Australian Shares End Flat as GQG Partners’ Funds See November Growth

Australian markets ended a quiet day on 10 December 2025, with major Australian shares barely budging despite a mix of strong headlines elsewhere. Meanwhile, investment firm GQG Partners saw its funds under management grow to US$166.1 billion by 30 November 2025.

That contrast, a flat local stock market alongside rising global fund inflows, raises questions. Why are investors pouring money into global funds when domestic shares are stalling? Are they shifting away from local markets?

This article takes a close look at what drove today’s muted market action, why GQG’s fund growth matters, and what it might signal about investor mood heading into the final weeks of the year.

The GQG Narrative: November Fund Growth

GQG Partners reported funds under management of US$166.1 billion as of 30 November 2025. The figure rose from the prior month despite mixed net flows. This shows investor interest in GQG’s global mandates. The number also highlights a shift of capital toward offshore managers even as the ASX held steady on 10 December 2025.

GQG’s increase came partly from market moves. Strong gains in selected global stocks lifted the asset base. At the same time, some investors pulled money from specific equity strategies. The mix of inflows and outflows explains the headline rise while signaling caution beneath the surface.

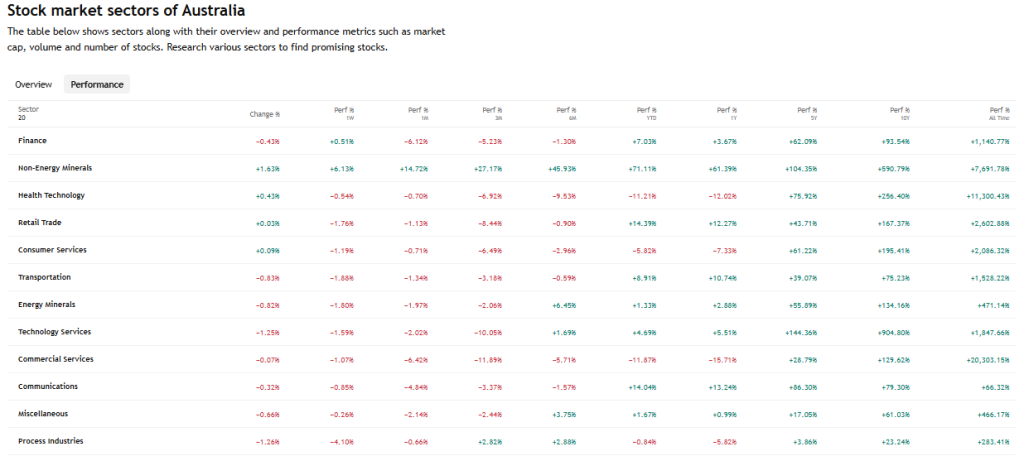

Sector-by-Sector Breakdown: Who Pulled the ASX Forward and Who Dragged It Back

Materials led the market’s mood on 10 December 2025. Miners rose on higher gold and base metal interest. Iron ore showed stability after recent volatility. This helped offset soft moves elsewhere.

Banks were flat to weak. Mixed lending data and uncertainty about future RBA moves kept traders tentative. Energy stocks followed global oil swings and closed mostly subdued. Consumer staples and healthcare saw defensive buying but little follow-through. The result was an index that barely moved.

The Invisible Forces: What Passive Flows and ETFs Did Today

Passive funds and ETFs shaped intraday flow. Index-tracking funds rebalanced ahead of month-end. That created modest buying in larger names and light selling in mid-caps. Algorithmic strategies trimmed positions where liquidity thinned. These moves kept volatility low while masking real rotation under the surface.

Smart-beta and factor funds also nudged sector weightings. Growth ETFs accumulated tech-linked exposures. Value and bank-heavy ETFs saw small outflows. The net effect was a flat headline but shifting internals. Use of an AI stock research analysis tool by some desks reportedly guided faster rebalances.

Macro Pressure Points: The Three Data Releases Investors Quietly Watched

Three data points set the tone even without big market moves. First, local economic prints showed steady activity but no clear upside. Second, China’s industrial data remained mixed, keeping miners cautious. Third, U.S. rates and Fed commentary dominated risk appetite ahead of a major Fed meeting. These inputs kept traders on the sidelines rather than pushing a clear trend.

Investors keyed on nuance. Small deviations in data produced outsized position adjustments. That explains shallow price action paired with rapid information-driven shifts inside portfolios.

Fund Manager Lens: Why GQG’s November Strength Matters

GQG’s FUM rise signals where large pools of capital prefer to sit. Allocations moved more toward global growth exposures than toward domestic cyclicals. That tilt can reduce local market depth and alter performance leadership. Institutional flows into GQG’s mandates suggest confidence in selected overseas markets even as Australian shares remain range-bound.

For local managers, this dynamic matters. Increased offshore allocation may pressure domestic liquidity. It can also raise premiums on well-loved domestic names as active money chases concentrated winners.

Key Movers & Outliers: Stocks That Broke the Flat Trend

Some individual stocks still produced big moves despite a calm index. Miners with strong metal exposure climbed on commodity optimism. A mid-cap tech firm advanced after a new contract announcement. A retail name slid on weak trading updates. These outliers provide clues. They show where active investors see opportunity or risk.

Reading these micro-moves helps identify early rotation. When several small winners align by sector, the next broad move may follow.

What Today’s Market Says About December Positioning

Positioning into year-end appears cautious. Managers trimmed risk and locked gains. Some shifted cash toward global equities with stronger late-year momentum. Others held back, awaiting clearer macro signals from the Fed and RBA. This creates a thin market where single headlines can move prices sharply.

Dividend plays and small-cap rotations may still emerge as managers finalize books. But large reallocations look measured, not aggressive.

Final Outlook: Can Australian Shares Break Out

A clear breakout needs fresh catalysts. One is a stronger Chinese stimulus to lift commodity demand. Another is clearer guidance from the RBA on rate direction. A firmer U.S. policy path would also help. Absent these, the market may stay stuck in a narrow range.

Investors should watch flows closely. Large fund moves, like GQG’s November update, can shift leaders. Monitor sector breadth and reporting season for signs of real momentum.

Frequently Asked Questions (FAQs)

Australian shares ended flat on 10 December 2025, as gains in mining were offset by weak bank and energy stocks. Traders also waited for global rate signals, keeping movements small.

GQG Partners’ funds grew in November 2025, driven by strong global stock performance and steady investor interest in overseas markets. This lifted total assets even with mixed monthly inflows.

Global rate forecasts are making ASX traders cautious. Investors expect policy updates from the U.S. and Australia, so they avoid big moves until clearer signals guide market direction.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.