ATO Warning Issued After $1.4 Billion Withdrawn Early from Super Accounts

On September 22, 2025, the Australian Taxation Office (ATO) raised the alarm after data showed that roughly AUD 1.4 billion had been withdrawn early from superannuation accounts. That massive movement of funds sparked fears that many people might be abusing the rules, or acting on poor advice. The ATO warning is clear: tapping into your super early can carry serious risks and often isn’t legal.

Superannuation is meant to protect your future. It is your nest egg for retirement. But when large sums are pulled out too soon, that safeguard begins to unravel. Many people don’t realize the long-term damage they may incur: lower balances, missed growth, and potential tax penalties. The ATO wants Australians to slow down and rethink before jeopardizing their financial security.

This article explains why so much money moved, shows how the ATO is stepping in, outlines the rules for early super access, and guides you on how to stay protected.

What Is Superannuation and Why It Matters?

Superannuation is money set aside for retirement. Employers pay part of wages into super. That money grows with time and investment returns. The system is meant to protect people when they stop working. Losing super today can mean much smaller savings in twenty or thirty years. Super rules aim to keep retirement funds safe and focused on long-term needs. These rules let people access funds early only in serious cases. The goal is to stop short-term choices from ruining lifetime security.

Background: How $1.4 Billion Was Withdrawn Early?

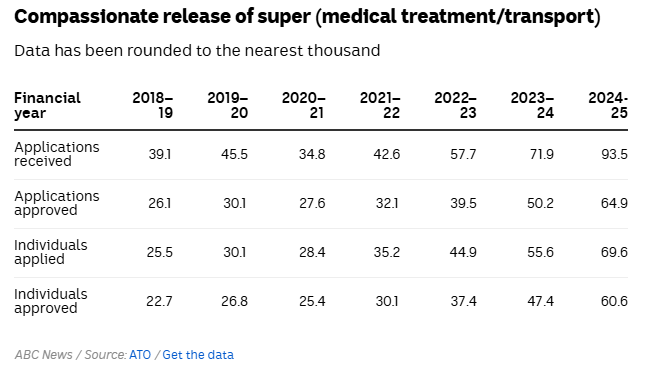

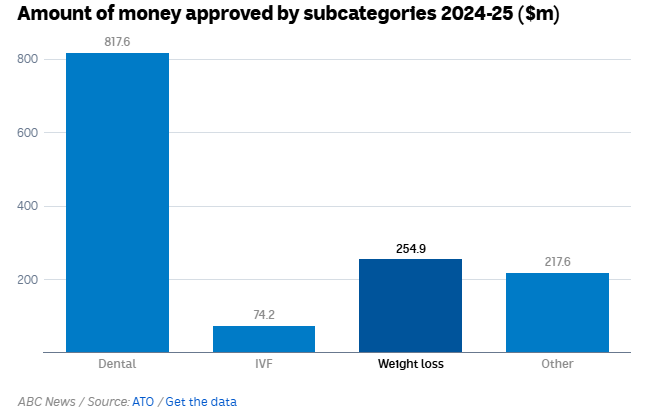

In the 2024-25 financial year, Australians withdrew more than AU$1.4 billion under compassionate grounds. Much of that money paid for medical services. Dental work and weight-loss procedures were a large share. The ATO counted tens of thousands of applications in this category. The scale surprised regulators and sparked fresh warnings in October 2025.

Why did the ATO Issue a Warning?

The ATO warned that some withdrawals did not meet strict rules. Regulators see cases of poor advice and possible misuse. Health practitioners and some businesses are under scrutiny for promoting treatments that may not qualify. The ATO and Ahpra told the public that early access should be a last resort. They stressed that wrong or fraudulent claims can lead to penalties. The joint ATO warning was published as concerns rose about system abuse on October 16, 2025.

Current Rules for Early Access to Super

Law allows early release only in defined cases. These include severe financial hardship, compassionate grounds for medical treatment, terminal illness, and permanent incapacity. Each ground has clear rules and documentation needs. For compassionate medical access, many claims must be supported by two health professionals. The ATO checks details against medical evidence. False claims can be refused and may trigger investigations.

Common Mistakes and Misconceptions by Individuals

Many people think super is like a savings account. It is not. Some follow online tips or paid promoters who promise fast access. Others accept advice from unlicensed advisers. Few realise the long tax or legal risks. A rejected application can cause stress and financial harm. It also leaves a person with less retirement money. Regulators warn to verify advice and avoid high-pressure sales.

ATO Crackdown and Compliance Actions

The ATO uses data tools to spot unusual patterns. Systems match medical certificates, practitioner details and payment records. Where claims look risky, the ATO asks for proof. Some applications were rejected by about 30% in certain medical categories last year. Investigations may follow. Practitioners who help improper claims risk sanctions by Ahpra. The ATO has signalled tougher checks ahead.

Financial Risks of Early Withdrawal

Taking money out now reduces the power of compounding returns. Small sums lost today can mean much less at retirement. Withdrawals can also carry tax or penalty costs. People who use super for non-essential treatments risk long term insecurity. Relying on early cash can leave one dependent on the age pension later. The advice is simple: protect the long term.

Impact on the Superannuation System and Economy

Large early withdrawals reduce the pool of retirement capital. That can push more people toward the public pension in later years. It also raises costs for funds and regulators. Trust in the system may fall if abuses spread. Stronger oversight will add compliance costs. These shifts affect savers and the wider economy.

How to Protect Your Super?

Check the official ATO website before acting. Get advice only from licensed financial advisers. Ask for clear, written reasons when someone suggests early access. Keep all records and receipts. Compare options: if debt or bills are the issue, other solutions may exist. A top rule is to think long term. One practical tool for checking investments is an AI stock research analysis tool, but do not use it as a substitute for regulated financial or medical advice.

What to Do If You Have Withdrawn Super Early?

First, check whether the withdrawal met legal grounds. If unsure, contact the ATO or your fund. Consider voluntary correction or payment back if possible. Seek licensed advice for tax and legal next steps. Start rebuilding retirement savings through extra contributions once stability returns. Act quickly to avoid penalties or larger losses.

ATO Warning and Future Plans

The ATO plans more data matching and public guidance. Expect closer checks on medical certificates and provider behaviour. Aphria and medical boards will update guidance to stop misuse. Public campaigns aim to warn consumers about risky schemes. The tone from regulators changed after figures for 2024-25 shocked the sector in mid-October 2025.

Government and Industry Response

Super funds urged members to be careful and to seek proper advice. Industry groups call for clearer rules and education. Regulators are talking with health boards about tighter rules for practitioners who touch early access claims. Lawmakers may consider further steps if misuse continues. The debate balances consumer protection and legitimate medical needs.

Role of Financial Education

Better education can reduce risky choices. Schools, employers and funds have a role. Short guides and plain language tools can help people assess real needs. Knowing how compounding works often changes choices. Financial literacy helps people plan and avoid harmful quick fixes.

Wrap Up

The $1.4 billion figure for 2024-25 changed the tone of the debate on early access to super. Regulators issued blunt warnings in October 2025. The message is clear: early release should be rare and well documented. Acting without proper grounds risks money, penalties and future security. Follow official guidance, use licensed advisers, and think long term.

Frequently Asked Questions (FAQs)

The ATO warned Australians in October 2025 because over $1.4 billion was taken from super accounts early, and many people may have broken rules or used false claims.

You can only access super early for severe financial hardship, compassionate medical needs, terminal illness, permanent disability, or approved schemes with proper proof and ATO permission.

Yes, the ATO can charge penalties, taxes, or take legal action if you access super without meeting the rules or providing correct documents for approval.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.