Analysts Shocked by Guidance, Oracle Stock Faces Pressure

Oracle is one of the world’s largest software companies. It is best known for databases and cloud services. In recent months, Oracle stock gained strong attention. Investors followed its growth in cloud and AI deals. But the latest earnings guidance surprised many analysts. The numbers were lower than what most of us expected. This change created pressure on the stock.

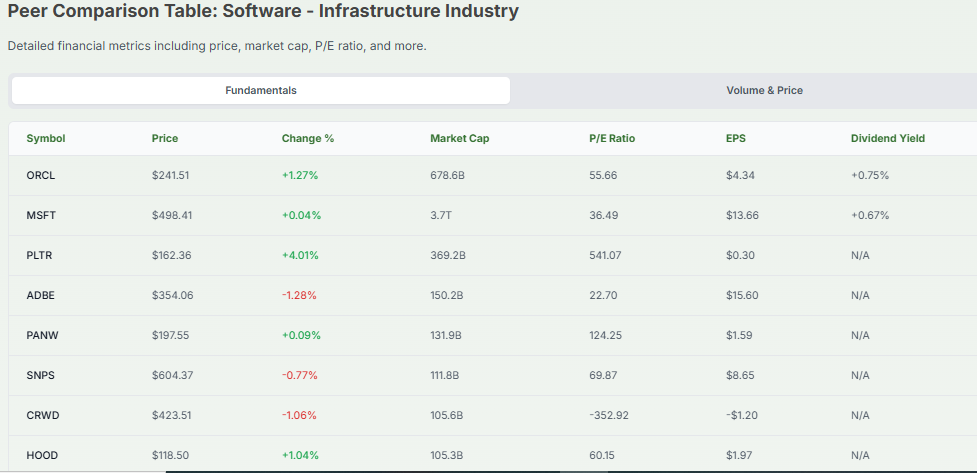

Why does this matter? Guidance gives us a picture of the company’s future. When a company projects lower revenue or slower growth, the market reacts. We saw this with Oracle. Even after strong momentum in AI partnerships, doubts are now rising. Some investors are wondering if Oracle can keep pace with its rivals, such as Microsoft and Amazon.

At the same time, Oracle has powerful strengths. Its database services remain vital for global businesses. Its AI and cloud push is not slowing down. But trust depends on results. We, as market watchers, want proof of growth. This is why guidance matters. It shapes how we see the company’s future.

Analyst Reaction on Oracle

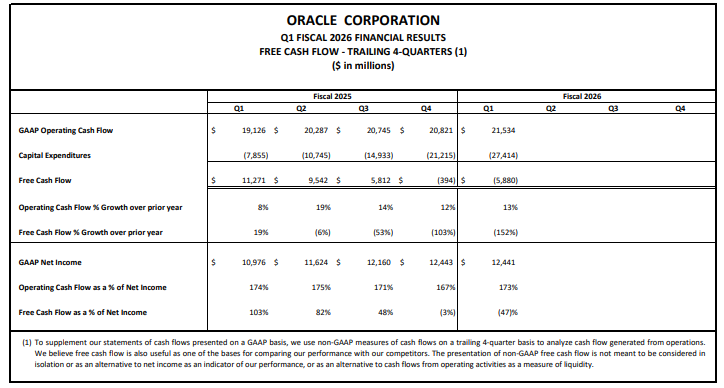

Analysts reacted strongly to Oracle’s latest guidance and disclosures. Many had expected steady growth in cloud revenue. The company reported a huge jump in booked future revenue. That surprised several Wall Street firms. Some analysts called the guidance ambitious. Others said the numbers raise questions about execution and capacity. A few noted that big multi-billion-dollar contracts can lift future revenue. But they also warned that strong bookings do not always mean near-term cash flow.

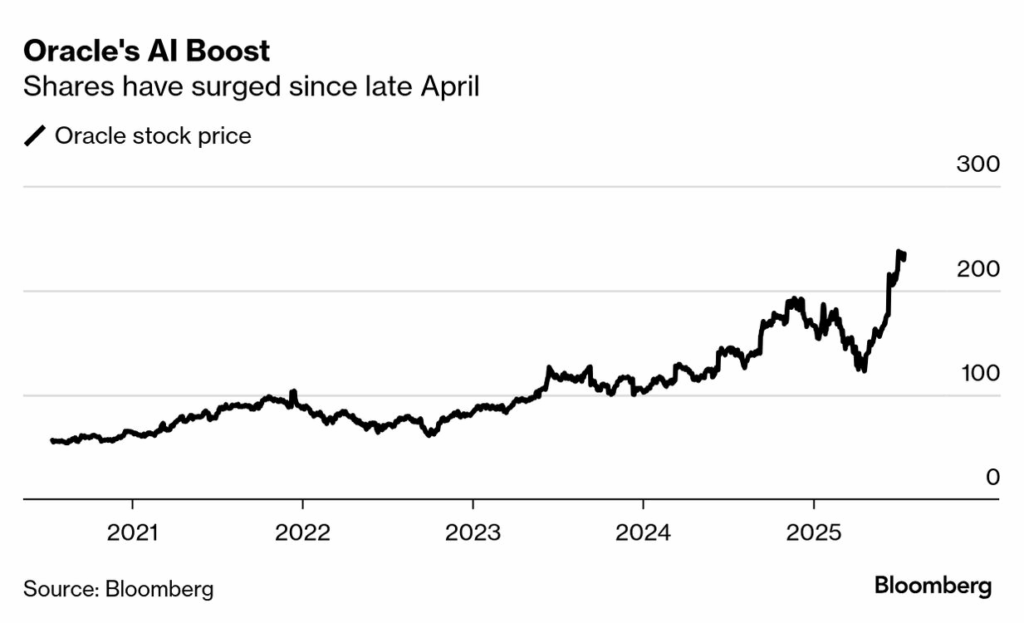

Oracle Stock Rally: The Catalyst

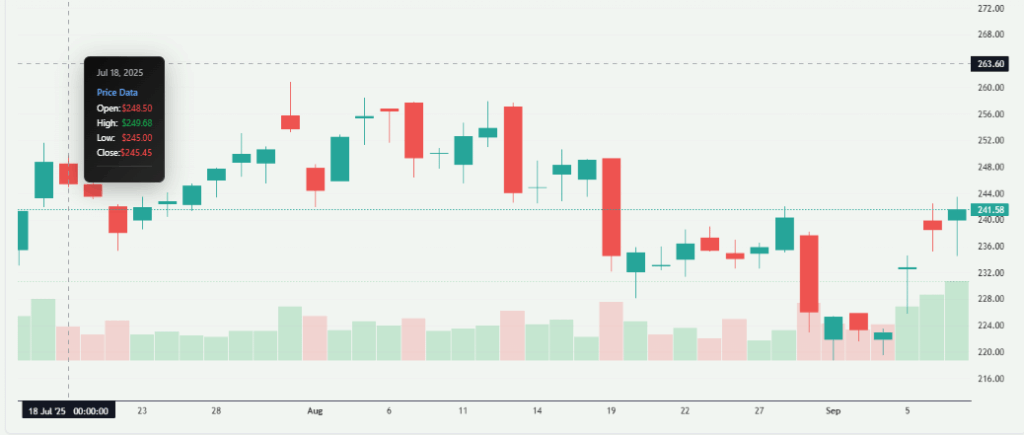

The stock moved sharply after the update. In after-hours trading, shares rose into record territory on news of a large backlog. The market focused on a 359% jump in remaining performance obligations, which signals heavy future demand. At the same time, Oracle missed revenue estimates for the quarter by a small margin. That mix of a slight miss plus a massive order book produced big swings in price. Traders reacted fast. Volumes spiked as investors re-priced expectations.

The AI and Cloud Computing Effect

Oracle called the quarter “brilliant.” Its cloud infrastructure business, fueled by AI demand, showed rapid expansion. The company expects 77% growth this fiscal year, with revenue forecasts rising from $18 billion to potentially $144 billion over the next four years. Oracle signed four multi-billion-dollar deals and raised its booked contract value, called remaining performance obligations (RPO), by 359% to $455 billion. The new Oracle AI Database service will let customers use AI models like ChatGPT, Gemini, and Grok inside Oracle systems.

Oracle’s Long-Term Growth Strategy

Oracle is shifting from its legacy software roots to cloud and AI-centric services. It plans to grow Oracle Cloud Infrastructure (OCI) from $18 billion now to as much as $144 billion in four years. The company boosts its data center reach by adding 37 new centers, bringing the total to 71 via partnerships with Amazon, Google, and Microsoft (its MultiCloud strategy). Oracle also expects massive demand for AI infrastructure. Ellison highlighted that Oracle is ready to exceed a trillion dollars in RPO soon.

Market Reactions & Investor Sentiment

Markets responded strongly. Oracle shares surged 23-27% after hours as results unfolded. Analysts see the backlog of AI and cloud contracts as key to future growth, even though earnings missed slightly. Some caution that chip shortages and high demand may strain infrastructure capacity.

Oracle Stock: Challenges Ahead

Competition is fierce. Oracle faces rivals like Amazon AWS, Microsoft Azure, and Google Cloud. Securing AI-grade infrastructure is costly and complex. Oracle’s shift to heavy capex for its cloud drive has paused share buybacks and hurt free cash flow. Analysts worry about its ability to meet demand amid tech shortages.

Why does the Guidance Matter?

Guidance shapes investor trust. Clear, realistic forecasts calm markets. Aggressive forecasts raise doubts. Oracle’s guidance included steep cloud revenue growth targets for the coming years. It also raised capital spending plans. Analysts will watch if the company can deliver the infrastructure and services needed. Execution risks now sit alongside large potential gains. If Oracle builds capacity on time, revenue should follow. If not, the stock could face renewed pressure.

Outlook and What to Watch Next?

Watch three things closely. First, contract conversion: will booked deals turn into billed revenue on schedule? Second, data-center delivery: can Oracle add capacity fast enough? Third, margins: heavy capex can squeeze near-term profits. Analysts will also track partnerships with major AI players and hyperscalers. Positive updates on these fronts could validate the bold guidance. Weak signals could force analysts to cut estimates and pressure the stock.

Bottom line

The company shows a large pipeline of future work. That excites some investors. It also forces scrutiny from analysts. Short-term results and execution will decide whether the stock stays strong or faces fresh pressure. Expect continued volatility as the market digests real delivery versus promises.

Frequently Asked Questions (FAQs)

Oracle shares jumped in September 2025 after strong cloud and AI growth. Ellison, as a major shareholder, saw his personal wealth rise by about $70 billion.

Oracle has signed big AI deals and expanded data centers in 2025. It can compete strongly, but Amazon, Microsoft, and Google still hold larger market shares.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.