Asian Markets Rise as Investors Weigh Japan Bond Concerns

Asian markets opened higher today, December 2, 2025, even as investors kept a close eye on Japan’s rising bond yields. The move surprised many traders. Just days ago, the region was under pressure as Japan’s 10-year government bond yield climbed toward its highest level in years. That rise signaled growing worries about inflation and a possible shift in the Bank of Japan’s policy.

Still, buying activity picked up across the Asia-Pacific region. Investors wanted clarity, but they also did not want to miss a rebound. Markets in Hong Kong, South Korea, China, and Australia moved higher. The Nikkei also showed strength, though traders stayed cautious.

The mood felt mixed. On one side, there was hope. On the other hand, there was fear that Japan’s bond market could shake the region if yields kept rising too fast. Global cues also played a role. Overnight gains on Wall Street helped Asian traders feel a bit more confident.

Japan’s Bond Market Concerns Explained

On December 2, 2025, yields on 10-year government bonds in Japan (JGBs) climbed to about 1.88%, their highest level in 17 years. The jump came after a public signal from the central bank that a rate hike might be coming soon. That stirred unease in markets.

Higher yields mean borrowing costs rise for companies and individuals. That tends to slow down investment and growth. At the same time, a stronger yield can attract investors back to bonds, which makes stocks less appealing. In Japan, banks and pensions face a complicated trade-off: new bonds become more profitable, but corporate borrowers may struggle with higher interest payments.

Because Japan is such a big economy and bond market, its bond yield shifts send ripples across Asia. Investors abroad track JGB yields closely. A sharp rise can shake confidence across Asian financial markets.

Market Snapshot: Asia-Pacific Indices

Despite bond tensions, many Asian equity markets rose on December 2. Outside Japan, Asia-Pacific shares gained. In Japan, though, the picture was mixed. The main index fell, weighed down by bond and yen moves.

Elsewhere, South Korea and Australia saw gains. Chinese markets showed a mixed reaction; some stocks rose, others slipped. The rebound partially reflected optimism about lower U.S. interest rates, which boosted risk appetite across the region.

In short, stocks in Asia showed resilience. Some markets rose despite jitters about Japan’s bond yields. Investors seemed willing to take selective risks rather than retreat broadly.

Key Drivers Behind Today’s Gains

One major driver was the growing belief that the Federal Reserve (Fed) in the United States may cut interest rates soon. Softer U.S. economic data fueled those hopes. That boosted global risk sentiment, and Asian stocks gained in response.

Another driver: some investors used the dip in asset prices and global volatility as a chance to buy, especially tech and growth-linked stocks in Asia.

Finally, some calm returned to bond markets after the initial shock. Demand for Japanese bonds remained fairly strong at auctions. That gave some confidence even as yields stayed elevated.

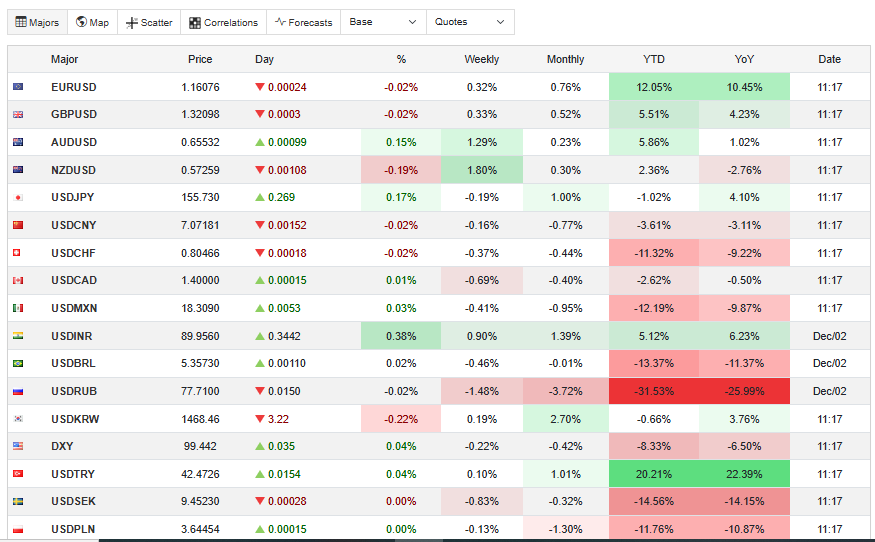

Currency & Bond Market Reaction

Currency markets also felt the effect of rising Japanese yields. The Japanese yen firmed against the U.S. dollar as traders bet on a rate hike. A stronger yen can dampen profits for Japanese exporters, which adds another layer of concern.

Meanwhile, bond markets beyond Japan showed some knock-on effects. Regional sovereign yields ticked up, and global bond prices weakened, as investors re-adjusted portfolios. Still, the fact that demand held up at Japan’s bond auctions suggests many investors view JGBs as a safe-ish refuge, even with rising yields.

Sector Highlights

Technology stocks across Asia saw gains, especially those tied to future growth, cloud, and AI demand. With bond yields and borrowing costs rising, growth stocks often become more attractive than value or debt-heavy companies.

Financials in Japan and elsewhere had a mixed day. Rising yields help banks earn more on new loans or securities. But higher borrowing costs can hit companies. That made investors cautious.

Commodity-linked and resource sectors moved modestly. Some benefit came from steady commodity prices, but they remained vulnerable to global demand conditions and currency swings.

Consumer and retail stocks stayed more stable than other sectors. But weak consumer-spending data from parts of Asia, along with uncertainty in China, limited strong rallies.

Analyst Commentary & Market Outlook

Analysts are watching for signals from the Bank of Japan (BOJ) very closely. The next policy meeting scheduled for mid-December could reshape expectations for interest rates and bond yields in Japan. That in turn will influence markets across Asia.

Many say this could be a turning moment. If BOJ raises rates or signals further increases, bond yields may continue to rise. That could weigh on risk assets like equities. But if it holds steady, investors might treat the current yield spike as a one-off shock.

Moreover, global factors, especially U.S. inflation data, economic growth signals, and ongoing rate expectations, will matter a lot. The interplay between U.S., Japanese, and regional Asian policies could create volatile swings in asset prices.

Some fund managers are already using an AI stock research analysis tool to scan large sets of economic and market data. They believe fast reaction may be key if markets get choppy.

Final Words

Asian markets held their ground on December 2, 2025, despite sharp moves in Japan’s bond market. Rising JGB yields created real uncertainty, but steady demand at auctions and hopes for U.S. rate cuts helped support regional stocks. The next signals from the Bank of Japan will decide whether this stability lasts or fades. For now, investors are balancing caution with selective buying as they wait for clearer policy direction and fresh global data.

Frequently Asked Questions (FAQs)

Japan’s bond yields rose on December 2, 2025, because investors expect the Bank of Japan to raise rates soon. Higher inflation and policy signals pushed borrowing costs upward.

Rising Japanese bond yields make borrowing more expensive. This can reduce confidence and slow growth. On December 2, 2025, many Asian markets stayed firm but showed caution.

The Bank of Japan has not confirmed a hike for December 2025. Investors only expect a possible increase because officials signaled concern about inflation and higher borrowing costs.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.