Axis Bank Shares Trade at Discount vs HDFC, ICICI; Morgan Stanley Raises Target

As of October 3, 2025, Axis Bank shares are trading lower than its peers, HDFC Bank and ICICI Bank. This discount has caught the eye of investors and analysts. Morgan Stanley recently raised its price target for Axis Bank to ₹1,450, up from ₹1,325. This implies a potential gain of around 25% from current levels.

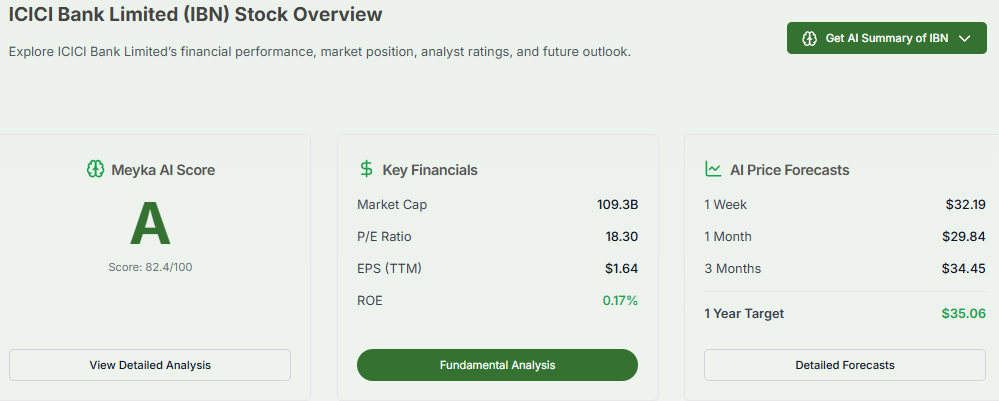

Axis Bank’s price-to-earnings (P/E) ratio is 12.2. HDFC Bank’s P/E is 19.8, and ICICI Bank’s is 18.8. This shows Axis Bank is trading at a 30-40% discount compared to its competitors. The gap exists even though Axis Bank shows similar growth and improved asset quality.

Morgan Stanley believes this undervaluation is temporary. They expect Axis Bank’s strategic moves to pay off in 2–3 years. Improvements in loan growth, net interest margins, and credit costs could narrow the gap.

Let’s explore why Axis Bank trades at a discount. We compare its financials with HDFC and ICICI. We also examine what Morgan Stanley’s upgrade means for investors.

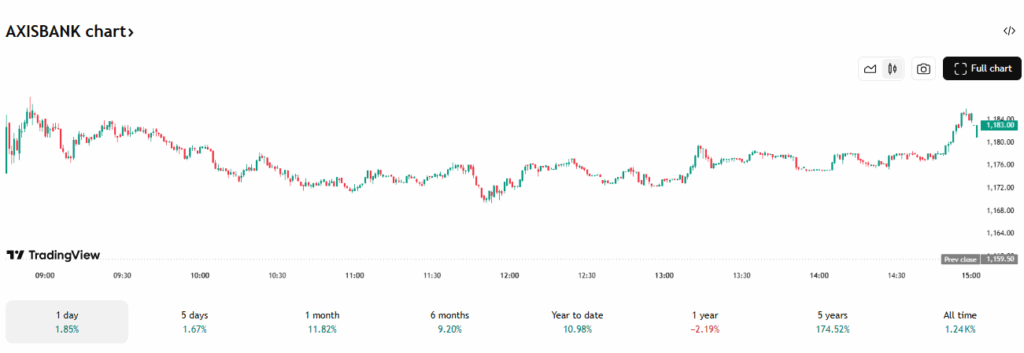

Current Share Performance

As of October 3, 2025, Axis Bank’s stock price stood at ₹1,161.40, reflecting a 2% increase following Morgan Stanley’s positive outlook. Despite this uptick, the bank’s valuation remains notably lower compared to its peers, HDFC Bank and ICICI Bank.

Axis Bank’s price-to-earnings (P/E) ratio is approximately 12.2, significantly trailing HDFC Bank’s 19.8 and ICICI Bank’s 18.8. This disparity suggests that investors are valuing Axis Bank less favorably, even though its financial fundamentals are comparable to those of its competitors.

Peer Comparison

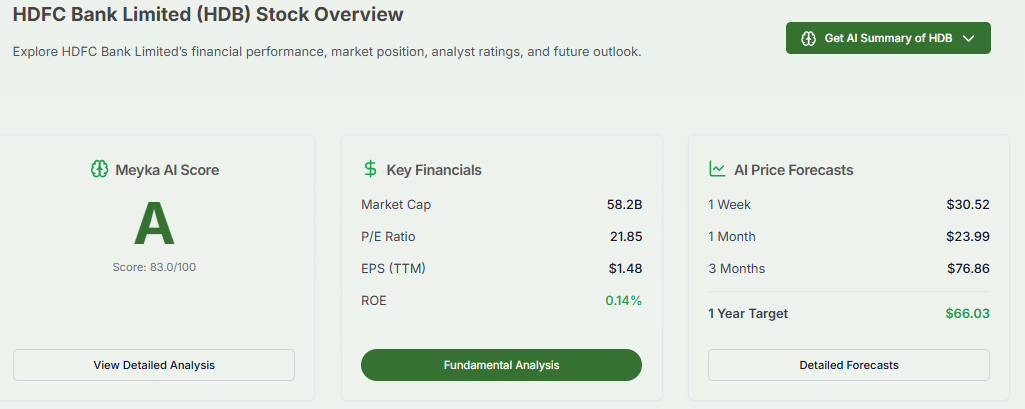

When comparing Axis Bank to HDFC Bank and ICICI Bank, several key financial metrics highlight the valuation gap. Axis Bank’s market capitalization is ₹341,299 crore, while HDFC Bank’s stands at ₹1,399,208 crore. This substantial difference underscores the market’s preference for HDFC Bank.

Additionally, Axis Bank’s net interest margin (NIM) is 3.37%, lower than ICICI Bank’s 3.97%. Furthermore, Axis Bank’s operating profit margin is 2.21%, significantly trailing ICICI Bank’s 12.54%. These figures suggest that while Axis Bank is performing well, it has yet to achieve the same level of operational efficiency and profitability as its peers, contributing to its lower valuation.

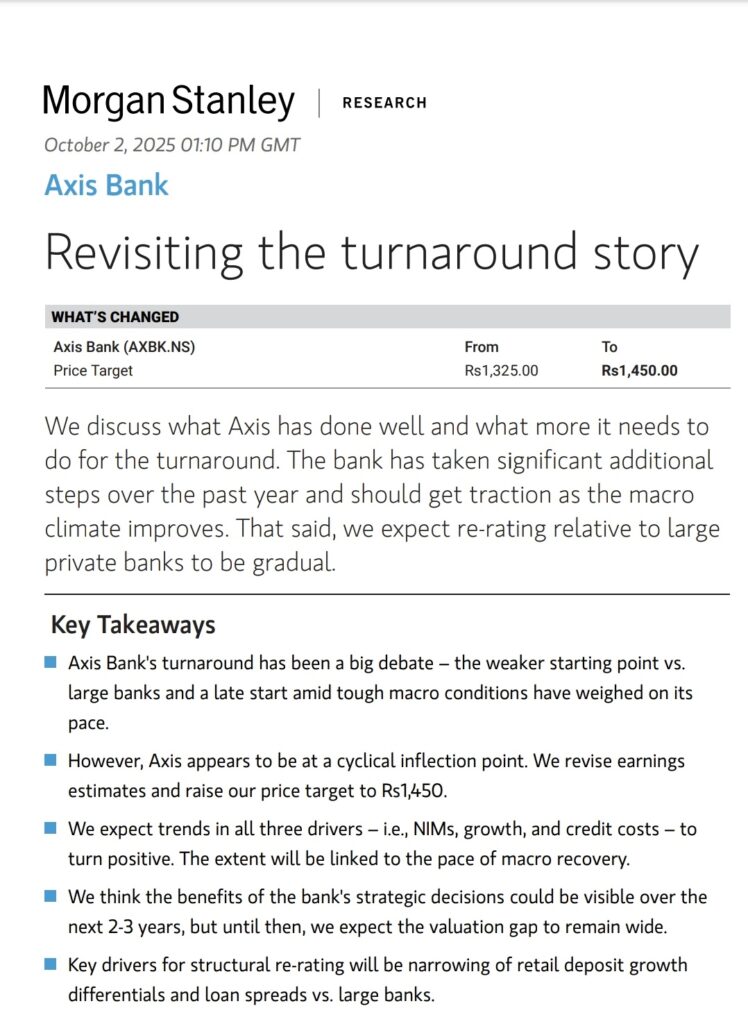

Morgan Stanley Upgrade

On October 3, 2025, Morgan Stanley raised its target price for Axis Bank to ₹1,450 from ₹1,325, maintaining a “positive” rating. The brokerage anticipates that the valuation gap between Axis Bank and its larger peers will gradually narrow. This optimistic outlook is based on Axis Bank’s strategic initiatives, which are expected to yield positive results over the next 2-3 years. Morgan Stanley projects improvements in net interest margins, loan growth, and credit costs, contributing to a potential re-rating of the bank’s stock.

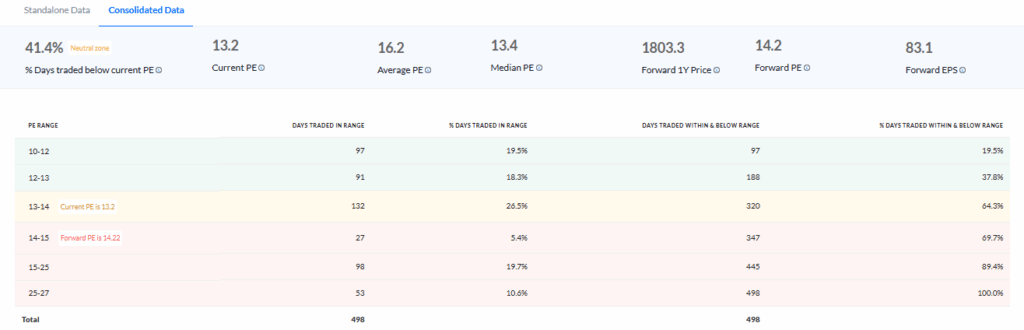

Valuation Analysis

Axis Bank’s current valuation presents a compelling opportunity for investors. The bank’s P/E ratio of 12.2 is significantly lower than that of HDFC Bank and ICICI Bank, indicating that the stock may be undervalued.

Axis Bank’s price-to-book (P/B) ratio is also lower than its peers. This adds to the idea that the stock may be undervalued. If Axis Bank’s strategies improve its financial performance, as Morgan Stanley expects, the stock price could rise. This could give investors significant gains.

Risk Factors

Investors should know about some risks when investing in Axis Bank. The bank’s net interest margin and operating profit margin are lower than its peers. This could limit profits.

Even though asset quality has improved, poor loan performance could hurt the bank’s finances. The wider economy also matters. Changes in interest rates or government rules can affect the bank.

Axis Bank depends more on government deposits. It has a smaller share of corporate salary deposits. This may increase funding costs and slow deposit growth.

Investment Outlook

Despite the risks, Axis Bank’s current valuation presents an attractive opportunity for long-term investors. The anticipated improvements in net interest margins, loan growth, and credit costs, as projected by Morgan Stanley, could lead to a re-rating of the bank’s stock. Investors with a long-term investment horizon may consider adding Axis Bank to their portfolios, capitalizing on the potential upside as the bank executes its strategic initiatives.

Wrap Up

Axis Bank’s shares are currently trading at a discount compared to its peers, HDFC Bank and ICICI Bank. Morgan Stanley’s upgraded target price and positive outlook suggest that the valuation gap may narrow over time.

While there are risks associated with investing in Axis Bank, the potential for improved financial performance makes it an attractive option for long-term investors seeking exposure to the Indian banking sector. Using an AI stock research analysis tool can also help investors compare valuations, track earnings trends, and spot opportunities like Axis Bank’s discount against peers.

Frequently Asked Questions (FAQs)

As of October 3, 2025, Axis Bank’s stock price is ₹1,171.00 per share, marking a 2.2% increase from the previous day.

Morgan Stanley raised its target price for Axis Bank to ₹1,450, up from ₹1,325, due to expectations that the valuation gap between Axis Bank and its peers, HDFC Bank and ICICI Bank, will narrow. The firm anticipates improvements in net interest margins, loan growth, and credit costs, contributing to a potential re-rating of the bank’s stock.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.