Asian Stocks Mixed as US Futures Slip and Oil Prices Jump Over $1

Asian stocks in the market opened on a mixed note on 1 December 2025, as global investors reacted to weak signals from the United States. US stock futures slipped early in the day, showing that traders were turning cautious again. At the same time, oil prices jumped by more than one dollar, adding another layer of tension to the market mood. These quick changes remind us how closely Asia follows movements in the US economy and global energy markets.

Some Asian indexes tried to stay positive. Others pulled back as investors waited for fresh economic data and central bank updates. Rising oil prices also created pressure for sectors that depend on fuel, while energy producers welcomed the boost. With so many factors moving at once, traders focused on simple questions: Where is demand heading? Will US rates stay high? And how will this shape Asia’s growth outlook?

Asian Stock Market and Key Movers

Asian stocks, Tokyo’s Nikkei, slid heavily after Japan’s factory data painted a weak picture for industry. The index fell about 1.9% as investors trimmed risk. In contrast, Hong Kong’s Hang Seng climbed modestly on strength in selective tech names. Mainland China’s Shanghai Composite and CSI 300 showed small gains, helped by state-linked buying and hopes for policy support.

South Korea’s KOSPI was subdued, hurt by weakness in chip-related counters. Australia’s ASX 200 drifted lower as some miners and cyclicals cooled after mixed commodity cues. These mixed moves reflected local data and global sentiment moving at once.

Why US futures matter Today?

U.S. equity futures were down at the Asian open. That set a cautious tone across the region. Traders pointed to soft US economic signals and uncertainty about the Fed’s next steps. When futures slip, risk assets in Asia often trade with a defensive bias. Higher expected volatility also lifted safe-haven demand for the dollar and some government bonds. The interplay between US futures and Asian trading is fast. One negative session in New York can shape Asian flows the next morning.

The Oil Shock: More than a Dollar Move

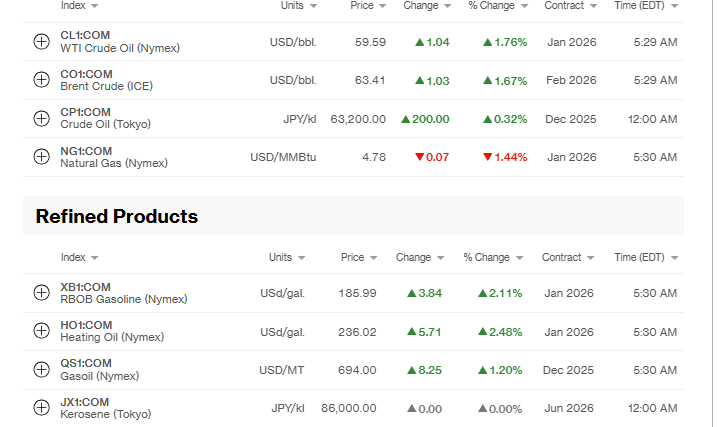

Oil prices jumped by over $1 a barrel on Dec. 1. The immediate trigger was OPEC+ confirming plans to hold production steady and a set of supply worries. Reports of pipeline disruptions and heightened geopolitical frictions also tightened the market tone. Brent climbed above $63 a barrel, while U.S. WTI moved near $59.5. The move is large enough to reshape sector bets across Asia within hours.

Sector Ripple Effects in Asian Stocks

Energy and oil-service names jumped on the price rise. Producers and exporters logged gains as traders priced in stronger near-term cash flows. Airlines and transport firms fell on higher fuel cost forecasts. Manufacturing names with big logistics bills also came under pressure. Tech stocks felt the squeeze from weaker U.S. sentiment and an uptick in real yields. Financials were mixed: some banks gained on higher bond yields, while others slipped due to risk-off flows. The result was a clear sector split rather than a uniform market move.

Currencies and Bonds: The Knock-on Effects

The dollar strengthened on the risk shift. The yen moved lower, which amplified the Nikkei’s slide when measured in dollars. China’s onshore yuan was steady versus the dollar, but pressure in global rates kept traders cautious. Government bond yields in the region reacted unevenly: yields rose where growth fears were lower, and fell where investors sought refuge. This patchwork response underscored that markets were first reacting to headline shocks and then sorting through local fundamentals.

Drivers behind the Moves beyond Headlines

Several deeper threads fed today’s action. First, data: Japan’s manufacturing PMI showed contraction, which amplified local risk aversion. Second, supply-side concerns in oil markets, OPEC+ posture, plus operational disruptions, forced traders to re-price energy risk. Third, forward-looking Fed signals remained mixed. Even hints that U.S. policy may stay restrictive for longer can pressure growth-sensitive assets globally. Together, these threads created a short-term cocktail of caution and rotation.

Market Impact for Asian Investors

Higher oil costs cut into margins for energy-intensive industries. Airlines may push for higher fares or hedges. Exporters that price in dollars could gain from a softer local currency. Equity investors will likely rotate toward stocks with visible earnings and away from momentum names that depend on cheap funding.

Short-term traders reacted quickly, while longer-term investors eyed policy signals and corporate guidance for signs of durability. Independent AI stock research analysis tool insights were also referenced by some desks to re-screen winners and losers after the oil move.

Near-term Watchlist

- U.S. ISM Manufacturing and jobs-related data due in early December. These reports can swing US futures and, by extension, Asian markets.

- Ongoing OPEC+ statements or supply updates. Any hint of further cuts or pauses matters for oil’s next leg

- Japan and China’s economic prints that may confirm or counter today’s PMI signals. Policymaker comments will be especially important for market direction.

Bottom Line

On 1 December 2025, markets in Asia split direction. Weak factory signals and softer U.S. futures pushed some indexes down. At the same time, oil rising more than $1 a barrel gave energy stocks a lift. The day showed how fast global headlines can shift local market flows. Traders should watch the coming U.S. data and any fresh OPEC+ news. Those two threads will likely shape market moves in the next sessions.

Frequently Asked Questions (FAQs)

Asian stocks were mixed on 1 December 2025 because US futures fell, oil prices jumped, and local economic data gave different signals. These factors created an uneven trading mood.

Rising oil prices raise costs for airlines, factories, and transport firms. Energy companies may gain, but many sectors face pressure, which often leads to mixed or cautious market moves.

US futures set an early tone for global markets. When they fall, Asian traders expect a weaker risk appetite. This often shapes price action at the Asian open.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.