Australian Economy Hit by $8B Stock Selloff, China Move Adds Pressure

Australia’s economy just took a sharp hit. More than $8 billion was wiped off the stock market in a single day. Investors sold shares at speed, fearing global and local risks. This fall is not just numbers on a screen. It shows how fragile our economy can be when global pressures rise.

At the same time, China has made policy moves that shake confidence further. China is the biggest trade partner of Australia. When its economy slows or shifts direction, Australia feels it right away. From iron ore to agriculture, many of their industries depend on Chinese demand. Now that demand looks weaker, that adds pressure to already stressed markets.

We need to see this in a wider context. Rising interest rates, falling consumer confidence, and global market fears all connect here. A selloff of this scale shows that investors are nervous about the future. If the trend continues, it could hit jobs, growth, and even household budgets.

Let’s explore what caused this sudden drop, why China’s decisions matter, and how Australia can respond.

The Stock Market Selloff

The selloff started when China confirmed that its giant battery maker CATL would resume operations at its Jianxiawo lithium mine in Yichun, Jiangxi province. This mine contributes about 8% of the global lithium supply. Until recently, the mine had been shut down because its license had expired. When the license issue was fixed, a flood of supply was expected.

Investors had priced lithium stocks on high hopes of scarcity. When news of the mine reboot came, they rushed to sell. Shares of Pilbara Minerals, Liontown, IGO, and others plunged between 13-17%. The total market loss from this drop reached about AU$8.4 billion.

Many mining firms had high valuations because lithium demand seemed boundless. Electric vehicles, batteries, and green energy made lithium one of the hottest commodities. But heavy supply entering the market lowered prices.

China’s Economic Moves and Their Impact

China is tightening oversight over its mining and resource sectors. The expired license at CATL’s Jianxiawo was one result. Authorities want to control overcapacity and environmental impact.

China is also resuming production of minerals that had been paused or restricted. This push boosts exports and supply. Australian mining firms depend heavily on Chinese demand. When China slows or changes rules, it hits exporters here.

For example, demand for iron ore falls if China’s property sector weakens. That sector drives much steel use. Less steel means less iron ore needed.

Broader Economic Implications for Australia

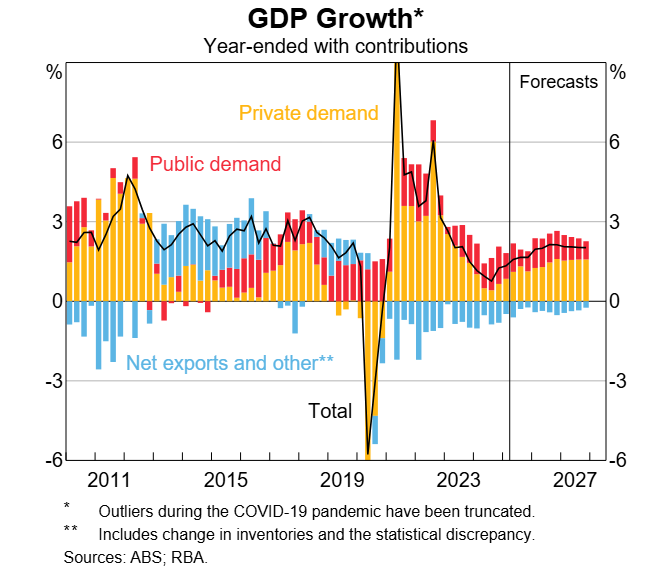

Australia’s GDP growth is facing headwinds. The Reserve Bank of Australia (RBA) forecasts slower growth in major trading partners, partly because of trade policy uncertainty and weak demand abroad.

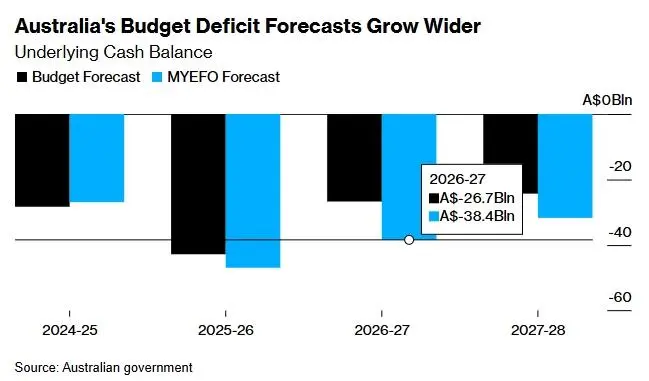

Mining export revenues are expected to drop sharply over the next few years. Australia’s Mid-Year Economic and Fiscal Outlook warned of a A$100 billion decline in mining exports over four years. That will reduce company tax receipts significantly.

The Australian dollar may weaken. Lower export income and risk perception hurt its value. This, in turn, raises import costs. Consumers could feel inflation rising again.

Households may begin to pull back on spending. That weakens domestic demand. Jobs in mining regions may be under threat. Private investment could stall, especially in resource infrastructure.

Government and Reserve Bank Response

The RBA has adjusted its forecasts. It expects Australia’s economy to grow more slowly in 2025 and 2026. Underlying inflation is expected to return to target in the medium term. Policy makers are also worried about productivity. Weak productivity growth will reduce potential output.

The government has lowered its budget forecasts due to weaker export income. Treasurer Jim Chalmers pointed out that China’s falling demand for minerals and lower prices will cut revenue.

Some stimulus or targeted policy support is likely in sectors under pressure. Mining communities may get relief. Also, plans to build infrastructure, invest in green industries, and support non-mining exports are being discussed.

Global Context and Comparisons

Global commodity markets are reacting. Lithium prices worldwide are volatile. Many battery and EV makers closely watch China’s supply shifts.

Other economies see similar risk. Countries that depend heavily on China for demand (like those exporting raw materials) are also exposed. A slowdown in China’s property, infrastructure, or industry sectors tends to ripple out globally.

Some nations manage by diversifying their export base. Others try to move up the value chain, adding processing or manufacturing. Australia is already trying this with critical minerals and refining.

Future Outlook: What Lies Ahead?

In the short term, we likely see more supply pressure in lithium and related minerals. Prices might remain volatile. Some mining stock corrections may continue.

Over 1-3 years, Australia must adjust its export strategy. Growth of non-mining sectors will matter more. Trade relationships beyond China may become more important.

Policy makers will need to balance trade risk, fiscal revenue, and domestic growth. Incentives for clean energy, innovation, and refining industries may increase.

Opportunities lie in critical minerals, renewable energy, and exporting higher-value goods or services. Risks lie in over-dependence on a single partner and on volatile commodity markets.

Wrap Up

The $8 billion selloff in mining stocks shows the danger of relying too much on supply shocks and over-optimism. China’s policy changes are a reminder that demand and regulations can shift fast. Australia faces challenges in revenue, jobs, and growth forecasts. It also has opportunities to diversify. Smart policy, investment, and balanced trade will help steer us through this turbulence.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.