ANZ Bank under fire for customer deception as executives earn $26m bonuses

ANZ Bank, one of Australia’s biggest lenders, is facing a growing public outcry after reports that senior executives collected $26 million in bonuses even as internal documents show the bank ignored many customer hardship pleas.

The Guardian’s investigation exposed patterns of automated, misleading communications to struggling customers, while some hardship requests were reportedly rejected or overlooked. The revelations have reignited questions about bank culture, executive pay, and regulatory enforcement in Sydney, Melbourne, and Canberra.

How did a major bank come under such sharp criticism?

ANZ Bank Faces Growing Backlash Over Customer Deception

Leaked records and reporting show that ANZ Bank continued aggressive collection and fee practices even when customers signaled serious financial distress, prompting anger among consumer groups and politicians.

The Guardian found internal documents suggesting staff were sometimes instructed to downplay hardship claims, while automated messages told customers help was available. Despite those messages, many genuine requests for relief went unanswered, leaving families at risk of enforcement actions.

This pattern has added fuel to a wider debate about bank ethics and corporate responsibility in Australia.

Why are Australians so angry? Many feel banks prioritized profit and bonuses over people during tight times, especially after previous scandals in the sector.

Internal documents reveal disturbing patterns

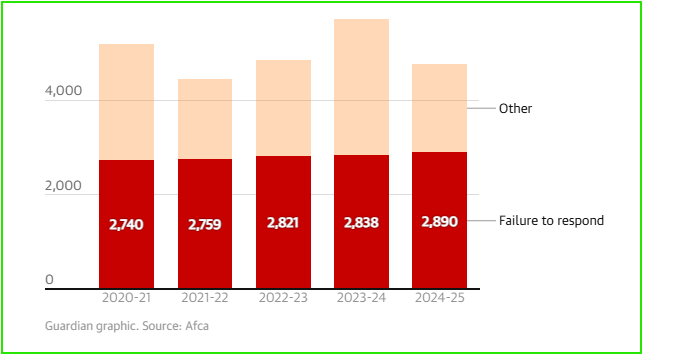

Investigative reporting shows examples where hardship notices from customers were not properly handled. The Australian Financial Complaints Authority recorded thousands of complaints about ignored hardship requests, and advocacy groups say reliance on automated replies has left vulnerable customers without real help.

Critics argue this is not isolated to ANZ, but part of a systemic problem across major lenders.

Executives Rewarded with $26 Million in Bonuses

Summary: While customer complaints mounted, top executives at ANZ Bank received roughly $26 million in bonuses over recent years, a decision many see as deeply tone deaf.

According to reporting, the payouts included sizable short term incentives, even as the bank faced regulatory scrutiny and public fury.

Former CEO Shayne Elliott is reported to have declined a longer term bonus but still received large short term payments, raising questions about the link between executive pay and customer outcomes.

Consumer groups and unions labeled the bonuses “indefensible” while calling for reforms to pay governance.

Is it fair for executives to profit while customers suffer? Public sentiment suggests no, and the optics of large bonuses amid job cuts and fees have intensified pressure on the bank.

ANZ Bank’s official response and public reaction

In statements, ANZ Bank has said it is reviewing hardship processes and committed to improving customer outcomes, while defending that bonuses were tied to established performance metrics.

The bank’s leadership has promised reforms, but the public reaction has been strong: social media and consumer groups are demanding tougher enforcement and meaningful restitution for affected customers. ASIC and other regulators are watching closely.

A Pattern of Misconduct in the Banking Sector

The ANZ case fits into a broader pattern of misconduct previously exposed by the banking royal commission, and regulators warn that the sector still has deep cultural issues to fix.

Recent reports showed that nearly 2,900 customers complained about ignored hardship requests in 2024–25, and AFCA data indicates rising nonresponses by large lenders. The pattern of automated, generic replies rather than human review is a recurring theme.

Analysts say the sector must rebuild trust through transparency, stronger complaint handling, and binding accountability for executives and boards.

Is this just ANZ’s problem? Experts say no, and point to systemic weaknesses across several major banks that the Royal Commission previously highlighted.

Government and regulatory pressure intensifies

Regulators including the Australian Securities and Investments Commission (ASIC) are under pressure to act, and lawmakers are calling for stricter penalties for banks that mistreat customers.

Consumer advocates want restitution for those denied proper hardship assistance. Observers expect ASIC to use its enforcement powers vigorously, and some suggest this episode could prompt further reforms to executive pay rules and tougher oversight of hardship processes.

The Impact on ANZ Bank’s Reputation and Market Performance

The scandal risks damaging ANZ’s brand, customer trust, and potentially investor confidence, even if short term market moves are limited.

Business analysts warn that reputational harm can translate into long term costs: higher customer churn, tougher regulatory conditions, and potential legal liabilities. While ANZ shares may experience only modest immediate volatility, the deeper risk is a sustained loss of public confidence that affects future growth and margins

AI Stock Analysis indicates that governance and public perception increasingly factor into investor decisions about financial firms.

What comes next for ANZ Bank

ANZ now faces possible fines, audits, and internal change programs. ASIC’s record $240 million penalty for related misconduct earlier this year signals that regulators are prepared to act decisively.

Shareholders will be watching the December AGM closely, and consumer groups will push for compensation and clearer hardship protocols. The bank’s leadership must show concrete, fast reforms if it hopes to rebuild trust.

Can ANZ Bank restore public trust? That will depend on transparent corrections, real customer remediation, and meaningful governance changes.

Conclusion

The ANZ Bank controversy is a stark reminder that profit and public trust must align. Revelations that executives earned $26 million while hardship pleas went unanswered reopened old wounds in Australia’s banking sector. Regulators, lawmakers, and the public now expect swift action: clearer hardship rights, stronger enforcement, and executive accountability.

As investigations proceed, ANZ faces a critical choice: rebuild credibility through genuine reform, or risk long term damage to its reputation in Sydney, Melbourne, and across Australia. For many customers, meaningful change cannot come soon enough.

FAQ’S

The ANZ Bank scandal refers to allegations that the bank deceived customers by ignoring hardship pleas and sending misleading automated messages. Reports revealed that executives earned $26 million in bonuses while many struggling customers were denied real financial help.

The ANZ rate scandal involves claims that the bank and other major lenders manipulated benchmark interest rates for profit. Regulators found that traders had attempted to influence the bank bill swap rate, leading to fines and public criticism over unethical banking practices.

Customers affected by ANZ’s misconduct can check their eligibility for remediation by visiting the official ANZ website or contacting the bank’s support team directly. Refunds are usually issued automatically if customers were part of the impacted group identified in the review process.

The ANZ offset lawsuit concerns allegations that ANZ failed to apply agreed offset accounts properly, causing customers to pay higher interest than they should have. The case has drawn regulatory attention and calls for compensation to affected borrowers.

Disclaimer

This content is for informational purposes only and is not financial advice. Always conduct your research.