ANZ Bank News: Nuno Matos Calls 3,500 Job Cuts ‘Last Resort’

ANZ Bank has announced plans to cut 3,500 jobs. The decision comes at a time when banks worldwide are under pressure. Rising costs, digital disruption, and changing customer behavior are forcing tough choices. For ANZ, these cuts are not made lightly. Nuno Matos, the bank’s CEO, called the move a “last resort.”

When we hear about thousands of jobs being lost, it feels personal. Behind every number is a worker, a family, and a future now uncertain. At the same time, banks face a new reality. Customers expect faster digital services, while global markets demand stronger performance. Balancing both is never easy.

Let’s look at why ANZ chose this step, how it affects employees, and what it means for the future of banking. We will also explore how other global banks are handling the same storm.

Background: ANZ Bank and Its Position

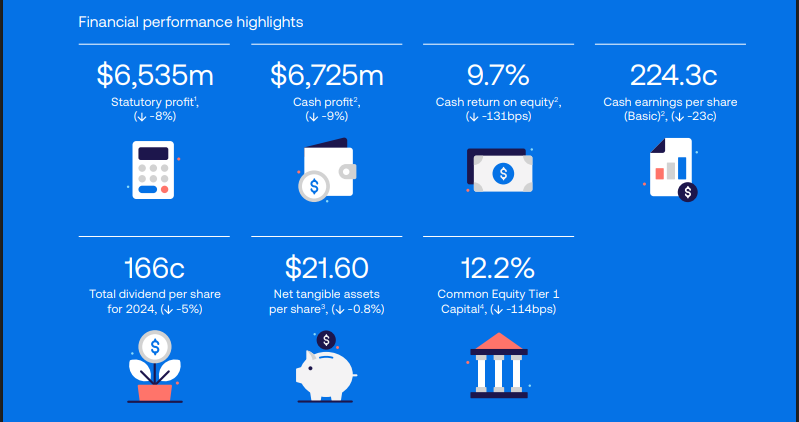

ANZ Group, headquartered in Melbourne, is Australia’s fourth-largest bank by market capitalization. With a workforce of approximately 42,000 employees, it offers a wide range of financial services, including retail, commercial, and institutional banking, as well as wealth management and insurance. In 2024, ANZ reported a profit of A$6.73 billion and assets totaling A$1.23 trillion.

The bank has faced increasing pressure from rising costs, regulatory scrutiny, and digital disruption. Despite a reported 16% rise in profits to A$3.64 billion, ANZ’s stock performance has lagged behind its competitors, prompting the need for strategic changes.

The Announcement of Job Cuts

On September 9, 2025, ANZ announced plans to cut 3,500 jobs and 1,000 contractor positions over the next year, representing nearly 10% of its workforce. This restructuring is part of a broader initiative to streamline operations, eliminate duplication, and improve risk management.

The decision is expected to incur a restructuring charge of A$560 million. While the bank aims to minimize the impact on customer-facing roles, the cuts are anticipated to affect back-office and support functions.

Management’s Perspective: Nuno Matos’s Statement

Nuno Matos, who became CEO in May 2025, described the job cuts as a necessary step to ensure the bank’s long-term sustainability. He emphasized that the decision was not about profits but about getting the basics right. Matos acknowledged the difficulty of the situation and pledged to manage the transition with care and respect for affected employees.

Economic and Industry Context

The banking sector is undergoing significant transformation due to factors such as digitalization, automation, and regulatory changes. ANZ’s decision aligns with broader industry trends, as banks seek to reduce costs and enhance efficiency. Similar moves have been observed globally, with institutions like HSBC and Citigroup implementing restructuring initiatives to adapt to the evolving financial landscape.

Impact on Employees and Stakeholders

The job cuts have elicited strong reactions from employees and unions. The Finance Sector Union condemned the layoffs as excessive and profit-driven, particularly given ANZ’s recent profit increase. Critics argue that the bank is prioritizing shareholder returns over employee welfare.

Shareholders and investors are closely monitoring the situation, as the restructuring may affect the bank’s short-term performance. However, some analysts view the move as a necessary step to position ANZ for future growth in a competitive market.

Public and Political Reaction

The announcement has sparked public debate about corporate responsibility and the social impact of large-scale job cuts. Political figures have attributed the layoffs to broader economic uncertainty and technological advancements, such as artificial intelligence, which are reshaping the workforce. While some support the restructuring as a strategic move, others express concern over the potential social consequences.

Future of ANZ Bank Post-Cuts

Following the job cuts, ANZ plans to focus on its core business areas and invest in digital transformation to enhance customer experience and operational efficiency. The bank is expected to provide a strategic update to investors on October 13, outlining its plans for the future.

The restructuring aims to position ANZ for long-term success by aligning its resources with strategic priorities and adapting to the evolving banking environment.

Expert Opinions and Analysis

Financial analysts have mixed views on ANZ’s decision. Some commend the bank for taking bold action to address inefficiencies and improve competitiveness. Others caution that the job cuts may lead to short-term disruptions and affect employee morale. The success of the restructuring will depend on how effectively ANZ manages the transition and communicates with stakeholders.

Wrap Up

ANZ’s decision to cut 3,500 jobs marks a significant shift in the bank’s strategy under CEO Nuno Matos. While the move aims to streamline operations and enhance long-term growth, it has raised concerns among employees, unions, and the public. The coming months will be crucial in determining whether the restructuring leads to a more agile and competitive ANZ or if it faces challenges in managing the social and operational impacts of the job cuts.

Frequently Asked Questions (FAQs)

On September 9, 2025, ANZ Bank said it will cut 3,500 jobs to reduce costs and make operations more efficient. CEO Nuno Matos called it a last resort.

The cuts will affect about 8% of ANZ staff, mostly in support roles. The bank promises to handle it carefully, but employees may face stress and uncertainty.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.