Asian Shares Rise as the Ceasefire Eases Geopolitical Tensions and Oil Prices Drop

Asian markets often react quickly to global events, and this week proved it again. In early October 2025, investors saw a sharp change in sentiment when a ceasefire agreement was announced in a long-running regional conflict. This news eased fears of escalation and helped restore calm across global markets. At the same time, oil prices dropped, removing pressure from import-heavy Asian economies shares as Japan, India, and South Korea. Lower energy costs mean cheaper transportation, improved profit margins, and relief from inflation.

As tensions cooled, major Asian stock indices started to rise, signaling renewed confidence. Traders shifted from safe-haven assets back into equities, especially in sectors like technology, manufacturing, and finance. The market mood turned positive because peace brings stability, and stability encourages investment.

However, investors are not just celebrating. They are watching whether this ceasefire will hold and how governments and central banks respond. Still, the combination of reduced geopolitical risk and falling oil prices has created a powerful boost for the region. This moment could mark the start of a broader market recovery if global conditions continue to improve.

Background: What Led to the Geopolitical Tensions?

The region saw two years of intense fighting that began in October 2023. The conflict caused deep human suffering. It also raised global fears about a wider Middle East war. Those fears pushed a risk premium into energy markets. Traders priced in the chance that oil supplies could be disrupted. That pushed oil and safe-haven assets higher. The higher risk hit investor confidence across Asia. Markets moved on headlines and on a sense of danger.

Ceasefire Announcement: A Turning Point

On October 9, 2025, Israel and Hamas agreed to a first-phase ceasefire and a hostage-release plan. The deal was brokered at talks in Sharm el-Sheikh. Leaders said the move could end the most intense chapter of fighting. Markets quickly treated the news as a major de-risking event. The ceasefire reduced the chance of conflict spreading to oil-rich neighbours. That eased one of the main drivers of the recent market stress.

Immediate Impact on the Asian Shares Market

Asian shares rallied as traders digested the ceasefire. Mainland China indices rose on Oct 9, 2025. The Shanghai Composite gained about 1.3% that day. Hong Kong and regional bourses also rebounded after earlier weakness. Japan’s markets showed mixed moves, but sentiment improved for exporters and tech firms. Investors rotated back into risk assets, including equities, and away from long-dated government bonds. Market flows reflected a renewed appetite for growth and cyclical stocks.

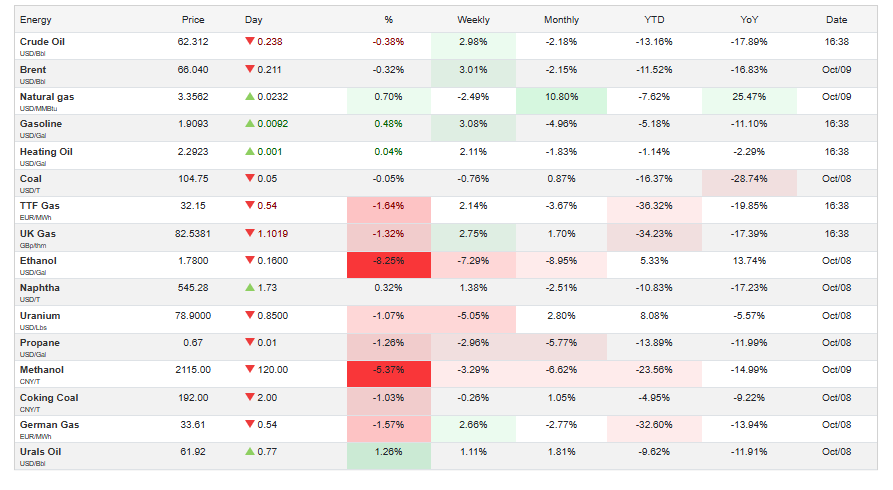

Oil Prices Drop: Why it Matters?

Oil eased after the ceasefire lowered the geopolitical risk premium. Brent crude traded near $65.90 a barrel on Oct 9, 2025. WTI hovered near $62.17 a barrel. The decline reflected both the ceasefire and ongoing signs of ample supply. Global data also point to slower demand growth in some regions. Lower oil costs cut a major input price for many Asian businesses. That can lift profit margins and ease inflation pressures.

Benefits for Oil-importing Asian Economies

Nations that buy far more oil than they sell stand to gain. Japan, India, and South Korea get immediate relief. Fuel and shipping costs fall. That helps manufacturers and consumer goods firms. Cheaper energy can also cool headline inflation. That may give central banks more breathing room. Lower inflation improves real incomes for households. The combined effect can support domestic demand and higher corporate earnings.

Sector Winners and Losers

Sectors that benefit most include airlines, shipping, and mass-market retailers. Lower fuel costs add directly to airline margins. Manufacturing and logistics firms see lower input costs. Technology stocks also gained as investors chased growth themes and AI optimism. On the flip side, oil producers and energy services firms felt pressure. Lower crude reduces revenue for exporters and some domestic oil names.

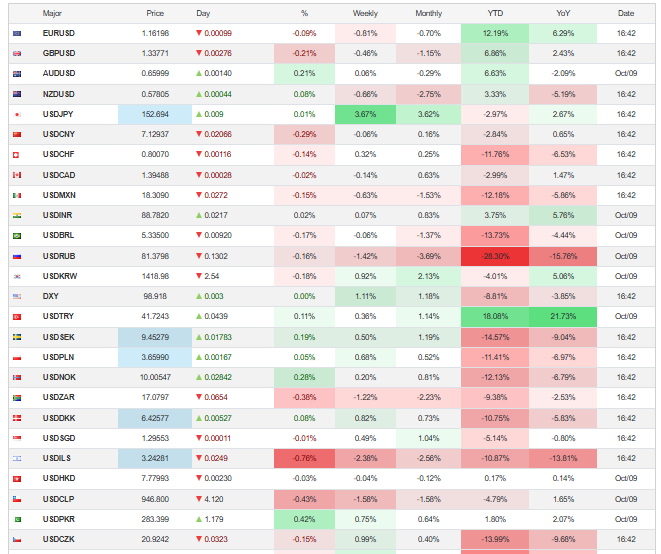

Currency Reactions

Asian currencies strengthened versus the dollar after risk eased. The Chinese yuan and South Korean won firmed on renewed capital inflows. A stronger local currency lowers import bills. That amplifies the benefit of falling oil prices. The Japanese yen moved in line with regional sentiment. Currency shifts will influence export competitiveness and corporate earnings for multinational firms.

Global Investor Sentiment Improves

Global risk appetite moved back toward “risk-on.” Investors reduced holdings of gold and long-dated Treasuries. Portfolio managers increased exposure to Asian equity ETFs and select single stocks. Hedge funds and active managers rotated into cyclicals that benefit from lower energy costs. The mood is more optimistic than in recent weeks, but caution remains.

Central Banks and Government Responses

Central banks watched the move closely. A drop in oil and softer inflation data may slow the push for further rate hikes. Policymakers signalled a desire to support growth if downside risks fade. Some finance ministries also flagged readiness to step in if the ceasefire brings stability and allows reconstruction spending. Any policy shift will be data-driven and gradual.

Comparison with Previous Geopolitical Recoveries

Markets have reacted similarly to prior ceasefires and de-escalations. Past episodes show a quick rebound in Asian equities followed by a period of consolidation. The key difference this time is the mix of tech-led optimism and structural oversupply in oil. That makes the recovery promising, but not guaranteed.

Short-term Market Outlook

Volatility is likely in the coming weeks. Traders will watch three main items: whether the ceasefire holds, weekly oil inventories, and major economic data such as PMI and inflation prints. Corporate earnings for Q3 will also set the tone. Momentum could continue if headlines stay calm and earnings beat expectations.

Long-term Implications

If the ceasefire endures, recovery could spread to travel, tourism, and trade flows. Supply-chain normalisation would help manufacturers. Sustained lower oil prices could feed into lower inflation for 2026. That could push real rates lower and sustain higher equity valuations. Long-term gains depend on durable peace and balanced energy markets.

Risks that could Reverse Gains

The main risk is a breakdown of the ceasefire. Renewed fighting would lift the oil risk premium fast. Another risk is an unexpected spike in global demand that tightens markets. Domestic political setbacks in key countries could also dent investor confidence. Finally, a sudden shift in U.S. or China policy could unsettle regional flows.

Expert Views and Data-Driven Tools

Analysts point to the ceasefire as a powerful near-term catalyst. Commodity strategists warn that oil oversupply remains the dominant structural force into 2026. Some fund managers say AI and tech remain long-term growth themes. Data tools and simulation platforms, including the AI stock research analysis tool, helped traders reweight portfolios as headlines moved markets.

(Authoritative research from the U.S. Energy Information Administration projects lower average Brent in late 2025 and into 2026, supporting the view of softer oil.)

What Investors Should Watch and Do?

Focus on quality names with solid cash flow. Track the ceasefire’s status and any diplomatic progress. Watch oil inventories and OPEC+ decisions. Consider hedging exposure to energy producers if prices stay weak. For long-term plays, monitor earnings and capital spending in tech and manufacturing. Keep position sizes sensible and avoid chasing short-lived rallies.

Wrap Up

The Oct 9, 2025, ceasefire news eased a major geopolitical risk. That news, combined with falling oil prices, helped lift the Asian shares market. The recovery looks meaningful but fragile. Markets will depend on diplomacy, demand trends, and policy moves. Careful monitoring and disciplined stock selection remain essential.

Frequently Asked Questions (FAQs)

Asian markets rose because the ceasefire on October 9, 2025, reduced fear of war, improved investor confidence, and made traders feel safer buying stocks again.

Falling oil prices lower transportation and energy costs, reduce inflation, and help companies save money. This can improve profits and make Asian markets more attractive to investors.

The rally may continue if peace holds and oil stays low. However, renewed conflict or rising energy prices could create fear again and push markets down.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.