Aussies Job Report November: Hiring Cools as Economy Hits a Soft Patch

Australia’s job market report showed clear signs of cooling in November 2025. New figures from the Australian Bureau of Statistics reveal that employment fell by about 21,000 jobs, the largest drop in nine months. At the same time, the unemployment rate stayed at 4.3%, unchanged from October, even though hiring was weaker than expected.

Full-time work dropped sharply, while part-time jobs rose slightly. The number of people in the workforce also fell, pushing down the participation rate. This mix of weak job creation and steady unemployment suggests the labour market may be shifting from strong to soft.

This change matters. It affects how businesses hire, how workers feel about their job prospects, and how the Reserve Bank of Australia might act on interest rates next year. These early signs of a slowdown make November’s report more than just another set of numbers.

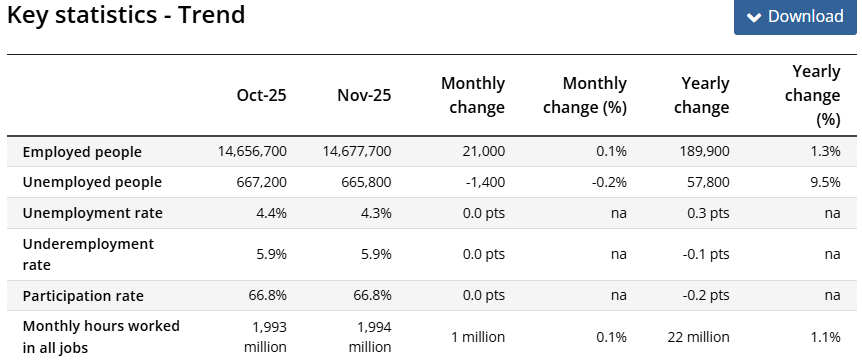

The Job Report Numbers Behind the Soft Patch

November’s data showed a split story. The Australian Bureau of Statistics (ABS) released the Labour Force report on 11 December 2025. In seasonally adjusted terms, employment fell by about 21,300 people in November.

Full-time roles plunged by 56,500, while part-time roles rose by 35,200. The unemployment rate held at 4.3%, but underemployment rose to 6.2% and the participation rate slipped to 66.7%. These mixed signals point to weaker demand for labour beneath a steady headline unemployment figure.

The Industries Cooled First: Not All of Australia Slowed the Same Way

Retail and hospitality showed clear strain heading into the holiday season. Reports indicate lower-than-expected casual hiring in November for seasonal shifts. Construction also weakened. Building approvals and pipeline activity have slowed, and that now shows up as fewer tradie hours and contractor cuts.

Professional services and corporate consulting firms signalled hiring freezes. By contrast, healthcare and education continued to add roles. Government-backed and essential services remain the clearest sources of resilience.

The Hidden Driver of Aussie Job Report

First, borrowing costs remain elevated. High rates tightened spending and made firms delay new hires. Second, strong population growth lifted labour supply. More people seeking work limits upward pressure on wages even when jobs fall. Third, firms face margin pressure from higher input costs. That pushed some employers toward short-term contracts and away from permanent staff. These forces together explain why hours worked and underemployment matter more than the headline unemployment rate.

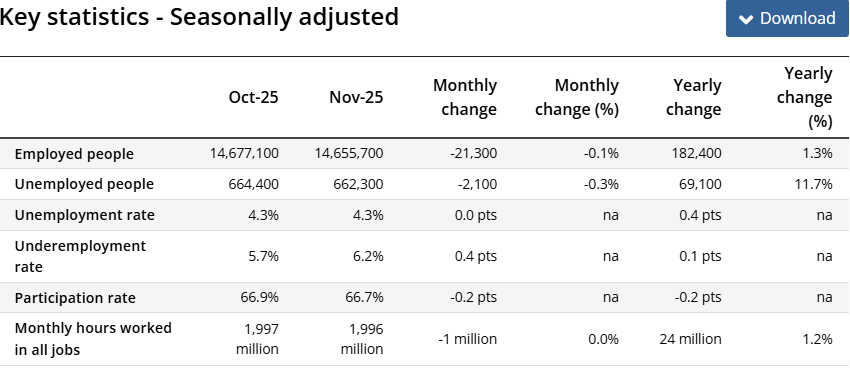

Market Reaction: How Investors Read the Soft Jobs Print

Markets moved quickly after the ABS release. The Australian dollar slipped on the softer employment numbers. Three-year government bond yields fell from recent highs as traders slightly pared back the odds of near-term tightening.

The ASX saw rotation into rate-sensitive sectors such as REITs and growth tech stocks, while banks and consumer cyclicals underperformed on weaker credit and spending outlooks. Traders and analysts, sometimes using AI analysis tools to read the data as nudging market pricing toward a slower RBA path.

RBA Implications: Does one weak month shift the 2025 playbook?

The Reserve Bank of Australia has treated the labour market as its last bulwark against inflation. A single weaker month will not automatically change policy. However, the combination of falling full-time jobs, a lower participation rate, and higher underemployment raises questions. If the labour market continues to cool, the RBA may grow more confident that inflation will moderate without further rate rises.

At present, commentators judge that November alone is more likely to delay than accelerate any policy pivot. Markets still see a lower probability of near-term hikes, but the RBA will watch incoming inflation and wage data closely.

Aussies Job Worker Reality Check

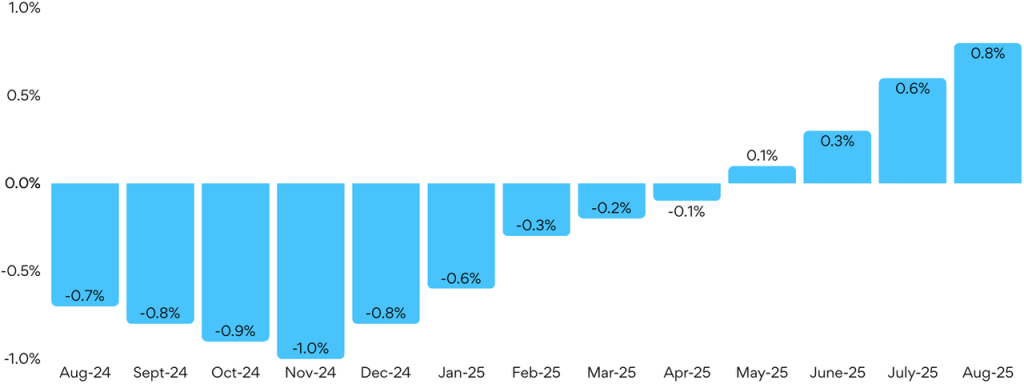

Jobseekers face more competition in some sectors. SEEK data show job ad volumes drifting lower and applications per ad rising. That implies more applicants per opening. Wage growth has eased from the peaks seen in 2024-25. Employers in some white-collar fields are pausing on permanent hires.

At the same time, specialist skills in health, IT, and engineering still command premiums. Overall, bargaining power is moving slowly from workers back toward employers in vulnerable sectors.

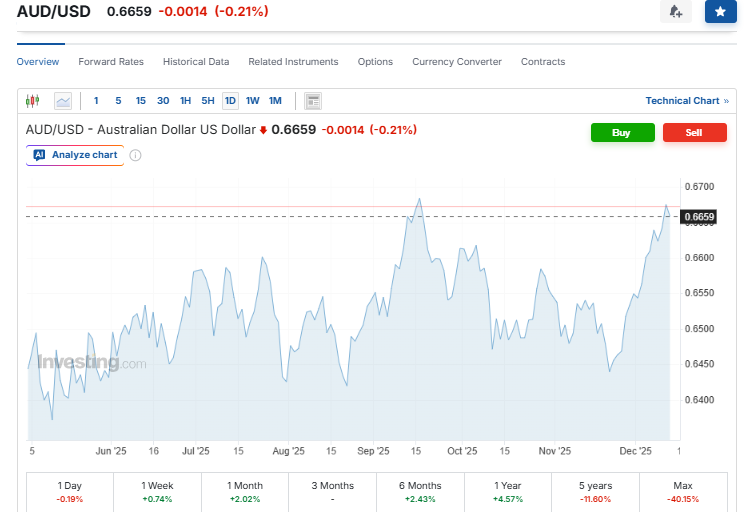

Forward Indicators: What December Q1 2026 could Look Like

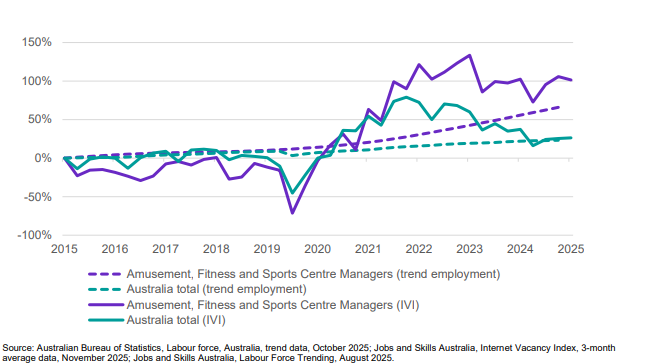

Leading indicators already flag softer demand. Jobs and Skills Australia’s Internet Vacancy Index recorded a 1.3% drop in job advertisements in November. SEEK’s ad volumes trended down earlier in the quarter.

NAB’s business survey for November reported weaker forward orders and cooling hiring intentions. PMI employment subindices from private surveys also showed softer employment demand. Taken together, these signals suggest the labour market could remain sluggish into early 2026 unless spending or investment re-accelerates.

Does this Soft Patch risk becoming a Downturn?

Scenario one controlled cooling: Hiring growth slows further. Unemployment edges up modestly. Inflation drifts toward the target. The RBA holds and then eases in mid-2026. Scenario two, harder landing: Consumer spending contracts faster.

Firms cut deeper. Unemployment rises more sharply, and wage growth stalls for an extended period. Current data favour the controlled cooling path, but global shocks or a sharper fall in consumer demand could push the economy toward the risk case. Analysts highlight the importance of the December-January retail season and early 2026 CPI and wage prints as decisive inputs.

Final Words

November’s labour figures show the job market moving from hot to warm. Full-time employment fell sharply. Underemployment ticked up. Job ad volumes and business surveys point to softer hiring ahead. This does not yet look like a collapse. It does mark a change in momentum. Policymakers, firms, and households should expect a slower hiring backdrop into early 2026. Close attention to incoming data will determine whether this patch stays mild or deepens.

Frequently Asked Questions (FAQs)

Yes. The ABS job report on 11 December 2025 showed a fall in total employment, mainly because full-time jobs dropped. Part-time work rose slightly, but not enough to offset the losses.

Yes. Job ads and hiring plans have been falling since late 2025. Firms are more careful with spending, so new roles are harder to find as demand cools.

The RBA may stay cautious after the November 2025 slowdown. The softer job report lowers pressure for more rate hikes, but any change will depend on future wages and inflation data.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.