Asian Markets Struggle Into Weekend as AI Bubble Fears Intensify

Asian markets closed the week on a shaky note as investors pulled back from high-flying tech names. On October 11, 2025, major indexes like the Nikkei, Hang Seng, and Kospi posted declines, reflecting growing worry that the rapid rise in AI-related stocks may not be sustainable. Over the past year, AI has driven massive gains in chipmakers, software firms, and data center companies. But now, many experts warn that valuations are rising faster than earnings.

Markets hate uncertainty, and this time the fear is clear. Are we entering an AI bubble similar to the dot-com crash of 2000? Traders are locking in profits, while cautious buyers wait for better entry points. Global pressure adds fuel to the fire, as U.S. tech weakness, policy shifts, and rising interest rates spill into Asian markets.

At the same time, some analysts believe AI remains a long-term growth engine. This creates a split: excitement vs. caution. As we move into a new week, the key question is whether the AI rally will correct or evolve into the next big economic revolution.

Current State of Asian Markets

Asian indices closed mixed to weak as the week ended on October 11, 2025. Tokyo and Seoul saw choppy trading, while Hong Kong and mainland China pulled back harder. Tech and chip names led the weakness. The Hang Seng and its tech subindex fell notably, placing pressure on the whole region.

What is Fueling AI Bubble Fears?

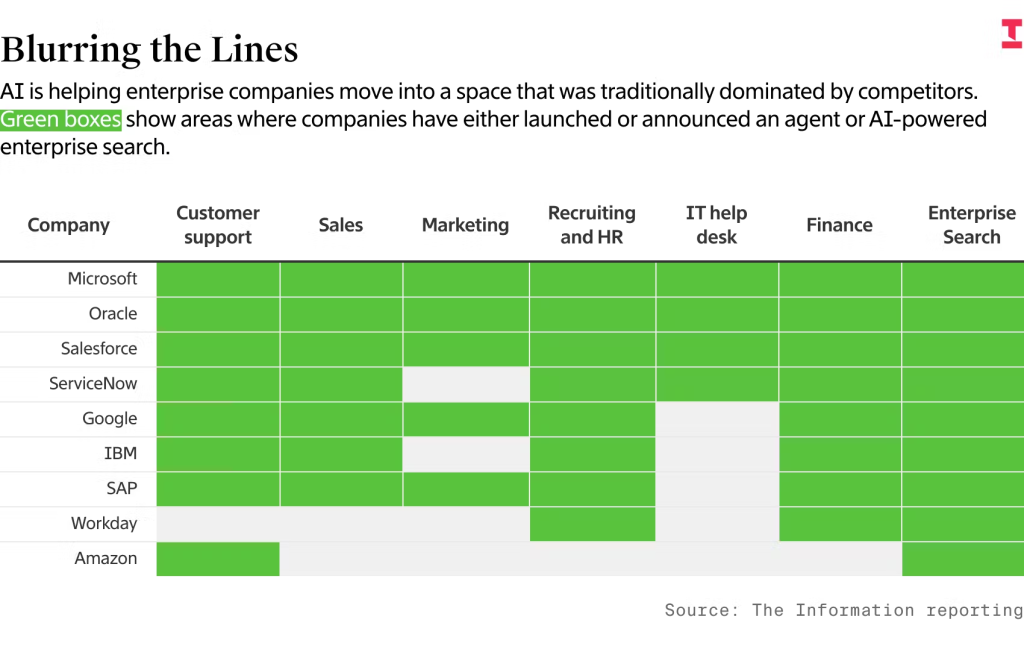

Rapid gains in AI-related stocks have outpaced earnings. Venture funding for AI is surging. Big funding rounds and sky-high private valuations have raised red flags for some investors. Central banks and regulators have also warned that high market concentration in a few tech names makes markets fragile. These trends make many traders ask if prices reflect future profits or just hype.

Key AI-Related Stocks Under Pressure

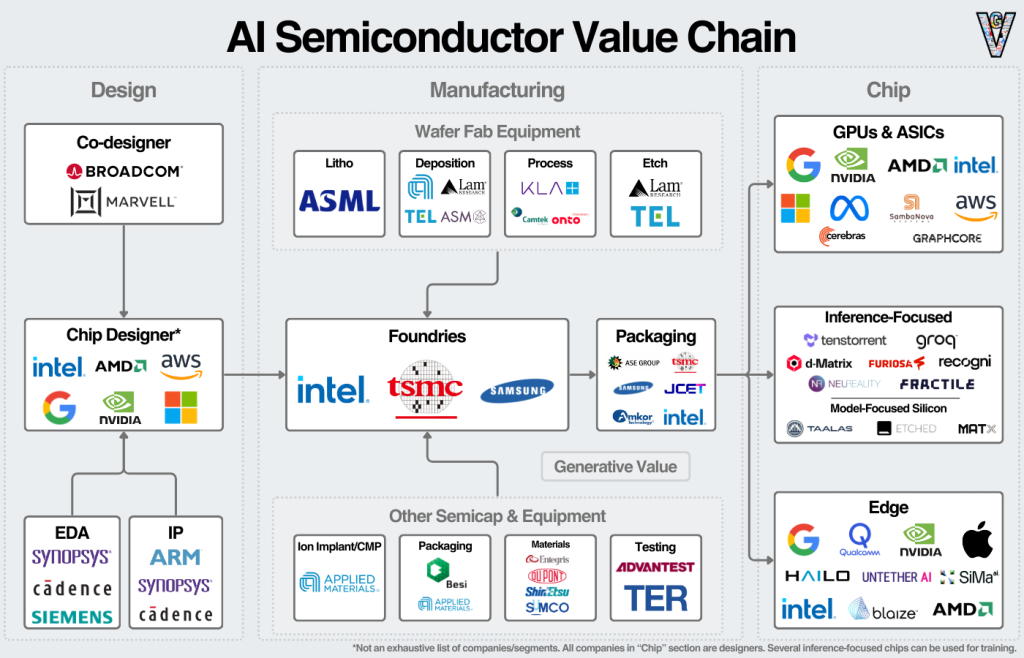

Large tech groups and chipmakers have seen wide swings. China’s big internet names and Hong Kong-listed tech firms fell on profit-taking and valuation worries. Semiconductor makers and AI infrastructure companies face extra scrutiny because AI needs huge computing power. Stocks such as those tied to chips and cloud services led moves as traders trimmed exposure.

Global Spillovers into Asia

Wall Street’s recent volatility filtered into Asian markets. U.S. tech corrections and profit-taking pushed risk-off flows overnight. The Bank of England and other authorities also warned that a change in investor mood on AI could trigger sharp global corrections. In short, a U.S. pullback can quickly affect Asian bourses because investors hold similar positions across markets.

Economic and Policy Pressures

China’s growth worries and weak domestic demand add to the risk. Policymakers in major Asian economies face a trade-off: support AI growth while guarding financial stability. Monetary policy shifts, especially in the United States, also matter. Tighter rates make high valuations harder to justify. That dynamic makes tech stocks more sensitive to macro news than before.

Are Markets in an AI Bubble? (Bull vs Bear view)

Some top banks say current gains do not yet match past bubble extremes. They point to improving tech earnings and real corporate spending on AI. Other experts call the rally excessive. They note sky-high private valuations, heavy venture funding, and speculative smaller stocks. The truth may lie in between: pockets of speculative pricing exist, even if the whole sector is not a uniform bubble.

Investor Sentiment and Behavior

Retail traders and momentum funds helped lift AI names on the upswing. Now, profit-taking and hedging are common. Institutional investors watch fundamentals more closely, and some are trimming the most stretched positions. That split in behavior raises volatility. Short-term swings may be sharp until earnings confirm the stronger forecasts.

How Governments and Central Banks Respond?

Regulators in Asia are talking about balanced steps. They want to keep innovation alive. At the same time, they aim to limit speculative excess. Policy measures range from closer market monitoring to support for local AI supply chains. Central banks watch inflation and growth while noting financial-stability risks from concentrated tech rallies.

Opportunities Despite the Fear

Not all AI exposure is the same. Companies with steady revenue from AI services and real client contracts look more durable. Firms that sell chips, cloud tools, and enterprise AI products may see steady demand even if prices cool. Long-term investors can focus on cash flow, margins, and proven product adoption. Tools such as the AI stock research analysis tool can help sort hype from substance when evaluating names.

What to Watch Next Week?

Earnings reports from major tech players matter. Any surprise in chip demand or cloud spending will move markets. Central bank comments and U.S. economic data will also shape risk appetite. Watch flows into and out of regional ETFs and whether the Hang Seng Tech index stabilizes or declines further. These signals will tell if the recent pullback is a short pause or the start of a deeper correction.

Risk Management for Investors

Diversify across sectors and regions. Focus on fundamentals over headlines. Use stop-loss limits and consider hedges if exposure is high. Avoid chasing small companies with thin trading and extreme valuations. For long-term positions, track cash generation and real customer adoption rather than press-driven narratives.

Final Words

Asian markets entered the weekend under pressure as AI bubble fears grew. Short-term volatility looks likely. Still, real AI adoption and strong companies offer long-term chances. The key is to be selective. Follow earnings, policy news, and on-the-ground indicators. That will help separate durable winners from speculative momentum.

Frequently Asked Questions (FAQs)

Asian markets dropped in the week ending October 11, 2025, as investors sold expensive AI stocks. Many fear prices rose too fast without strong earnings support.

Some experts compare today’s AI surge to the 2000 dot-com crash. However, many AI companies now have real products and revenue, which makes the outcome less certain.

AI stocks can still be safe if chosen carefully. Experts suggest focusing on stable, profitable companies and avoiding risky startups during market uncertainty.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.