Apollo Micro Systems Price Hits 52-Week High as Market Momentum Builds

Apollo Micro Systems (AMS) has caught the market’s attention once again as its share price touched a fresh 52-week high. The company, known for its role in defense and aerospace technologies, has become a talking point for investors looking at India’s growing defense sector. This surge is not just about one stock moving up; it reflects the broader momentum in mid-cap defense plays and the rising confidence in “Make in India” programs.

We see a clear trend where companies supplying DRDO, ISRO, and the armed forces are gaining investor trust. Apollo Micro Systems stands out because of its steady order book and its position in niche, high-tech segments.

At the same time, retail participation and institutional interest have added fuel to the rally. For many, the question now is not just why the stock is rising, but whether this momentum can hold in the months ahead.

Apollo Micro Systems (AMS): Company Background

Apollo Micro Systems (AMS) designs and builds rugged electronic and electro-mechanical systems. The company serves aerospace, defence, space, and homeland security. It works on mission-critical gear such as avionics, command systems, and naval electronics. The firm began as a design partner to DRDO and ISRO and later scaled manufacturing. Clients include DRDO, Indian Army and Navy, DPSUs, and major private contractors. The stated focus is indigenisation and long-life support for field use.

Stock Performance Overview

The stock just printed fresh 52-week and lifetime highs in late August 2025. The move followed back-to-back gains through the month. On August 22, shares jumped about 15% intraday after the company emerged as the lowest bidder for orders worth ₹25.12 crore from DRDO and defence PSUs. Prices then extended to new records on August 25, with coverage noting a near 25% five-day rise and a year-to-date double. Live trackers show the 52-week high in the ₹240-255 zone across exchanges.

Key Drivers Behind the Surge

Fresh order wins acted as the direct spark. The order news signalled steady demand from strategic programs. Momentum also rides on a strong FY25 print. Multiple outlets reported the company’s highest-ever annual revenue and sharply higher profit for FY25.

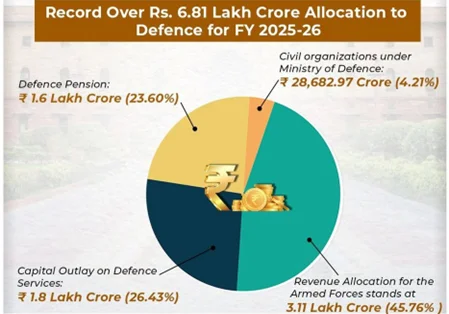

This sits against a supportive policy backdrop. India lifted total defence allocation for FY2025-26 to about ₹6.81 lakh crore, with a large capital outlay aimed at modernisation and local procurement. Sector reports project 15-17% revenue growth for defence manufacturers in FY26, helped by thick order books and localisation.

Technical Analysis Insights

Price cleared prior resistance near the ₹236-240 band and closed firmly above it. That validates a breakout to new highs after weeks of higher lows. Trading pages also mark the all-time high set in August 2025, which now acts as immediate resistance on any pullback. Recent sessions showed strong range expansion and volume, a common sign of trend continuation after news-driven gaps. Short-term support sits around the breakout area and the prior day’s close.

Risks & Challenges

Dependence on government and PSU orders can bunch revenue and extend payment cycles. Procurement delays may slow execution despite larger budgets. Valuation looks rich after a fast run, as trackers flag elevated P/E and price-to-book levels. Supply chain issues in specialised components can also pinch timelines. Any shift in defence capital outlay, or slippage in program milestones, could cool sentiment.

Peer Comparison

AMS plays in the same demand cycle as larger listed defence names such as BEL and HAL, and mid-size electronics firms like Data Patterns and MTAR. The difference is mixed. AMS leans toward rugged custom systems and program electronics rather than full platforms.

Peers with bigger balance sheets often book large platform or subsystem orders, while AMS focuses on high-reliability modules and integration niches. That can deliver faster growth from a smaller base but also higher earnings swings. Recent media roundups show small-cap defence outpacing large caps in August, with AMS among the top movers.

Analyst & Market Views

Mainstream business media highlighted the sharp rise, new highs, and the link to order wins. Coverage also stressed how the stock has doubled in 2025 and rallied about 25% in five sessions. Aggregators show limited formal analyst coverage, with a single published price target around ₹240 on some portals. That points to a discovery phase where news flow and execution can drive outsized moves.

Future Outlook

The defence spending cycle looks supportive. The Union Budget raised outlays and kept a focus on domestic procurement and modernisation. Industry notes expect mid-teens revenue growth for the sector in FY26, aided by localisation that can lift margins.

For AMS, more wins from DRDO, DPSUs, and strategic programs would help sustain the order book. Execution discipline and working-capital control will matter as scale builds. If the company converts bids to firm orders and ships on time, the recent price breakout can hold.

But a hot valuation means progress must show up in quarterly numbers. Watch order announcements, receivable days, and margins through FY26.

Bottom Line

Apollo Micro Systems caught a wave of good news and a strong tape. Fresh orders, record FY25 numbers, and a friendly policy climate pushed the stock to its 52-week and all-time highs. The setup looks constructive as long as execution and cash flows keep pace with ambition. The risk is slower procurement or valuation stretch after a very fast climb. For now, the trend is up, and the story sits at the crossroads of defence modernisation and domestic tech manufacturing.

Frequently Asked Questions (FAQs)

As of August 25, 2025, Apollo Micro Systems’ 52-week low is ₹87.99 and the 52-week high is ₹240.40.

The stock has shown strong gains and recent growth. However, it’s expensive and volatile. It may suit risk-tolerant investors but needs careful watching.

The stock has risen due to large defence orders, strong profits, export wins, and a bullish defence sector trend.

One analyst forecasts a 12-month target of ₹200, implying around a 16 % upside from current levels.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.