Asian Paints Shares, Nov 6: Stock Jumps Over 5% as Earnings Beat Estimates

On 6 November 2025, shares of Asian Paints Ltd. surged by more than 5 percent after the company reported earnings that beat expectations, and investor optimism took hold. The rise came as the broader market received a boost from strong quarterly results in multiple sectors. The stock’s performance reflects a shift in sentiment for the paint and home decor sector, which has been under pressure in recent times.

For Asian Paints, this uptick is a clear signal that its strategy and market positioning are resonating with investors. In this article, we will explore what drove the jump, how the company performed, and what it means for its future outlook.

Asian Paints: Company Overview

Asian Paints is India’s largest paint maker. The company leads in decorative paints. It also sells industrial coatings and allied products. The brand has a wide dealer network across India. International operations add to revenue. Asian Paints keeps pushing into premium segments and adjacent categories such as waterproofing and home décor. The company’s scale helps it manage costs and invest in new products. Official investor documents show steady revenue streams and a large market share in decorative paints.

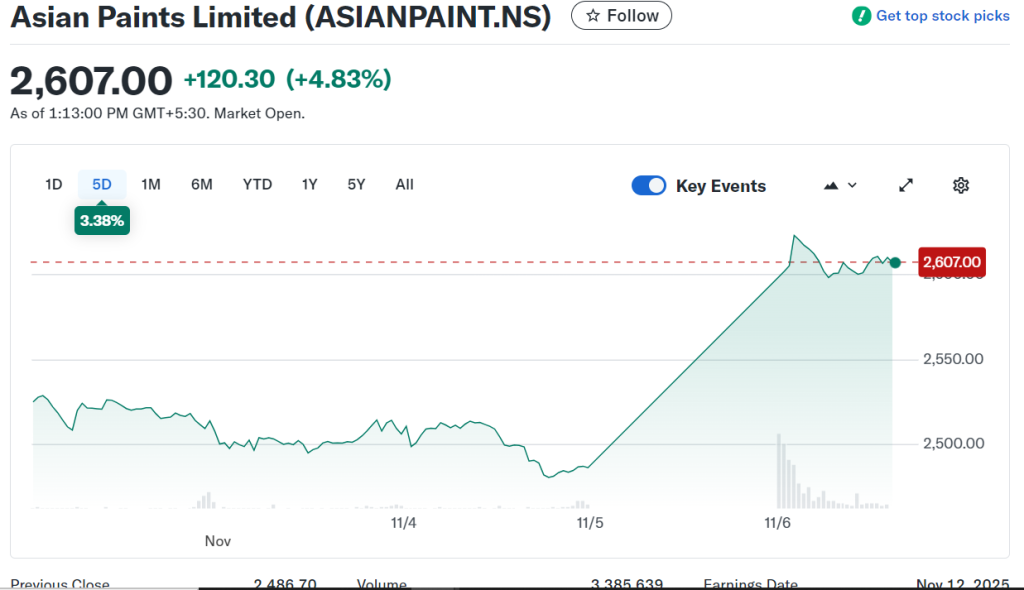

Asian Paints’ Recent Stock Performance

On 6 November 2025, Asian Paints shares jumped more than 5 percent. The stock opened higher and hit intraday highs above previous resistance levels. Trading volumes rose sharply as buyers stepped in early. By late morning, the stock traded well above the prior close and outperformed the broader market. Price action and volume suggest strong short-term appetite from both retail and institutional investors. Live market updates recorded the breakout and intraday pivot levels for that session.

Quarterly Earnings Report Highlights

The recent quarterly update showed earnings that beat many market estimates. Consolidated revenue held up despite mixed demand. Net profit improved versus some earlier quarters, helped by better margins. Management cited favourable product mix and cost controls as key drivers. Decorative paints remained the primary revenue engine.

Industrial coatings and exports contributed to margins. The company also noted festive demand and early signs of rural recovery. Broker polls and preview pieces had expected a tougher quarter, but the final numbers were stronger than the consensus.

Analyst and Market Reactions

Brokerages reacted quickly. Several houses raised near-term estimates. Some analysts bumped target prices. Others urged caution and focused on valuation. Comments from brokerage notes highlighted margin improvement and the company’s pricing power. Analysts also noted that a stable input price environment helped the margin story.

Market commentary emphasized that earnings beats often trigger quick re-rating, especially for a market leader in a cyclical sector. Live broker commentary and updates from market portals reflected these shifts in stance.

Factors Driving the Growth

Festive season demand provided a clear sales lift. Urban repainting and new home purchases drove decorative paint volumes. Product mix shifted toward premium paints. Pricing actions helped offset input cost pressure. Supply chain improvements reduced lead times. International projects and recent capacity additions also supported top-line momentum.

Lower crude and derivative prices gave relief to chemicals and pigment costs, helping gross margins. An AI stock research analysis tool flagged the combination of volume recovery and margin stability as a positive signal for earnings quality.

Challenges and Risks

Raw material volatility remains the main risk. Many chemicals used in paints tie back to global crude and petrochemical prices. A fresh spike in oil could compress margins quickly. Competition is intense. Local players and multinationals chase market share with discounts and trade schemes. A slowdown in real estate or a weak rural cycle would hit volumes.

Currency swings can affect import costs for some raw materials and impact export competitiveness. Finally, high valuation multiples mean the stock can be prone to sharp corrections when sentiment changes.

Future Outlook and Guidance

Management scheduled board and results events around mid-November 2025, which will give clearer guidance for H2 FY26. The company’s long-term focus is on premiumization and category expansion. Continued distribution expansion and faster new product rollouts can support steady volume growth.

If input costs remain benign and demand keeps improving, margins could expand further. Analysts watching the story expect moderate earnings upgrades if quarterly momentum sustains. Key catalysts to watch include subsequent quarterly results, seasonal demand trends, and any management commentary on pricing and capex.

What Investors Should Watch Next?

Track quarterly margin trends closely. Watch raw material prices and crude-linked indices. Monitor urban versus rural volume splits. Look for commentary on pricing and market share from management calls. Keep an eye on institutional buying patterns.

Also, watch broker model revisions and target price changes after the company’s next formal disclosures. These items will indicate whether the recent jump is a short squeeze or a durable re-rating.

Wrap Up

The 6 November 2025 stock jump reflects a concrete earnings beat and improved sentiment. Asian Paints shows resilience through strong brands and wide distribution. The path ahead depends on raw material trends and demand stability. Investors should weigh the growth story against valuation and sector risks. Future board updates and quarterly disclosures will clarify the medium-term outlook. For now, the company stands as a leading play on India’s housing and renovation cycles, but caution is warranted given the usual cyclical swings.

Frequently Asked Questions (FAQs)

Asian Paints shares rose over 5% on November 6, 2025, after the company reported strong quarterly earnings that beat forecasts and showed improved profit margins.

Asian Paints’ Q2 earnings improved due to higher festive demand, better product mix, lower raw material costs, and strong sales in decorative and industrial paint segments.

Analysts say Asian Paints remains a steady long-term stock, but investors should watch crude prices, raw material costs, and valuation before making fresh investment decisions.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.