ASST Stock Moves After Strive Introduces $500 Million ATM Program for Preferred SATA Shares

On December 9, 2025, Strive, Inc. made a big move in the market, and ASST stock reacted fast. The Nasdaq-listed company filed to sell up to $500 million of its preferred SATA shares through an at-the-market (ATM) program. These are not normal shares. They are preferred stocks with special dividend rights. This plan allows Strive to sell shares in pieces at current prices instead of one large block.

The news hit traders fast. ASST stock began moving in both directions. Some saw it as a sign of strength. Others worried about more shares entering the market. The size of this ATM program is large for a company of this kind, and it shows that Strive wants to raise serious capital. The aim is to support growth goals and strengthen its Bitcoin strategy, among other uses.

This shift in strategy has attracted attention. It makes ASST stock a major headline in finance news right now.

What Exactly Strive Announced: Breaking Down the $500M ATM Program

On December 9, 2025, Strive, Inc. filed a sales agreement to offer up to $500 million of its Variable Rate Series A Perpetual Preferred Stock (SATA) through an at-the-market program. The filing was made under the company’s existing shelf registration that became effective on September 15, 2025.

The program allows Strive to sell preferred shares in pieces at prevailing market prices rather than in a single block. Brokers named in the filing include Cantor Fitzgerald and Barclays.

Why Strive Is Targeting SATA Preferred Shares?

Strive chose preferred stock for a reason. Preferred shares pay a stated dividend and sit above common stock in the capital stack. That makes them attractive to yield-seeking investors. SATA carries a variable dividend that has been reported at around 12% for December 2025.

Issuing preferred stock can raise large sums without immediately changing common-share counts. But preferred issuance can later convert or create obligations that affect common holders.

Why the Company Says It Needs the Capital?

Strive listed several uses for proceeds. These include buying more Bitcoin, funding working capital, and possible acquisitions. Management framed the move as a way to scale its Bitcoin treasury strategy while keeping financing flexible. Market observers note this mirrors tactics used by other corporate Bitcoin holders that favor preferred or debt-like instruments to fund crypto buys.

Market Reaction: How ASST Stock Moved?

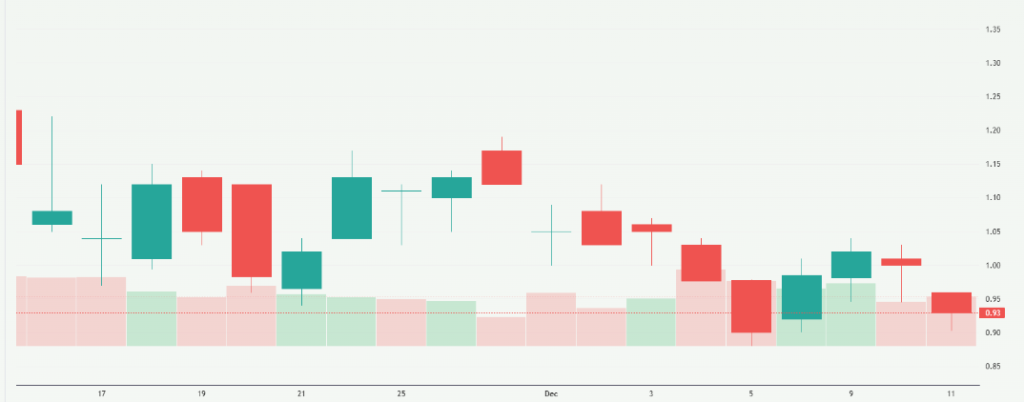

Traders reacted quickly. On December 10, 2025, ASST shares showed higher volume and a modest price uptick as markets processed the news. Some outlets reported a roughly 3.5% intraday gain on the day following the announcement, though intraday swings and later pullbacks were also recorded. The pattern suggests mixed sentiment: buyers who like the growth angle, and sellers who fear dilution or higher financial risk.

The Dilution Question: What Investors are Really Worried About?

Preferred ATMs do not dilute common shares in the same immediate way that new common stock would. Yet the risk is not zero. If preferred dividends become burdensome, the company may issue more securities, sell assets, or take other steps that affect equity value.

Also, if preferred shares are convertible or if payouts force cash strain, common holders could feel pressure later. Rating agencies and fixed-income desks will watch payout coverage closely.

Why Some Investors Call This Bullish?

There is a bullish case. First, the ATM gives Strive optionality. Management can raise cash when market conditions are favorable. Second, SATA’s high dividend may attract a different investor base. Third, proceeds aimed at buying Bitcoin could increase the company’s BTC-per-share metric if execution is accretive.

For income investors, SATA’s yield and priority could be appealing. Finally, opportunistic capital raises can fund growth without the time and cost of a large underwritten deal.

Competitive Context: How This Stacks Up

Strive’s move follows a pattern in the crypto-finance niche. Firms that seek to scale Bitcoin holdings have used debt, convertible notes, or preferred stock. The $500 million program is large relative to Strive’s market cap and is among the more aggressive ATM sizes announced by a crypto-focused public company in 2025. That scale matters. It signals conviction but raises the stakes for execution.

What Analysts and Commentators are Saying?

Analysts split into two camps. One camp praises the strategy as capital-efficient and growth-oriented. The other worries are about timing and payout burden, especially given Bitcoin’s price volatility. Social channels amplified both takes. Short-term traders focused on liquidity and technical levels.

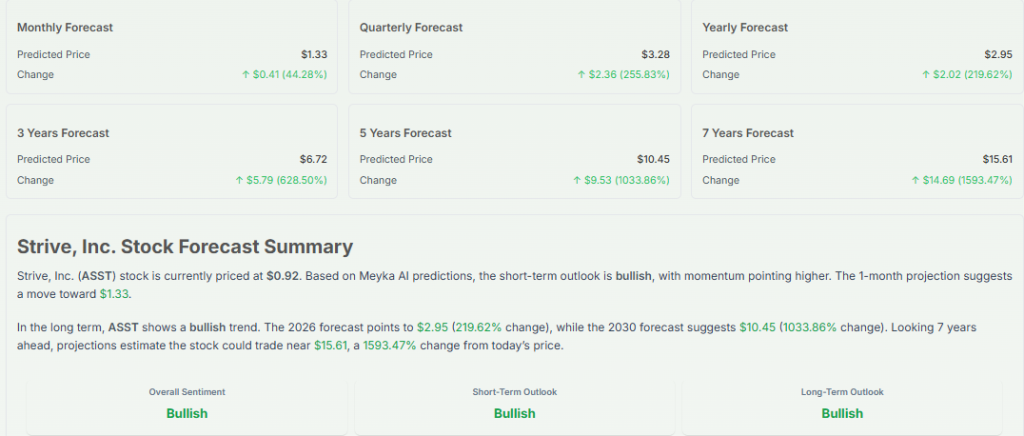

Longer-term analysts pushed models that stress test dividend coverage and BTC acquisition cost. Some AI-driven platforms summarized the filing and modeled scenarios using an AI stock research analysis tool to estimate possible per-share outcomes.

Forward Outlook: 6-12 Month Scenarios

If Strive uses proceeds to buy Bitcoin at attractive prices and holds it, the BTC treasury could lift intrinsic value per share in a bullish market. That is the upside. The downside is material, too. If dividends and other obligations pile up while BTC lags, pressure could build on earnings and cash flow.

Key near-term indicators to watch are the pace of SATA placements, the company’s disclosed use of funds, monthly dividend rates on SATA, and BTC purchase disclosures. Expect updates to appear in Form 8-K filings and prospectus supplements.

Risks Investors Cannot Ignore

Risk is multifaceted. The dividend cost, conversion features, and market appetite for high-yield preferreds matter. Macro factors matter as well. Interest rate moves, equity risk sentiment, and Bitcoin price swings will shape outcomes. Execution risk is also real: large ATM placements can push prices if sold too quickly. Investors should read the December 9, 2025, filings closely and monitor monthly SATA dividend announcements.

Bottom Line: What This Means for ASST Stock Right Now

Strive’s $500 million SATA ATM, announced on December 9, 2025, is a bold funding tool. It brings both opportunity and uncertainty. For income investors, SATA’s yield could be attractive. For equity investors, the main questions are timing and execution. Watch the pace of the program and how proceeds are deployed. Those developments will drive whether ASST’s near-term moves look visionary or risky.

Frequently Asked Questions (FAQs)

ASST stock moved on December 9, 2025, because investors reacted to Strive’s $500M ATM plan. Some saw it as growth. Others expected higher activity, which created short-term price swings.

The program may create pressure if many preferred shares enter the market. But it also gives Strive more capital. The impact depends on how the company uses the funds.

The Bitcoin plan could help if prices stay strong. But it also adds risk during volatility. ASST’s future price will depend on how Strive manages new capital and timing.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.