Angel One share falls over 5% as company’s client growth drops 17% YoY in November

Angel One grabbed attention on December 1, 2025, when its share price fell more than 5% in early trade. The drop came right after the company reported a sharp slowdown in new client additions for November 2025. The YoY decline was almost 17%, and that number quickly raised concern in the market. Investors began asking one simple question: Why is one of India’s top brokerage platforms losing momentum?

This slowdown matters. Angel One is known for fast client growth and an active retail base. When that growth softens, it affects revenue, market share, and future plans. The stock market reacts fast to any sign of pressure in the broking industry, and this update was no exception.

At the same time, the brokerage space in India is getting more competitive. New fintechs, low-cost platforms, and smarter trading apps are making it harder to grow at the same pace as before. So this drop is not just a number. It is a signal. And it tells us a lot about how the market is changing, and what Angel One must do next.

What Triggered the Sell-off on December 3, 2025?

Angel One’s stock slid more than 5% on December 3, 2025. The market reacted after the firm disclosed that gross client acquisitions in November 2025 fell 17% year-on-year. That single number alarmed traders. It implied slower new user inflows than the market expected. Short sellers and cautious funds moved quickly. The share price drop followed high volume on the exchanges.

The Numbers behind the Slowdown

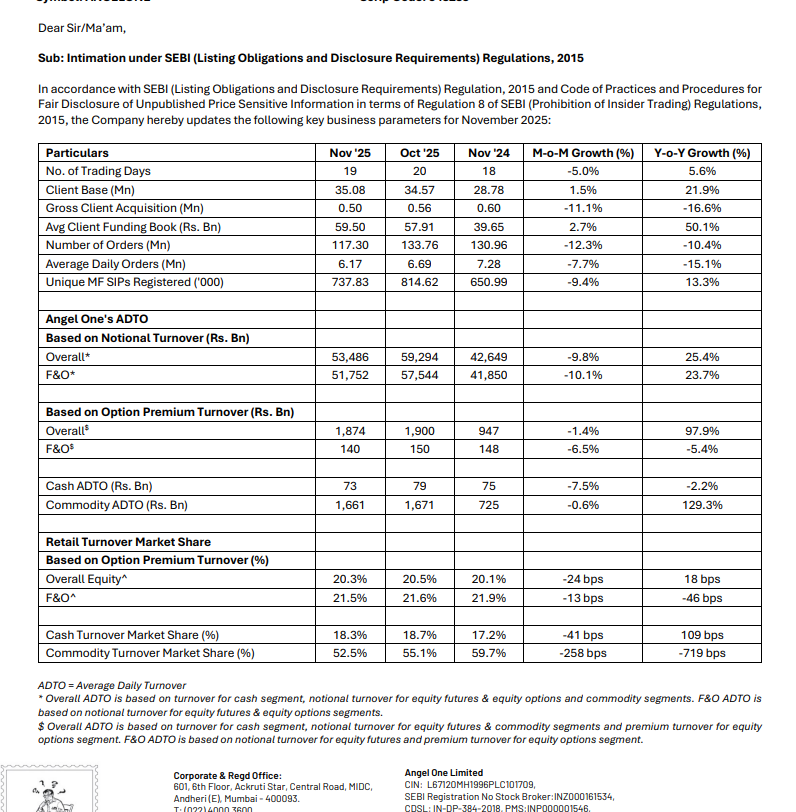

Angel One still shows a larger total client base. The company reported a client base of about 35.08 million in November 2025. Yet new signups dropped sharply compared with the same month a year earlier. Average daily orders and total orders also fell. Orders slipped about 10.4% YoY in November, and average daily orders were down roughly 15.1% YoY. These operational dips make future revenue growth less certain.

Why this Matters for Revenue and Margins?

Broker firms earn from transaction fees, margin funding, and advisory services. New clients usually bring trading volume. That volume turns into brokerage income. A fall in fresh clients can lower future trades. It can also raise the cost of growth. Marketing spends may rise to win back momentum. Lower orders reduce high-margin option and derivative revenue. That hurts profit margins faster than it hits top line.

Market Context and Regulatory Pressure

The Indian broking space faces multiple pressures. SEBI’s tighter rules on derivatives have reduced risky trades. That has cut option and futures volumes across brokers. Retail traders are also shifting to low-cost or no-frills platforms. Many fintech apps now offer advanced features that attract young investors.

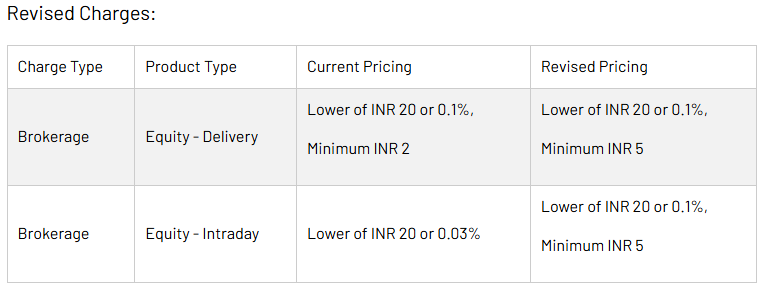

Angel One must operate in that tougher environment while protecting revenue. Recent fee changes by Angel One in mid-November 2025 may also have affected signup behavior. The firm updated its pricing schedule effective November 17, 2025.

Competitors, Fintech Trends, and Client Retention

Discount brokers and neo-brokers continue to push fees lower. They also run heavy digital campaigns. That increases user expectations. Many new users sign up with one app and switch after a few months. Retention is now as important as acquisition. The market rewards platforms that boost monthly active users and average daily orders. Without these, valuations look fragile. Analysts will watch retention metrics closely over the next quarters.

How the Angel One can Respond?

Angel One can act on three fronts. First, improve user experience to cut churn. Second, focus on deeper financial products to lift per-user revenue. Third, sharpen cost control to protect margins. Tech upgrades and better customer support help. Data and analytics can pinpoint at-risk customers.

Some sell-side teams already use an AI stock research analysis tool and similar tech to spot trends. Any clear plan will matter to investors. Angel One’s investor pages and recent presentations show a focus on platform improvements and wider product offers.

Short-term vs Long-term View for Investors

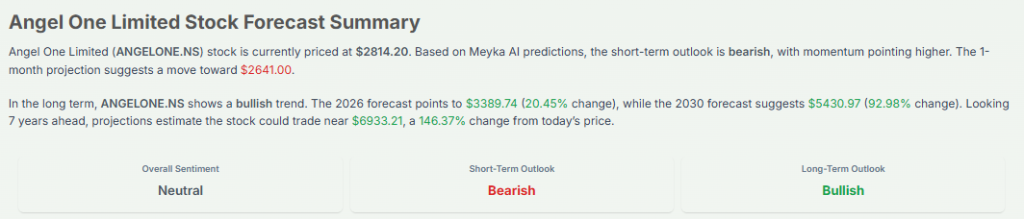

In the short term, the stock may stay volatile. Headlines about client additions will move the price. Traders can react to small swings. In the long term, the key question is structural.

Can Angel One grow client value even if new signups slow?

Watch these metrics: monthly active users, gross client acquisition, average daily orders, and revenue per user. If these stabilise or improve, the business remains viable. If they do not, margins and valuation will face pressure.

Angel one Share: What to Watch Next?

Look for the company’s next monthly update. Compare November 2025 with December 2025 data. Check quarterly results and commentary from management. Also watch industry signals: trading volumes across exchanges and any SEBI rule changes. Analyst notes and broker reports will flag whether the slowdown is temporary or structural. Investor sentiment often shifts quickly once fresh data arrives.

Final Take

The 17% YoY drop in gross client acquisition for November 2025 is a clear warning sign. It triggered the stock slide on December 3, 2025. The bigger question is whether this is a temporary lull or the start of a longer trend. That answer will come from the next few monthly updates and the quarter-end results. For now, caution is sensible. Focus on hard metrics, not just market noise.

Frequently Asked Questions (FAQs)

Angel One’s stock fell on December 3, 2025, because the company reported weaker client growth for November. Investors reacted to the slowdown, and the share price moved down.

Client growth fell 17% in November 2025 due to lower new sign-ups, weaker trading activity, and rising competition from other online brokers offering cheaper or easier trading options.

The slowdown in new users suggests pressure on market share. It does not confirm a big loss yet. Future monthly numbers will show if the trend continues or improves.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.