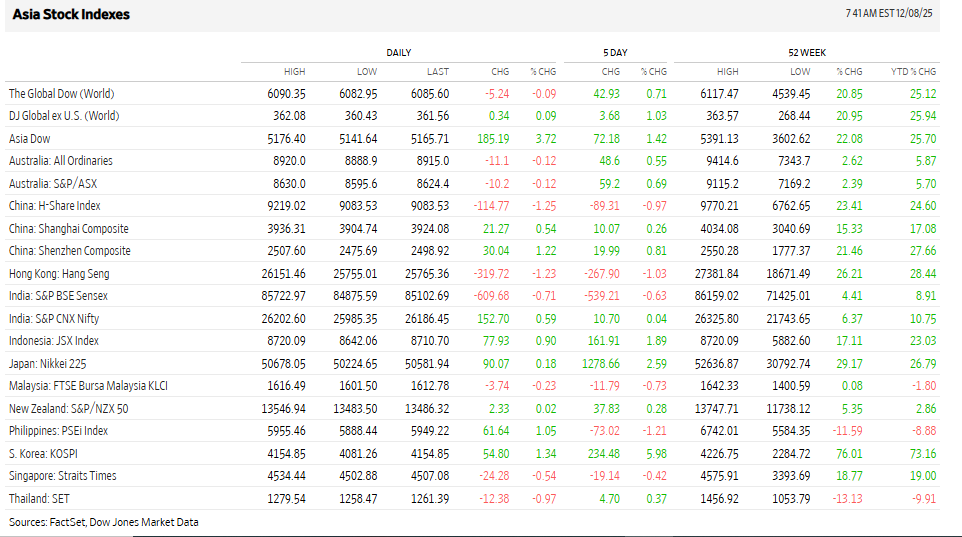

Asian Stocks Stall as Investors Brace for Expected U.S. Rate Cut

Asian stock markets found themselves stuck in neutral on December 8, 2025. Investors paused. They were waiting for a key decision from the Federal Reserve (Fed). The Fed is widely expected to cut interest rates at its December 9-10 meeting.

But even a “priced-in” cut is not calming markets. Nervousness remains high. Traders worry it signals deeper trouble in the U.S. economy. That fear is spreading.

As a result, Asian indexes are barely moving. Traders are not buying not selling. They are waiting. This moment feels like a quiet before a storm. Everyone senses the action is coming. But few know if it will bring relief or more pain.

Why Asia’s Markets Stalled as the Fed Looms?

Asian markets moved very little on December 8, 2025. Traders sat on their hands ahead of the U.S. Federal Reserve meeting on December 9-10. Many firms now expect a 25 basis-point cut at that meeting. That prediction has lifted hopes. But it has also raised new worries about U.S. growth and global liquidity.

The Paradox: Priced-in Cut, Rising Fear

An “expected” cut can still upset markets. If the Fed cuts because growth is weak, that is bad news. Investors fear a global slowdown more than higher rates. At the same time, pricing in the cut tightens positioning. That makes markets fragile. Short-term moves can look sharp even though the change is small.

Country Checks: Who is feeling the Pain?

Japan’s market showed caution. The yen’s swings have a big effect on exporters. A weaker dollar or volatile yen can hit profits and trading flows. China’s mainland and Hong Kong felt mixed pressure. China’s trade and credit data keep traders cautious even as some stocks try to rebound. South Korea’s tech names paused after a recent rally. India and Southeast Asian markets took a defensive tilt. Fund flows into equities slowed.

Three Hidden Risks Traders Watch

First, bond yields can twist sharply. Yields may stay high even if cuts happen. That can confuse banks and insurers. Second, currency swings add stress. A rapid dollar move will hurt hedges and earnings. Third, corporate forecasts can come under pressure. Multinationals may need to change guidance if rates or demand shift. These risks can turn a calm market into a volatile one quickly.

Cross-Asset Reads: Oil, Gold, Crypto, Bonds

Oil edged higher on hopes of easier U.S. policy. That helps some Asian exporters, but it also points to mixed demand signals. Gold rose as traders priced lower rates and a softer dollar. Crypto showed quick swings as traders chased risk after small moves in equities. Local bond markets in Asia watched the Fed closely. Central banks in Asia avoid big moves until the Fed’s tone is clear.

How are Larger Managers Positioning?

Large managers are splitting bets. Some move into high-dividend names in Japan and Singapore. Others add selective Chinese growth stocks on dips. Many funds use options to hedge currency and yield risk. A few teams test portfolio signals with an AI tool for faster scenario checks. That limits one-way exposure while keeping upside.

Data to watch this week

Markets will track U.S. payrolls and inflation prints the day after the Fed meeting. China’s upcoming trade and credit figures matter for regional demand. Japan’s policy commentary can shift the yen. India’s inflation and factory data will affect local flows. These releases will decide if the Fed cut looks like relief or a red flag.

Market Outlook: Three Short Scenarios

Best case: The Fed cuts and signals calm. Risk appetite returns. Asian tech and cyclicals rally.

Worst case: The cut is seen as a sign of U.S. weakness. Earnings get downgraded. Global flows retreat.

Middle path: The cut happens, but yields and currencies stay volatile. Markets trade in a range until clearer data arrives. Current odds point to a near-term trading range with quick bursts of volatility.

Final Thought

Asian stocks are pausing. The Fed’s tone will set the next move. Traders must watch data and flows, not just headlines. The true test comes after the first trading session that follows the Fed’s decision on December 9-10, 2025.

Frequently Asked Questions (FAQs)

A U.S. rate cut on December 10, 2025, can help Asian stocks by easing borrowing costs. But it may also signal weak U.S. growth, which can limit gains and create mixed market reactions.

Japan, China, and South Korea usually react first. These markets trade heavy volumes and link closely linked to U.S. growth. Their currencies also move quickly after any Fed decision or policy change.

A Fed cut can weaken the U.S. dollar. This may lift some Asian currencies. But sharp swings can hurt exports and investor plans, creating short-term uncertainty in regional markets.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.