Analysts Eye $8 Billion Setback in Nvidia Earnings from China Restrictions

Nvidia, the world’s most valuable semiconductor company, could be facing an $8 billion earnings setback as analysts warn about looming U.S. export restrictions targeting China. Known for powering breakthroughs in artificial intelligence (AI), cloud computing, and high-performance graphics, Nvidia has become the heartbeat of the global tech revolution. Yet, the company now finds itself walking a tightrope between soaring international demand and rising geopolitical tensions.

While Nvidia continues to dominate the AI hardware market, its heavy reliance on Chinese sales has raised red flags for Wall Street. With Washington tightening controls on advanced chip exports to Beijing, the stakes for Nvidia’s next earnings call have never been higher.

Why China Matters So Much for Nvidia

China is more than just a large customer; it is a critical growth engine for Nvidia. Estimates suggest that the country accounts for 20–25% of the company’s total revenue, underscoring how central Chinese demand is to Nvidia’s success. From AI startups in Beijing to autonomous vehicle research labs in Shenzhen, Chinese firms have long depended on Nvidia’s GPUs to power machine learning and advanced computing projects.

However, as the U.S. government continues to expand export restrictions designed to curb China’s access to cutting-edge chips, Nvidia faces a delicate balancing act: safeguard its dominant market position while ensuring compliance with U.S. regulations.

Analysts now project that deeper restrictions could result in a loss of nearly $8 billion in annual revenue, a setback that could slow the company’s record-breaking momentum and weaken its leadership position in AI infrastructure.

Investors Voice Growing Concerns

The possibility of a multibillion-dollar earnings hit has not gone unnoticed in financial markets. Investors are increasingly voicing concerns about Nvidia’s vulnerability to policy changes.

On X, trader @TailThatWagsDog remarked:

“Nvidia’s revenue is more vulnerable than most realize if China decides to retaliate with stricter trade rules.”

This sentiment mirrors the growing unease across Wall Street. While confidence in Nvidia’s technology remains high, investors are uneasy about the unpredictable political risks tied to U.S.–China relations.

Another market watcher, @FortunaTrading1, noted that:

“Nvidia’s stock movement has started to mirror its exposure to export restrictions.”

Such comments reflect the shifting investor psychology. While institutional investors remain committed to Nvidia as a long-term AI leader, retail traders are becoming more cautious, closely tracking regulatory headlines that could sway quarterly guidance.

Stock Market Impact

Nvidia’s stock has been one of the most remarkable stories in financial markets over the past year. Shares have surged by more than 200%, fueled by the company’s dominance in AI chips and its central role in powering generative AI models. However, the specter of China’s restrictions has introduced volatility into what was once considered a one-way trade.

Every headline about U.S.–China trade policy now sparks noticeable swings in Nvidia’s stock price. Analysts say the company has become a barometer for tech-sector risk, where political developments can move billions of dollars in market value overnight.

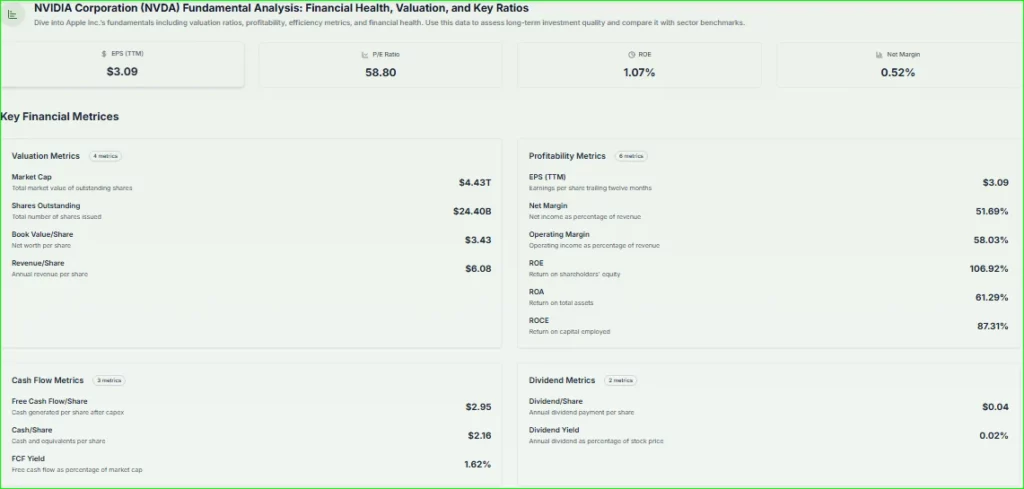

To better understand Nvidia’s current market position, a look at its key financial metrics shows just how stretched yet powerful the company’s valuation has become:

The figures highlight Nvidia’s massive $4.43 trillion market cap, a sky-high P/E ratio of 58.8, and extremely strong operating margins (58%). Yet, with a dividend yield close to zero, the stock remains a classic growth play, meaning its valuation is highly sensitive to geopolitical risks and future earnings potential.

The uncertainty has made short-term price forecasting particularly difficult. While Nvidia’s fundamentals remain strong, even the perception of tighter export rules has been enough to inject caution into one of Wall Street’s most favored growth stories.

The Bigger Geopolitical Picture

The challenges facing Nvidia go far beyond its balance sheet. Washington has made clear that restricting China’s access to advanced chips is not only an economic issue but also a matter of national security. Policymakers argue that preventing Beijing from acquiring the most powerful GPUs helps slow China’s progress in AI and military applications.

On the other hand, China has accelerated efforts to develop its own domestic chip industry, seeking to reduce reliance on American technology. This has set the stage for what many analysts describe as a technological Cold War, where trade, innovation, and security are tightly interlinked.

In a recent CNBC YouTube discussion, industry experts explained how the latest U.S. export bans could reshape global supply chains and force multinational companies to rethink long-term strategies. The consensus was clear: Nvidia is at the epicenter of this geopolitical clash, and its path forward will likely influence the broader direction of the global semiconductor industry.

Can Nvidia Adapt?

Despite the mounting headwinds, Nvidia has shown resilience. The company has already begun developing modified versions of its chips designed specifically for markets affected by restrictions. By lowering certain performance thresholds, these chips aim to remain compliant with U.S. export rules while still addressing demand in countries like China.

This approach could help Nvidia maintain a presence in restricted markets, but the risk remains substantial. If China accelerates its push toward self-sufficiency and develops competitive domestic GPUs, Nvidia could see a permanent erosion of its market share in a region that has long been central to its growth story.

Still, Nvidia’s innovation engine remains unmatched. The company continues to expand its reach into data centers, cloud computing, gaming, and even autonomous driving technologies. Many analysts believe these emerging opportunities could help offset losses from China over time.

What Analysts Are Watching

Wall Street remains split on Nvidia’s long-term trajectory. Optimists argue that the company is well-positioned to diversify beyond China, pointing to booming demand from hyperscalers, cloud providers, and enterprises racing to adopt AI technologies. They believe Nvidia’s technological edge, strong ecosystem, and dominance in CUDA software will shield it from prolonged disruptions.

Skeptics, however, caution that losing even a fraction of Chinese revenue could trigger a ripple effect, reducing R&D budgets, slowing innovation, and weakening Nvidia’s ability to fend off competitors like AMD or emerging chipmakers in Asia.

For now, analysts agree on one point: Nvidia’s upcoming earnings report will be pivotal. Investors will be closely watching for management’s guidance on China, as well as updates on product roadmaps and diversification strategies.

Looking Ahead: What to Monitor

Investors now await Nvidia earning call with keen interest. Key questions include:

- Will management adjust its full-year guidance excluding China revenue?

- How will these losses affect gross and net margins?

- Can new products like the Blackwell chips offset losses from limited China sales?

- How will broader export policies evolve under U.S. and Chinese regulatory shifts?

Conclusion

Nvidia is not just another tech stock; it has become the heartbeat of the AI revolution. Yet, as Washington doubles down on export restrictions and Beijing seeks alternatives, the company faces one of the greatest tests in its history.

An $8 billion earnings setback would not only hit Nvidia earning bottom line but also serve as a stark reminder that even the most powerful companies remain vulnerable to the forces of geopolitics.

The coming months will reveal whether Nvidia can adapt, diversify, and sustain its dominance, or whether the weight of political pressures will finally slow the momentum of Silicon Valley’s most celebrated AI juggernaut.

FAQ’S

Because U.S. export restrictions may block a significant portion of its sales to China, which is a major revenue source.

Analysts estimate China contributes around 20–25% of Nvidia’s total revenue.

Yes, Nvidia has had to redesign chips to comply with earlier restrictions, and future rules could bring further setbacks.

Its GPUs are the backbone of AI research, data centers, and large-scale computing worldwide.

China is investing heavily in domestic chip development, but catching up with Nvidia’s advanced technology will take years.

Disclaimer

This content is for informational purposes only and is not financial advice. Always conduct your research.