ATO Cracks Down on Sunscreen Retailers in GST Update

Australia’s sunscreen market is growing fast as hotter summers push people to buy more sun protection each year. But on 1 December 2025, the Australian Taxation Office (ATO) released a major GST update that puts sunscreen retailers under closer watch. The ATO says too many stores are mixing up the tax rules. Some are treating cosmetic sunscreens as GST-free, even though only TGA-listed therapeutic products qualify. This mistake has led to lost revenue and uneven pricing across the market.

Now the ATO wants to fix the problem. The new update explains how retailers must classify sun-care products and report GST correctly. It also warns businesses about stronger audits in 2025. The message is clear. The ATO expects tighter compliance as sunscreen sales rise nationwide.

This shift has created a wave of attention across pharmacies, supermarkets, and online sellers. Many businesses are reviewing their records to avoid penalties. The ATO says the goal is fairness, clarity, and proper tax treatment in a fast-growing product category.

Background: Why Sunscreen GST Rules Became Confusing?

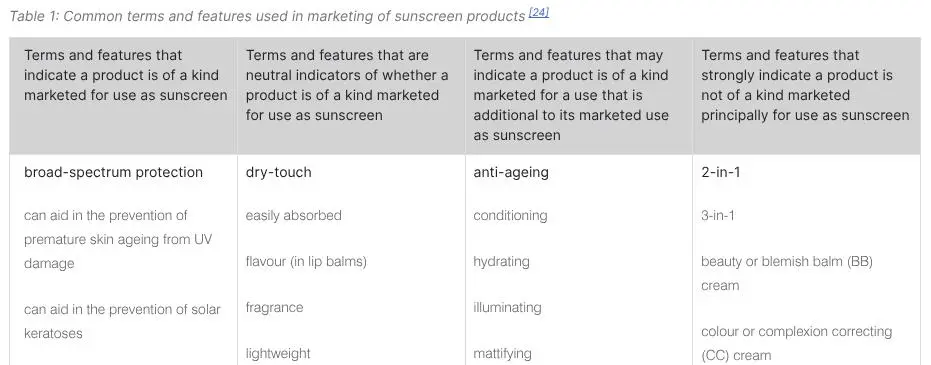

On 14 February 2025, the ATO issued a major clarification to resolve long-standing confusion over the GST treatment of sunscreen. Today, many sunscreens are marketed as cosmetics, skincare, or “dual-purpose” beauty products, which blur the line between therapeutic sunscreen and SPF makeup.

The ATO clarified that only products meeting four specific conditions qualify as GST-free. They must be applied to the skin, have SPF 15 or higher, be listed on the Australian Register of Therapeutic Goods (ARTG), and be marketed mainly for use as sunscreen.

Changes in marketing across the beauty industry led many retailers to mistakenly treat non-therapeutic SPF cosmetics as GST-free. This created inconsistent pricing and confusion across pharmacies, supermarkets, and online stores.

What Triggered the ATO Crackdown?

The ATO announced that many retailers were misclassifying moisturisers, BB creams, tinted foundations, and multi-purpose lotions with SPF. These products are often promoted as skincare or makeup first, with sun protection as a secondary feature.

According to reporting on 9News, the ATO is now closing this loophole because it caused “lost revenue” and uneven tax treatment across the market.

The growing popularity of hybrid beauty products also created compliance gaps. Retailers often relied on brand marketing rather than strict GST definitions, resulting in products being sold as GST-free even without an ARTG listing.

Details of the GST Update

The ATO’s clarified guidance states that any product with both cosmetic and therapeutic claims will be treated as taxable. Moisturisers with SPF, foundations with SPF, BB creams, CC creams, and tinted sunscreens may all attract GST unless they meet TGA therapeutic criteria.

Only therapeutic sunscreens with ARTG approval carrying an AUST-L or AUST-R number remain GST-free. These products must follow strict TGA rules on SPF testing, broad-spectrum protection, water resistance, and accurate labelling.

This update did not change the law. It only restated how the law should already be applied. The ATO said the clarification was needed because retailers misunderstood the original rules.

Impact on Retailers and Businesses

Retailers now face major compliance tasks. Many need to recode items in their point-of-sale systems, check invoices, update catalogues, and review product descriptions. Small stores and online sellers feel the pressure most because they sell many dual-use skincare items.

SmartCompany reported that retailers will be expected to correctly classify every product before the next audit cycle. Non-compliance could lead to penalties.

Industry analysts warn that GST changes may increase shelf prices for some beauty-SPF products by around 10%, especially for hybrid items.

ATO’s Enforcement Measures

The ATO confirmed that stronger monitoring will continue throughout 2025. The crackdown includes data-matching tools, automated GST risk flags, and targeted audits on large retail chains and high-volume online sellers.

The guidance also warns businesses that GST exemptions apply only when products strictly meet therapeutic standards. The ATO encourages retailers to review product marketing and packaging because claims like “hydration + SPF,” “tinted coverage,” or “beauty finish” can automatically disqualify products from GST-free status.

Industry Reactions and Market Response

Retail associations expressed concern that the cosmetic–therapeutic divide is becoming harder to navigate. Many manufacturers design products that blend skincare and beauty functions because consumers want convenience. This trend makes compliance more complex.

Dermatologists and skin-health advocates say clear labelling is essential for consumers. Many support the ATO’s clarification because it may push shoppers toward genuine protective sunscreens rather than relying on makeup for UV protection.

Some industry groups suggested that Australia may need a unified SPF labelling standard to avoid future confusion.

Consumer Impact and Price Changes

Consumers will likely notice higher prices on SPF-infused beauty products. Dual-purpose items may lose GST-free status, increasing final shelf prices.

People who rely on tinted or moisturising sunscreens may now compare labels more carefully. ARTG-listed sunscreens remain GST-free and follow stricter testing, making them more reliable for outdoor protection.

Reports suggest some shoppers may shift back to traditional sunscreen products for cost savings and stronger UV protection.

Insights from Tax and Regulatory Experts

Tax experts note that this clarification is part of a broader ATO effort to tighten GST rules on health and beauty products. As categories overlap more, regulators want to ensure tax exemptions are used correctly.

The TGA also continues to update sunscreen standards. In 2025, it launched a review of certain sunscreen ingredients to make sure products remain safe and effective. Experts say the GST clarification and TGA standards together reinforce consumer trust in sunscreen products sold nationwide.

What Retailers Should Do Next?

Businesses are expected to audit all SPF-related items, check ARTG listings, update GST codes, and correct any misclassified products. The ATO suggested reviewing marketing materials because product claims determine tax status.

Retailers must also ensure systems are updated before the next compliance cycle. Those who operate online marketplaces must verify product data to avoid errors.

For risk assessment, many retailers are now turning to AI stock research analysis tools to track compliance trends and identify products that may require reclassification.

Future Outlook & Final Words

The sunscreen category in Australia enters a new phase. Retailers are adapting to clear GST rules. Regulators are increasing scrutiny.

Consumers may shift buying habits as cosmetic SPF items become more expensive. The ATO’s clarity, combined with the TGA’s safety standards, is expected to reshape product design, marketing, and pricing in the years ahead.

Industry experts believe further guidance may emerge as new hybrid skincare items enter the market. For now, the 2025 update stands as the strongest reminder that therapeutic claims must match regulatory standards and tax obligations.

The ATO’s 2025 update brings clearer GST rules for sunscreen and SPF products. Retailers must follow strict classifications, and consumers may see price changes. The goal is simple: accurate tax treatment and better clarity across the sunscreen market.

Frequently Asked Questions (FAQs)

Yes. Many sunscreens are still GST-free in 2025, but only if they meet ATO rules. The product must be listed on the ARTG and promoted primarily for sun protection.

Some sunscreens are now taxed because the ATO found many were marketed primarily as beauty or skincare products. Under the updated 2025 guidance, these products no longer qualify for GST-free status.

To qualify for GST-free status in 2025, a sunscreen must be listed on the ARTG. This includes therapeutic sunscreens designed mainly for UV protection with SPF 15 or higher.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.