ASX Outlook December 15, 2025: Aussie Stocks Set to Fall; Fortescue to Acquire Remaining Canadian Copper Holdings

Australian shares (ASX) head into Monday, December 15, 2025, under clear pressure. Futures point lower before the opening bell. Global markets set the tone overnight. Wall Street eased as investors stayed cautious on interest rates. Bond yields remained firm. That kept risk appetite in check. Commodity prices also sent mixed signals. Iron ore softened again. Copper held steady, but optimism stayed limited.

The timing matters. Mid-December trading is often thin. Small moves can look bigger than usual. Fund managers are also adjusting books before year-end. Some are locking in gains. Others are reducing exposure to volatile sectors. This creates uneven price action across the ASX.

Against this backdrop, Fortescue is back in focus. The miner is moving to take full control of its Canadian-linked copper interests. The step highlights a long-term shift toward future metals. It also raises short-term questions for investors.

Today’s session reflects more than one headline. It shows how global rates, China’s demand, and corporate strategy are shaping sentiment at once. The market opens cautiously. Direction will depend on conviction, not headlines alone.

ASX at the Open: Why Futures Point to a Softer Monday Session

ASX 200 futures signalled a weaker start on December 15, 2025. Markets were tracking frail US leads and slower iron ore trades. Thin year-end liquidity made moves sharper. Traders priced in profit-taking ahead of major US data this week.

Global Market Signals Weighing on Australian Equities

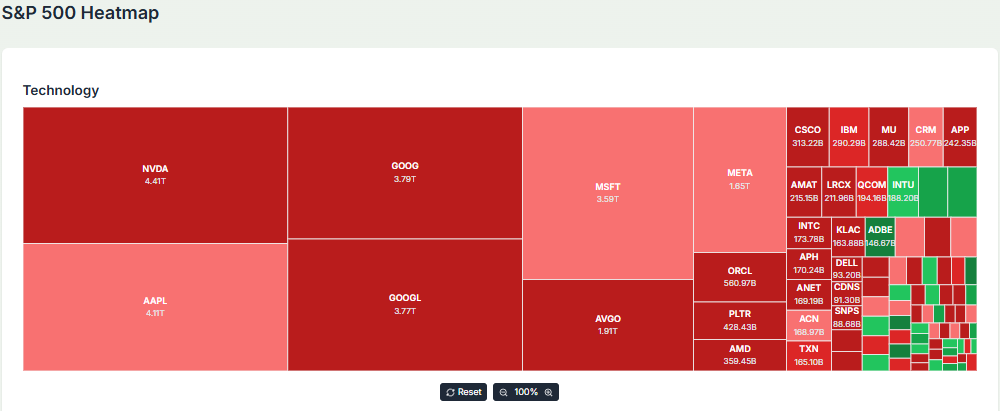

US markets pulled back late last week. Tech stocks underperformed and pushed indices lower. The Nasdaq and S&P saw pressure as traders fretted over higher bond yields. The yield story, not earnings, drove much of the risk-off mood. That set a negative tone for Australian equities.

China’s demand tone also cooled. Iron ore contracts on Dalian fell to a five-month low as policy and export plans raised doubts about steel demand. That hit miners on the ASX. Commodity watchers flagged the split between bulk commodities and future metals like copper.

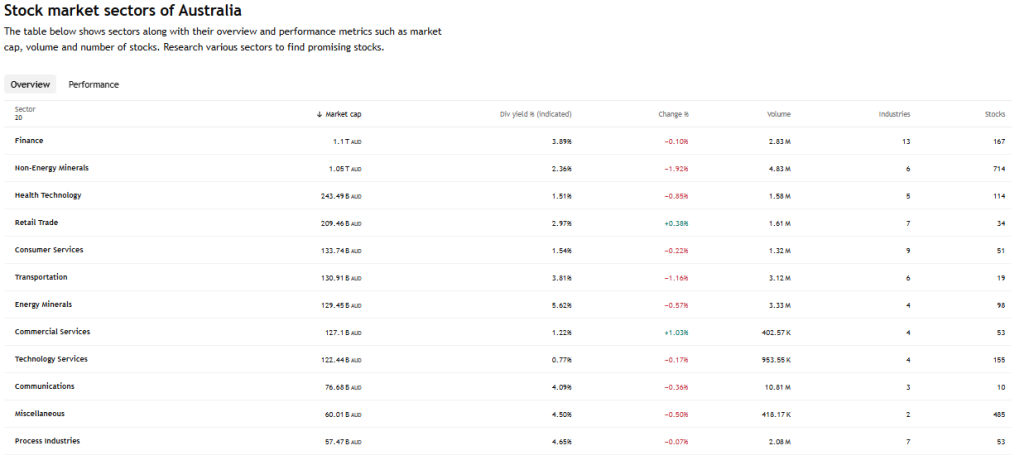

Sector Breakdown: Where Selling Pressure Is Likely to Hit Hardest

Materials led the downside. Iron ore exposed miners suffered the most. Banks lost some ground. The market’s sensitivity to rates weighed on the big four. Energy names tracked oil consolidation and posted modest weakness. Industrials lagged as global growth nerves resurfaced. Market breadth was narrow. These moves reflected both macro and sector rotation forces.

Stock in Focus: Fortescue’s Strategic Push Into Canadian Copper

Fortescue Metals announced a plan to buy the remaining 64% of Alta Copper in a cash deal valuing the company at C$139 million. The offer sits at C$1.40 per share. Fortescue’s bid follows an industry push to secure copper assets amid tight supply and robust demand for electrification metals.

Alta holds the Canariaco project in Peru, with large reported copper resources. The deal reinforces Fortescue’s pivot from pure iron ore into copper and battery metals. Market reaction was muted at first, with Fortescue shares edging down on the day of the announcement.

Analysts note the strategic logic. Copper is central to decarbonisation. It feeds grids, EVs, and renewables. Buying Alta gives scale in copper development. The move may dilute near-term cash. But it could boost long-term optionality if copper prices hold. The market will watch for integration costs and any production timelines offered by Fortescue’s teams.

Investor Sentiment: Risk-Off Without Capitulation

The investor tone felt cautious, not panicked. Funds trimmed cyclical exposure. Some managers shifted into cash and high-quality defensives. Others used lower prices to top up long-term positions in select miners and utilities. The balance suggested tactical risk reduction rather than a broad exit from equities. Economic releases this week will likely decide whether buying returns or selling intensifies.

Key Levels and Indicators to Watch During Today’s ASX Session

Watch the ASX 200 near its intraday support and the recent session lows around 8,635. Higher volume on down days would confirm a genuine sell-off. A weaker SPI alongside falling futures would open the door for short sellers. Conversely, narrowing breadth with a few large caps holding up could signal selective buying. Traders should monitor iron ore prices, copper quotes, and US Treasury yields for directional clues.

Macro Risks Hanging Over the Market This Week

The big macro risks are still the US rate signals and China demand. Markets await fresh US economic prints that might shift Fed expectations. Recent Fed communications show active management of reserve rates and liquidity tools. Those moves can swing bond yields and equities quickly. China’s policy mix will determine raw-material flows. Domestically, RBA commentary remains a background risk for banks and property-sensitive names.

Short-Term Outlook: Is This a Dip or Start of a Deeper Pullback?

Near term, the bias leans to caution. Seasonally thin markets can exaggerate moves. If Treasury yields push higher and China signals more weakness, the market could test lower support. If yields cool and commodity rallies resume, miners could recover.

The path depends on incoming US data and any new China stimulus signals. Short traders will hunt momentum. Long investors should watch for confirmed price and volume rebounds before adding exposure.

Closing Takeaway

Caution is justified on December 15, 2025. The ASX opened softer, and miners took the brunt of the pain. Fortescue’s Alta Copper takeover is a clear strategic bet on copper’s role in the energy transition. That deal could pay off if copper tightness persists. Consider holding cash or high-quality names until risk leads become clearer. Look for disciplined entries into thematic miners. Use an AI stock research analysis tool once to cross-check valuations and project timelines before making sizable allocations.

Frequently Asked Questions (FAQs)

The ASX may open lower on December 15, 2025, due to weak global markets, steady bond yields, lower iron ore prices, and cautious investor trading ahead of key data.

Fortescue shares may see short-term swings, but the copper deal supports long-term growth plans tied to clean energy demand and future metal supply trends.

Mining and banking stocks face near-term risk as China’s demand stays uncertain, interest rates remain high, and investors reduce exposure to cyclical sectors.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.