Asian Shares Today Decline as Wall Street Rally Loses Momentum

Asian shares slipped on Tuesday, September 24, 2025, as the upbeat mood from Wall Street failed to hold. The U.S. rally, which lifted markets earlier this week, slowed down after investors turned cautious. That change in tone quickly echoed across Asia.

When Wall Street loses pace, we often see ripples in Asian trading. This is because global funds move together, and confidence shifts fast. Today, major indexes across Japan, China, Hong Kong, and India opened lower. Weak cues from U.S. tech stocks and mixed data on inflation added pressure.

We are also watching the U.S. Federal Reserve. Its policy outlook matters for every region, especially Asia. A stronger dollar and higher bond yields make investors pull money out of riskier Asian markets.

This decline is not just about numbers. It tells us how fragile global sentiment remains. Growth worries in China, currency swings in Japan, and geopolitical tensions keep traders on edge. We must ask, are these just short-term jitters, or signs of a deeper slowdown?

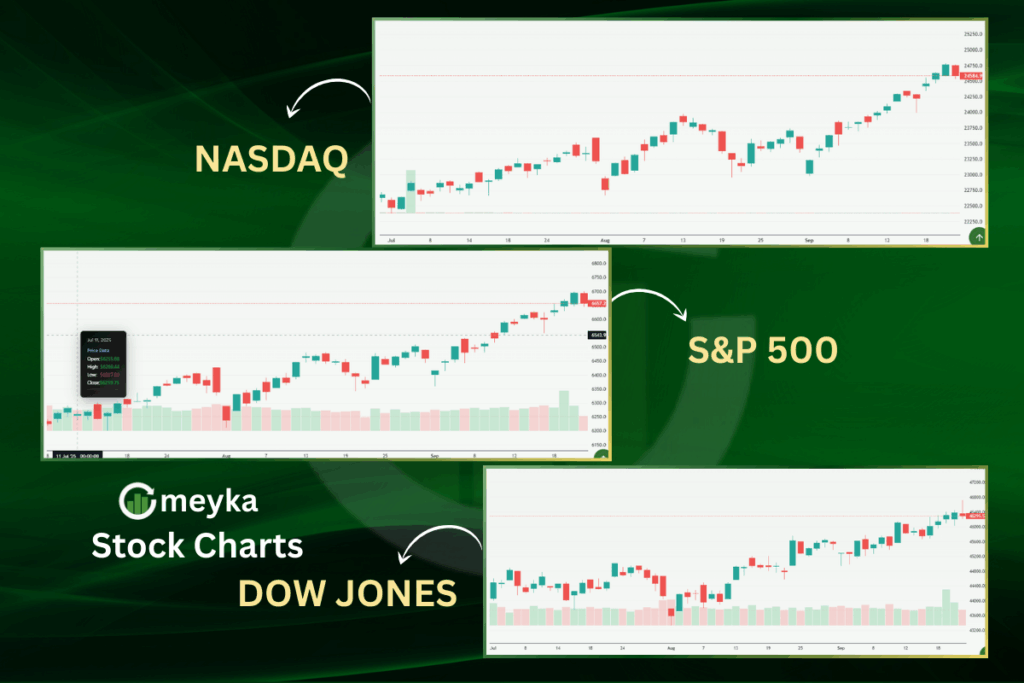

Asian Shares: Recap of Wall Street Rally

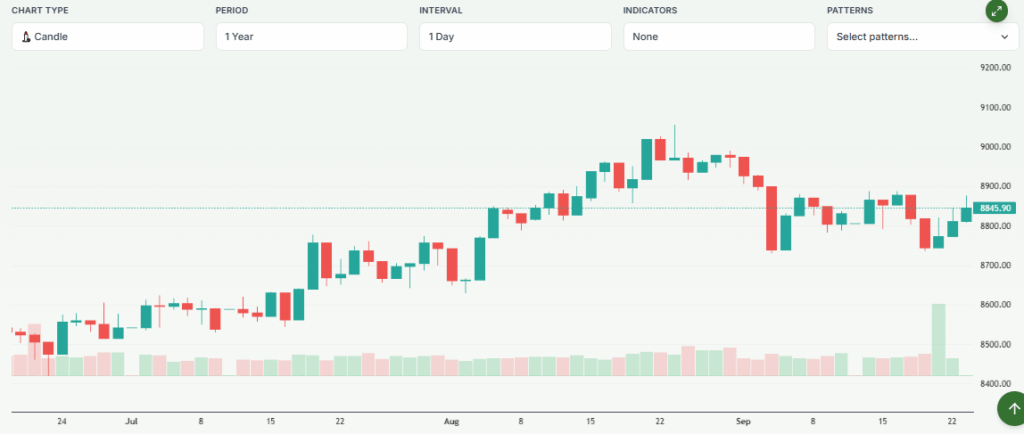

The U.S. stock market experienced a remarkable surge earlier this year, with the S&P 500 and Nasdaq Composite reaching nearly 30 record highs each. Over the past month alone, the S&P 500 rose by 4%, and the Nasdaq gained 6%. This rally was fueled by strong corporate earnings, particularly in the technology sector, and expectations of looser monetary policy from the Federal Reserve.

However, this momentum began to wane as Federal Reserve Chair Jerome Powell expressed concerns about stock valuations and the persistence of inflation above the 2% target. His remarks introduced uncertainty regarding the future path of interest rates, leading to a pullback in U.S. equities.

Asian Market Performance Today

On Wednesday, September 24, 2025, Asian markets showed mixed results. Japan’s Nikkei 225 index closed at a record high of 45,630.31, buoyed by investor optimism surrounding artificial intelligence investments. In contrast, Australia’s S&P/ASX 200 fell by 0.9% due to higher-than-expected inflation data. South Korea’s Kospi declined by 0.4%, while China’s Shanghai Composite gained 0.8%, reflecting resilience amid global uncertainties.

Global Factors Influencing the Decline

The recent pullback in Asian markets can be attributed to several global factors:

- Chair Jerome Powell’s cautious comments on stock valuations and inflation have led to speculation about the future trajectory of U.S. interest rates, impacting global investor sentiment.

- The dollar’s appreciation against other currencies, including the yen and euro, has made investments in emerging markets less attractive, leading to capital outflows from Asia.

- Fluctuations in commodity prices, particularly oil, have added to the uncertainty, affecting economies dependent on exports of these resources.

Regional Economic & Political Drivers

Specific regional factors have also contributed to the market downturn:

- Weaker-than-expected economic data and concerns over the property sector have raised doubts about China’s growth prospects, affecting investor confidence.

- The yen’s decline has raised concerns about inflation and the effectiveness of the Bank of Japan’s monetary policy, impacting market stability.

- The Indian rupee has reached an all-time low against the U.S. dollar, influenced by factors such as the U.S. visa fee hike and broader economic vulnerabilities.

Investor sentiment has turned cautious, with many shifting towards safer assets like bonds and gold. The volatility in global markets has prompted a reevaluation of risk, leading to reduced appetite for equities, particularly in emerging markets.

Market Outlook and Investor Takeaways

Analysts suggest that while the recent rally was impressive, it may have been unsustainable given the underlying economic challenges. Expectations for modest gains in the U.S. markets in the near term reflect a more cautious outlook. In Asia, the focus remains on economic reforms and policy adjustments to stabilize markets.

For global investors, the current market conditions highlight the importance of diversification and a balanced approach to risk. While opportunities exist in specific sectors and regions, the global economic landscape requires careful navigation to mitigate potential downsides.

Wrap Up

The decline in Asian markets on September 24, 2025, underscores the interconnectedness of global economies and the impact of U.S. monetary policy on investor sentiment worldwide. As markets adjust to new economic realities, both challenges and opportunities lie ahead for investors.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.