Asian Market News Today: Asian shares rise after Wall Street hits another record high

Asian shares started the day on a positive note, following a strong close on Wall Street. The S&P 500 and Nasdaq once again reached record highs, giving investors in Asia more confidence. When U.S. markets rise, we often see a ripple effect across global exchanges, and today was no different.

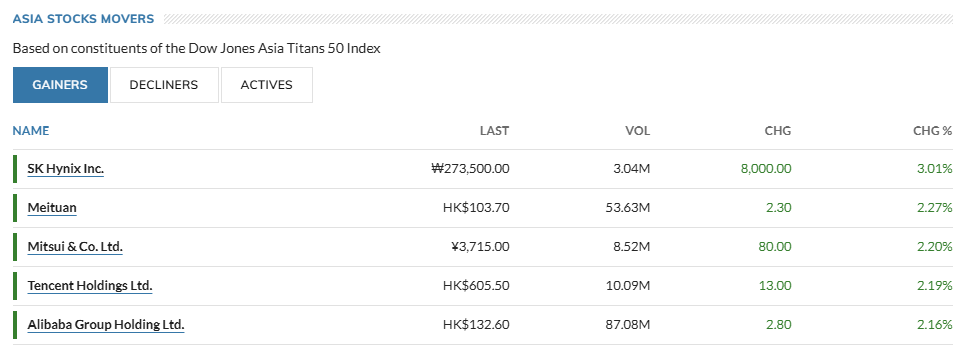

Japan’s Nikkei gained strength from technology stocks. Hong Kong’s Hang Seng moved higher with support from property and internet firms. China’s markets stayed cautious but showed signs of recovery as policy support continues. In India, the Sensex and Nifty followed the global trend, with foreign investors adding to the momentum.

We can see how one market connects to another. A rally in U.S. tech giants can lift chipmakers in South Korea or software firms in India. This link shows us how global markets are no longer separate but move together. For investors, these signals matter. Today’s rise in Asia is a sign of that shared growth story.

Global Market Context

Wall Street pushed U.S. stock indexes to fresh highs. The S&P 500 and Nasdaq both closed at record levels on Thursday. Traders pointed to softer U.S. labor signals. Those signs raised hopes the Federal Reserve might cut rates soon. Lower bond yields and easier financial conditions helped risk assets worldwide. Asian markets opened on that positive tone and followed the U.S. lead into gains.

Performance of Major Asian Indices

Tokyo’s Nikkei rose strongly. Exporters and big technology names led the advance. The Topix also climbed, showing broad buying across Japanese stocks. Hong Kong’s Hang Seng moved higher, lifted by gains in property and internet firms after a mixed session in China. Mainland indexes such as the Shanghai Composite and the CSI 300 added modest gains after recent volatility.

South Korea’s Kospi pushed up on strength in chipmakers and electronics firms. India’s Sensex and Nifty posted positive moves as foreign flows returned and some upbeat corporate news supported local names. Overall, Japan and Taiwan were among the stronger performers on the day.

Sector Breakdown

Tech stocks set the tone in many markets. The U.S. tech rally lifted Asian chip and software suppliers. Semiconductor names in South Korea and Taiwan reacted to that momentum. Financial stocks benefited from lower yields that improved margin calls for some credit-sensitive areas. Energy shares slipped as oil prices eased on supply expectations ahead of an OPEC+ meeting.

Consumer and retail names showed mixed moves. Luxury and exporters gained where currencies weakened. Property and real estate shares in Hong Kong were volatile but mostly positive after buyers returned.

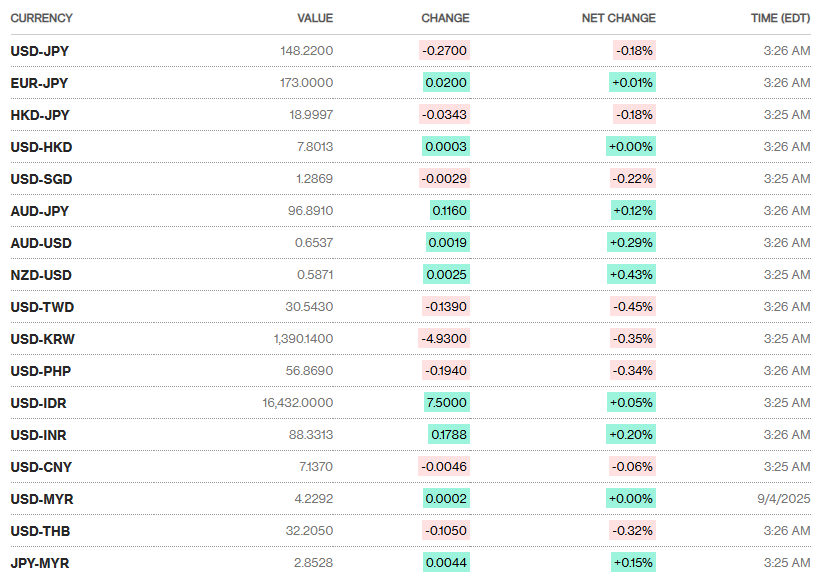

Currency and Commodities Impact

The U.S. dollar weakened against a few Asian currencies as Treasury yields fell. A softer dollar helped commodity-linked markets. The Japanese yen gained some ground after data showed rising household spending and firmer wages in July, which eased worries about deflation there. Oil prices slipped after traders priced in potential increases in OPEC+ output. Gold steadied near recent highs as investors weighed growth signals and rate-cut prospects. Currency moves supported exporters in Japan and parts of East Asia by making local goods cheaper abroad.

Investor Response and Capital Flows

Risk appetite returned to markets after recent jitters over China’s slowdown. Foreign institutional investors increased net purchases in several Asian bourses, especially in India and Japan. Short-term traders pushed into cyclicals and tech names that benefit from global demand. At the same time, many investors stayed cautious ahead of the U.S. nonfarm payrolls report.

That data could quickly change rate expectations and reverse flows. Sentiment now rests on a mix of Fed timing, China’s policy steps, and near-term corporate earnings.

Key Economic and Policy Factors

Monetary policy in the U.S. remains the single biggest driver. Market odds for a Fed rate cut this month rose after softer hiring signs. Traders priced in at least one cut by the September 2025 meeting. China kept its policy tone supportive but cautious. Beijing’s recent steps to stabilize financial markets calmed investors after a week of heavy selling in some sectors.

Japan’s policy stance still centers on gradual normalization, and any further signs of wage growth could shift expectations there. In India, economic data and corporate earnings continue to guide market moves amid steady foreign inflows. Political or trade moves, such as the recent U.S.-Japan trade developments, also fed local optimism.

Expert Commentary and Market Outlook

Analysts said the current rally could extend only if U.S. data keeps pointing to a cooling labor market. Some strategists warned that Wall Street’s record highs raise downside risk if inflation surprises to the upside. Others noted that Asia can still outperform in a gentle easing cycle because of cheaper valuations and strong export demand.

Short-term risks include the U.S. payrolls release, any surprise from China’s economic reports, and geopolitical tensions that could disrupt flows. On balance, many market watchers see a cautious but constructive path for Asian equities over the next few weeks, provided central bank signals remain dovish.

Wrap Up

Asian markets rose after Wall Street’s latest record close. The move reflected hopes for U.S. rate cuts and softer bond yields. Tech and exporters led gains while energy eased with lower oil. Attention now shifts to U.S. jobs data and China’s next policy steps. If labor numbers stay weak and Beijing keeps supporting growth, markets may hold onto this rally. If not, volatility could return fast. Investors and traders will watch data and central bank clues closely.

Frequently Asked Questions (FAQs)

As of September 5, 2025, Asian markets are mixed today, with many rising. Japan, Australia, and India gained. China and Hong Kong dipped on regulatory worries. Markets follow U.S. rate-cut hopes.

Some Asian markets are falling due to concern over Chinese regulators tightening rules. Investors sold shares to lock in profits. The mood turned cautious amid policy uncertainty.

China’s stock market has surged due to strong gains in the tech and AI sectors. Investors see value in cheap shares, and dollar weakness supports emerging market assets.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.