Apple Stock Falls After Underwhelming iPhone 17 Reveal

Apple’s stock faced a sharp drop after the much-anticipated iPhone 17 reveal. We all know Apple has a history of exciting launches. Every new iPhone often drives huge sales and investor confidence. But this time, the response was different. The iPhone 17, while polished, failed to impress many users and analysts. Its upgrades felt small compared to the hype surrounding previous models.

We saw investors react quickly in the stock market. Shares slipped as traders reassessed Apple’s growth potential. The underwhelming features of the new iPhone sparked questions. Will Apple continue to lead the smartphone market? Can it maintain its high profit margins?

Let’s explore why the iPhone 17 reveal did not meet expectations. We will analyze how it impacted Apple’s stock, what experts are saying, and what this means for the company’s future.

Overview of iPhone 17 Reveal

On September 9, 2025, Apple introduced its latest iPhone lineup, featuring the iPhone 17, iPhone 17 Pro, iPhone 17 Pro Max, and the new iPhone Air. This event marked the most significant design overhaul since 2019, with the iPhone Air standing out due to its ultra-thin 5.6mm titanium frame. This makes it the slimmest iPhone to date.

The iPhone 17 series boasts several enhancements:

- iPhone 17: Equipped with the A19 chip, a 120Hz ProMotion display, and improved camera capabilities.

- iPhone 17 Pro and Pro Max: Feature the A19 Pro chip, a 48MP Fusion rear camera system with 8x optical zoom, and vapor-chamber cooling for better thermal management.

- iPhone Air: Prioritizes portability without compromising performance, featuring the new C1X 5G modem and the N1 chip with Wi-Fi 7 and Bluetooth 6.

Despite these upgrades, the event lacked groundbreaking announcements, leading to a muted market reaction.

Impact on Apple Stock

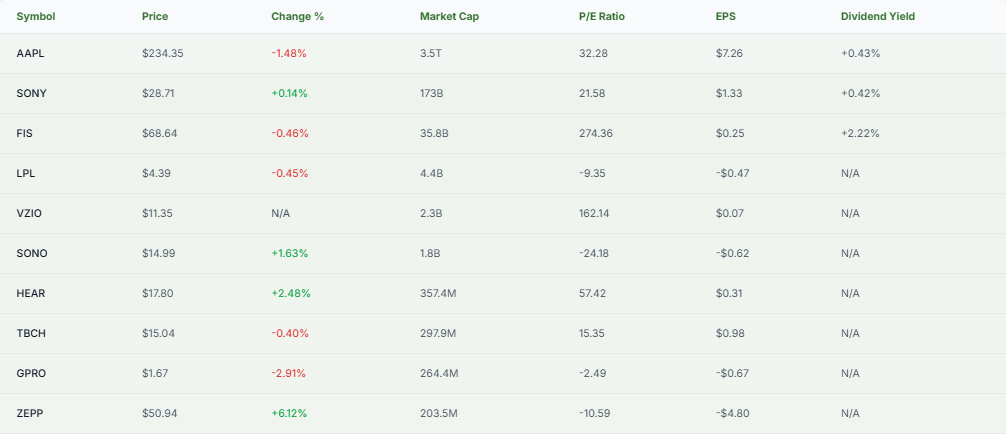

Following the iPhone 17 reveal, Apple’s stock experienced a notable decline. On September 9, 2025, shares fell by 1.5%, closing at $234.35. This downturn continued into the next day, with the stock trading at $237.31, down 0.24%.

The trading volume was significantly lower than average, with only 28 million shares changing hands compared to the usual 54 million. This suggests a lack of investor enthusiasm and confidence in the company’s future growth prospects.

Market Expectations vs Reality

Leading up to the event, analysts and investors anticipated significant innovations, particularly in artificial intelligence and augmented reality. However, the iPhone 17 series introduced incremental upgrades rather than revolutionary changes. Notably, Apple’s minimal focus on AI advancements, such as the lack of progress on Siri, drew criticism, especially as competitors like Google have made significant strides in this area.

Furthermore, the decision to maintain pricing amid potential U.S.-China tariffs raised concerns about Apple’s ability to absorb increased costs without impacting margins.

Broader Implications for Apple

The iPhone 17 reveal could cause some problems for Apple. Sales might grow more slowly because the new phone does not have big new features. This could hurt the company’s revenue for the next few months. Apple also faces a challenge with innovation. If it cannot bring exciting new ideas, it may lose its lead over other tech companies.

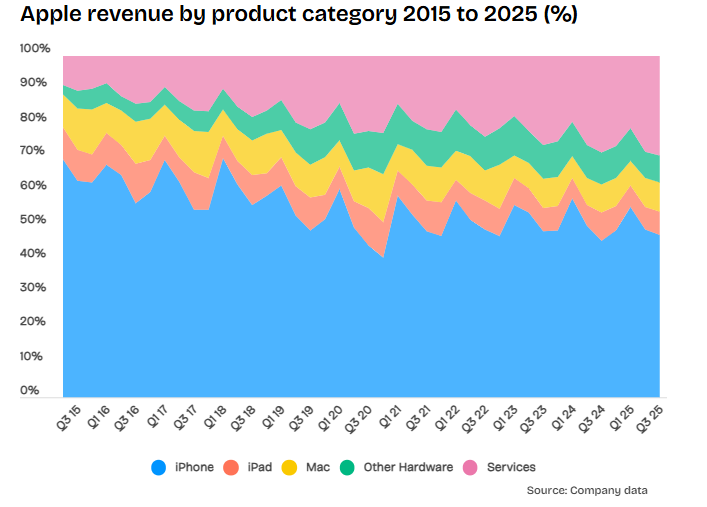

Another concern is that Apple earns most of its money from iPhones. Relying too much on one product makes the company more open to market changes. The company may need to focus on other products and services to stay strong and avoid risks in the future.

Apple Stock: Competitor Landscape

Apple faces increasing competition from companies like Samsung and Google, which are making significant advancements in AI and other technologies. Samsung’s recent innovations in foldable displays and Google’s advancements in AI-powered devices have set new industry standards, challenging Apple’s position in the market.

Analyst Insights and Future Outlook

Analysts express caution regarding Apple’s future performance. While the company maintains a strong brand presence, the lack of significant innovation in the iPhone 17 series raises concerns about its ability to sustain growth. The upcoming release of iOS 26 and potential updates to Siri may provide opportunities for Apple to regain investor confidence.

Bottom Line

The iPhone 17 reveal, while introducing several enhancements, failed to meet the high expectations set by analysts and investors. The resulting dip in Apple’s stock price reflects concerns about the company’s innovation trajectory and competitive positioning. Moving forward, Apple will need to deliver more substantial innovations and address market challenges to maintain its leadership in the tech industry.

Frequently Asked Questions (FAQs)

Apple stock fell on September 9, 2025, due to investor disappointment with the iPhone 17’s incremental upgrades. The market expected more significant innovations, leading to cautious trading.

The iPhone 17 introduces a 6.3-inch display with 120Hz ProMotion, an A19 chip, and a dual 48MP camera system. It also includes the new N1 chip supporting Wi-Fi 7 and Bluetooth 6.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.