Asian Shares Rise as U.S. Futures Advance After Wall Street Gains

Asian markets opened higher on 24 November 2025, following a strong rebound on Wall Street the previous night. Investors in the region reacted quickly to the upbeat U.S. session, where major indexes posted solid gains. The rise in U.S. futures also added support, signaling that the positive momentum may continue when American markets reopen. This early boost helped build confidence across Asia, where traders have been watching global signals closely.

Many investors are now paying attention to new economic data, changing rate expectations, and earnings updates from big U.S. companies. These factors often guide market mood in Asia because both regions are linked through trade, technology, and global demand. The latest Wall Street rally gave Asian traders a clear hint that risk appetite is improving again. It also shows that investors expect steady growth if inflation stays under control and policy conditions remain stable.

Overall, the morning rise in Asian shares reflects a mix of global optimism, better market signals, and hopes for stronger economic activity in the coming weeks.

What Sparked Wall Street’s Gains?

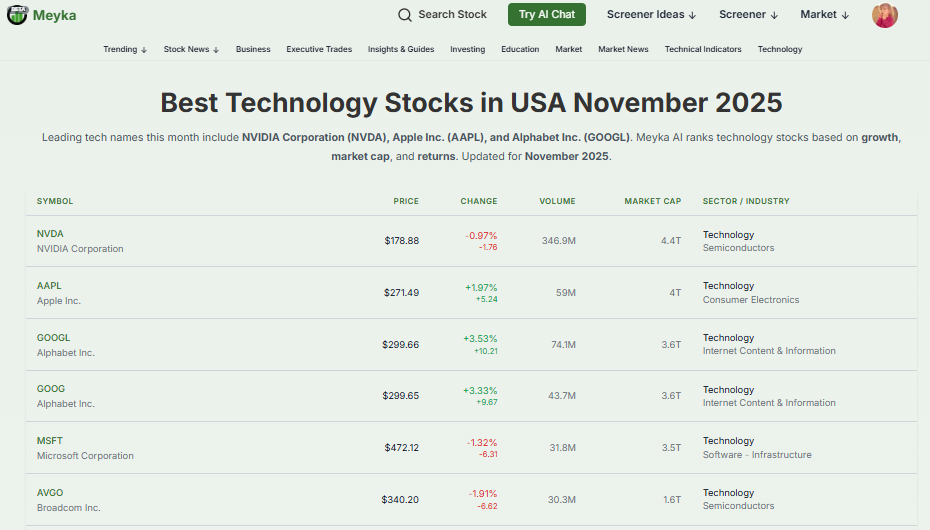

Strong corporate reports set the tone. Big tech firms posted better-than-expected revenue and profit. Investors also reacted to softer signals about policy tightening. That pushed up indexes late on 23 November 2025. Traders priced in a higher chance of rate cuts farther down the road. Risk appetite rose after a choppy week.

The move was led by tech and large-cap names that had beaten forecasts. Comments from analysts about holiday sales also helped. MarketWatch and Reuters reported the bounce in U.S. stocks and the growing rate-cut talk.

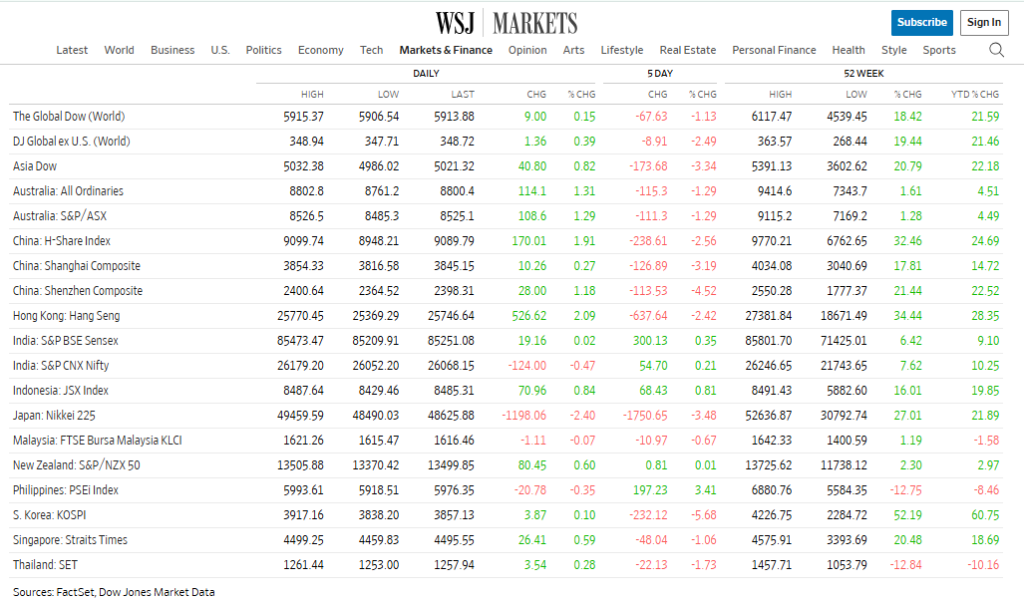

Asian Markets Snapshot

Markets in Asia opened mostly higher on 24 November 2025. South Korea’s KOSPI gained, helped by chip and electronics names. Hong Kong’s Hang Seng climbed strongly on tech strength. Australia’s ASX 200 rose on miners and financials. China’s Shanghai Composite lagged and moved mixed amid local concerns about growth.

Tokyo traded with caution due to mixed domestic cues and currency moves. The pattern shows local differences. Some markets followed U.S. cues closely. Others reacted to country-specific news and earnings. Live market trackers and regional reports captured these moves.

Rise in U.S. Futures and What it Signals?

U.S. futures rose before Asian trading hours. S&P futures were up around 0.5%. Nasdaq-100 futures jumped by nearly 0.8% in early trading. The lift indicated that traders expected the positive momentum to continue when U.S. markets opened.

Futures reflect expectations about earnings, macro data, and Fed policy. They also set the risk tone for Asian investors. Higher futures often have lower risk premia in Asian equities for the morning session. Market commentary ahead of the short Thanksgiving week noted lighter volumes but higher sensitivity to holiday retail data.

Sector-wise Performance across Asia

Technology-led gains in several markets. Chipmakers and software firms outperformed after strong U.S. tech results. Financial stocks moved higher, where yields and sentiment supported banks. Resource and mining firms rallied in Australia as commodity prices stayed firm. Consumer names edged up, where analysts warned of watching holiday retail trends.

Energy stocks were mixed, tracking oil price swings. In China, property and cyclical sectors remained under pressure. Sector flows showed investors chasing growth themes while avoiding areas with weak local demand.

Key Economic Factors Supporting the Rally

Rate-cut expectations helped. Traders priced a higher chance of easier policy steps in the coming months after recent Fed commentary. U.S. inflation and jobs data will be crucial next. The calendar shows major releases in the coming weeks that can change the path. Currency moves also mattered.

A softer dollar helped commodity exporters. Commodity prices, especially oil and some metals, lent support to resource stocks. Central bank signals from the Fed and other major banks remain the main macro driver for markets.

Risks that could limit further Gains

Volatility remains a risk. Markets have short memories for shocks. Geopolitical tensions could flare and alter risk appetite. China’s economic weakness is still a drag. Corporate earnings may disappoint in the coming quarters. Inflation could surprise on the upside, forcing faster policy tightening. Also, the thin volume around the Thanksgiving holiday can amplify moves. Traders should watch upcoming CPI, jobs readings, and company updates for signs of stress.

Analyst Opinions and Market Outlook

Analysts are mixed. Some point to a durable rebound if earnings keep beating estimates. Others urge caution due to stretched valuations in some tech names. Short-term sentiment looks positive because of rate-cut pricing and strong U.S. data. Medium-term views vary and hinge on inflation trends, China’s growth, and corporate profit cycles.

One firm noted that model scans and an AI stock research analysis tool flagged earnings strength in certain sectors, but also highlighted concentration risk in a few megacaps. Investors should balance opportunity with risk.

Bottom Line

Asian shares rose on 24 November 2025 after Wall Street’s late gains. U.S. futures added fuel before the open. The rally rests on earnings, rate expectations, and stronger risk appetite. Key data in the coming days will decide if gains hold. Caution is still needed because markets can flip quickly. Watch CPI, jobs, and major corporate updates for the next clear signals

Frequently Asked Questions (FAQs)

Asian markets rose on 24 November 2025 because Wall Street showed strong gains. U.S. futures were higher, too. These signals lifted confidence and pushed Asian traders to buy more shares.

U.S. futures show what investors expect later in the day. Asian traders watch these numbers. When futures rise, they feel more confident and often buy more stocks during their morning session.

The rally may slow if inflation rises again. Weak data from China can also hurt markets. Geopolitical tensions or poor company earnings may add more pressure on shares.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.