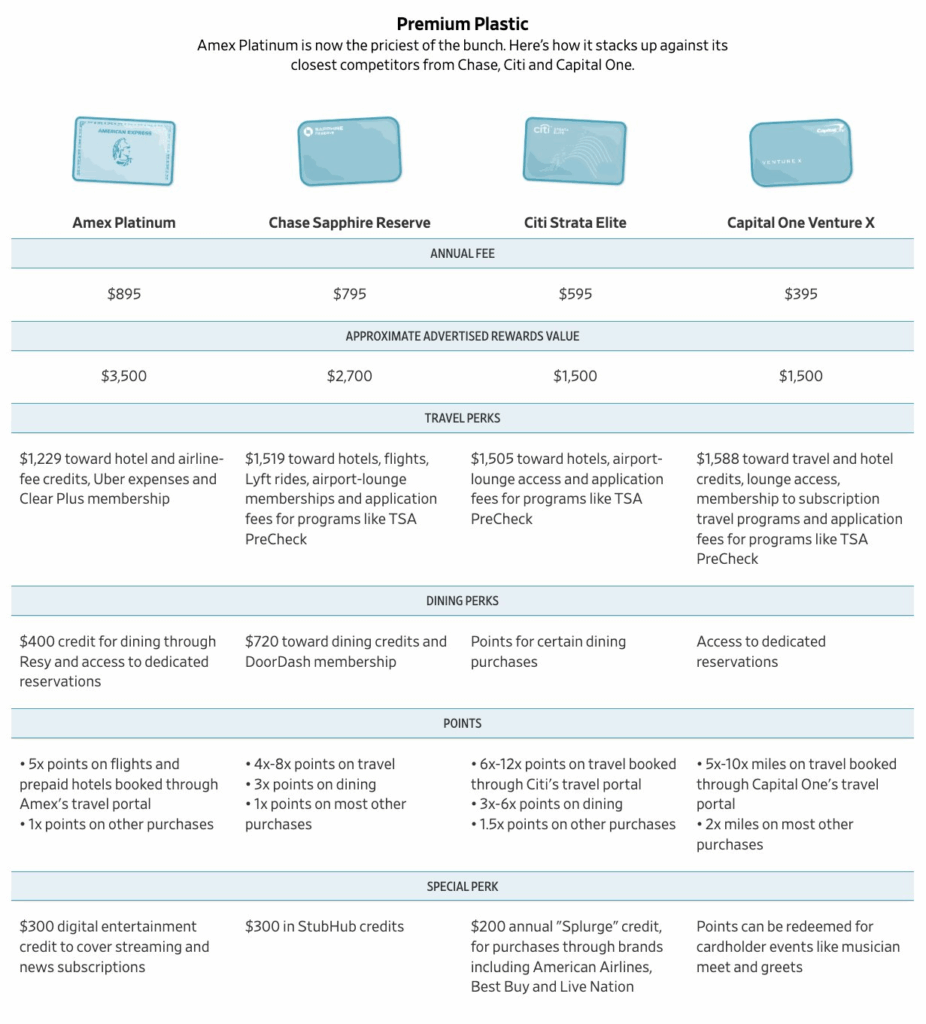

Compared to the Amex Gold, which targets dining and groceries at a lower fee, the Platinum is still aimed at travel and experiential perks. The refreshed Platinum is now priced above the Chase Sapphire Reserve, and Amex is pitching the higher fee as justified by curated hotel benefits and lifestyle credits. For many buyers, the right choice will hinge on which specific credits they will actually use.

Why did Amex raise the Platinum fee? Amex raised the fee to fund expanded benefits, cover higher operating costs, and sharpen its premium positioning in a crowded market. Analysts see it as a bet on affluent customers.

What are the new benefits? New benefits include $400 in Resy dining credits, $600 in hotel credits split semiannually, additional lifestyle credits, and app enhancements to help members track perks.

Is the Amex Platinum still worth it? If you will reliably use the new credits, frequent luxury hotels, and value lounge access, it can still be worth it. If you do not use these specific credits, lower fee alternatives may provide better net value.

How to decide and maximize value

Make a short plan, list credits you will use this year, and estimate realistic redemption values. Enroll in credits early, use semiannual hotel credits on stays that meet enrollment rules, and track digital entertainment and dining offsets in the Amex app.

Small planning steps can turn a high fee into a net benefit.

Social and media coverage, and the video explainer

Coverage has been wide, from long-form reporting to quick social takes. Outlets from WSJ and Reuters to regional and personal finance sites published breakdowns, while finance and travel creators posted video explainers on YouTube showing examples of how to use the new credits. That mix of coverage shaped early impressions.

A short history and a practical example

A quick history note helps. The Platinum Card has changed many times since it moved into the consumer market. Amex has added and removed credits such as lounge access, Saks and Equinox, and streaming and travel statement credits.

This fee jump is one of the largest recent changes and signals a shift toward bundling curated perks instead of boosting base point earning rates. Analysts have tracked this evolution in outlets including WSJ and Investopedia.

Here is a practical sample you can try at home. Add $400 from Resy, $600 from hotel credits, $120 for Uber One, $300 for streaming, and estimate $600 for lounge and elite hotel perks.

That subtotal equals $2,020 in potential benefits before extra travel discounts or signup bonuses. Card writers suggest using conservative numbers for each item so you do not overcount potential value.

Major outlets, including CNBC, WSJ, Livemint, and Meyka, ran explainer pieces the same day, and Amex’s newsroom is the definitive source for exact terms, enrollment windows, and renewal dates. Check official Amex guidance to confirm the timing that applies to your account.

Final verdict on Amex

The Amex Platinum refresh is a clear statement that premium cards will keep evolving into curated membership-style products. The fee increase is significant, but for the frequent traveler and luxury-oriented buyer, the new credits can offset the cost.

For casual users, careful math is essential before renewing. This update forces a simple test: do the perks match your life? If yes, Amex still makes sense; if not, it may be time to reallocate.

FAQ’S

The Amex Platinum fee is high because it includes premium perks like lounge access, hotel credits, and luxury travel benefits that cost Amex more to provide.

The 175k Amex Platinum welcome bonus is usually a targeted or referral offer. Check mailers, Amex’s official site, or use a trusted referral link to apply.

Yes, Amex Platinum is considered a high end card, designed for frequent travelers and luxury seekers who want elite perks and premium rewards.

The Amex Platinum fee went up to $895 in 2025, reflecting inflation, rising lounge investments, and expanded lifestyle and travel credits.

Amex Platinum requires excellent credit, strong income, and a clean financial profile. Amex also reviews spending history and repayment patterns before approval.

Amex Platinum is worth it if you travel often and use credits like hotel stays, dining perks, and airport lounges. For casual users, the high fee may outweigh benefits.

Disclaimer

This is for information only, not financial advice. Always do your research.