Apollo Tyres Stock Climbs 2% to Rank Among Nifty Midcap Gainers

Apollo Tyres made headlines after its stock jumped nearly 2% and secured a spot among the top gainers in the Nifty Midcap index. This movement reflects not just investor confidence but also the growing strength of India’s auto and tyre sector. As markets shift daily, even a small gain can highlight strong fundamentals or positive news driving demand.

We often see midcap companies like Apollo Tyres as indicators of wider economic trends. When such stocks rise, it shows that investors are looking beyond large-cap names and placing bets on long-term growth stories. Apollo Tyres has built a strong presence both in India and global markets, and its consistent performance continues to draw attention.

The 2% rise might seem small, but it positions Apollo Tyres as a stock worth watching. Let’s explore what drove this move and what it could mean for investors in the coming months.

Company Background

Apollo Tyres is a well-known tyre maker from India. The firm makes tyres for cars, trucks, buses, and off-road vehicles. It has factories in India and Europe. The company sells tyres in many countries and has built a global brand over the decades. Apollo has focused on both passenger car radial (PCR) tyres and truck/bus radial (TBR) tyres. The business mixes domestic sales with exports to balance cycles in different markets. Recent sports and marketing moves have also raised the company’s public profile.

Recent Stock Performance

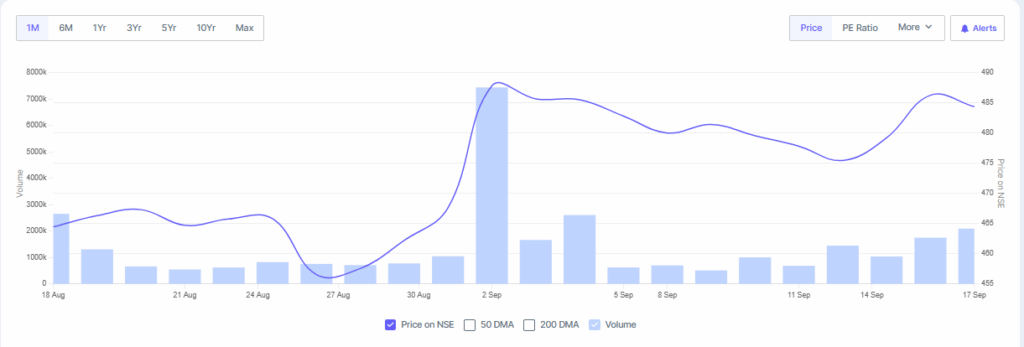

Apollo Tyres shares rose about 2% on September 16, 2025, ranking among the top gainers on the Nifty Midcap 150. Trading began with a stronger open and above-average activity. The stock gained interest after the company updates and broader market cues on that trading day. Over the past month, the stock has shown pockets of strength but also periods of consolidation. Midcap peers in the auto and manufacturing space moved in both directions during the same week.

Factors Driving the Stock Rise

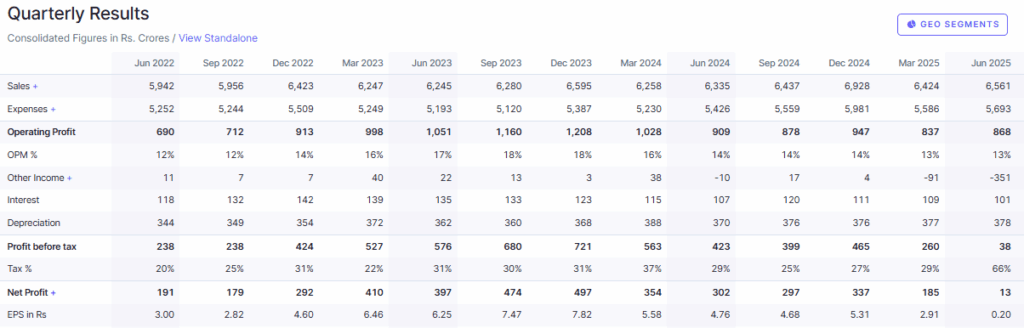

Investor interest followed a string of recent corporate updates. First, the latest quarterly numbers showed stable revenue for the quarter. Apollo reported consolidated revenue in the first quarter at around ₹6,500-₹6,600 crore, which reassured some investors about demand resilience. Second, the firm announced fresh capacity and investment plans for the near term. Management flagged planned capital spends to expand passenger tyre capacity and upgrade plants.

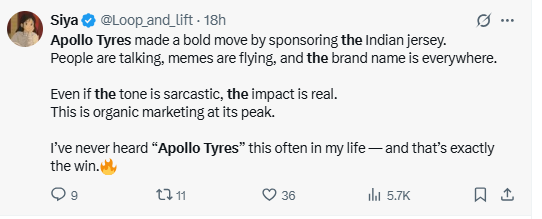

Third, a high-visibility sponsorship win added to brand momentum. Apollo secured the lead jersey sponsorship for India’s national cricket team, a move that raised visibility and may support domestic demand. Finally, brokers and market watchers pointed to improving volumes in key markets and steady export flows. These items together helped lift sentiment on the stock.

Broader Market Context

On the same session, the Nifty Midcap index saw mixed action. Some midcap names led gains while others lagged. Market breadth showed selective buying. Global cues also mattered. Strength in commodity and auto cycles helped some industrial midcaps. Domestic flows into midcaps picked up slightly on that day as traders shifted from the very largest names into growth-oriented stocks. This environment tends to magnify moves in individual midcap names such as Apollo.

Analyst Views & Market Sentiment

Analyst coverage on Apollo is mostly positive. Several broker reports carry buy or Bullish views. Consensus price targets sit above recent market prices, signaling upside in analyst models. Some technical analysts pointed to a breakout zone near key levels, which could attract momentum traders.

However, brokers also note that margin recovery will be key to sustaining higher targets. Short-term traders reacted to the sponsorship and growth news, while longer-term investors tracked capacity investments and European business performance.

Risks & Challenges

Cost pressures remain a key risk. Raw material costs, especially rubber and oil-linked inputs, can squeeze margins. Currency swings are another challenge because export earnings and European operations face foreign exchange exposure. Competition is intense from both domestic peers and global tyre makers.

Execution risk also exists for the planned expansion projects; delays or cost overruns could hurt returns. Finally, macro slowdowns in key markets or a slump in auto sales would weigh on volumes. Investors should weigh these risks against the growth signals.

Future Outlook

The near-term outlook will depend on demand trends, margin control, and timely capital deployment. If revenue growth stays steady and the company manages costs, margins could improve. The planned ₹1,500 crore investment for capacity and upgrades is aimed at boosting PCR output and lowering per-unit costs over time.

Expansion in India and selective growth in Europe may lift volumes. Brand-building moves like the cricket sponsorship may help domestic retail sales and channel strength. For investors, watch quarterly numbers, export trends, and updates on the Chittoor/Hungary capacity projects for signals.

Bottom Line

A 2% stock rise signals renewed interest in Apollo Tyres. The move reflected steady revenue, fresh capital plans, and a high-profile sponsorship win. Analysts still see upside but caution about costs and execution. For traders, the stock offers a short-term momentum play. For longer-term investors, focus on margin trends and the successful delivery of expansion projects. Clear updates in the next few quarters will show whether the company can turn this momentum into sustained growth.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.