Balyasny Expands Asia Macro Operations with $30M Hire and New Trading Team

On September 15, 2025, the multi-strategy firm Balyasny Asset Management (BAM) announced that its Asia arm has grown to more than 200 professionals. Now, it is making an even bolder move: investing roughly US$30 million to bring in a senior macro hire and launch a new trading team focused on Asia.

This marks a clear signal that BAM sees major opportunity in Asian markets from FX and interest-rate shifts to emerging-market credit and equity flows. With global macro volatility high and talent competition fierce, the firm aims to build local depth in cities like Hong Kong and Singapore.

Let’s explore why BAM is doubling down on Asia, how the hire and team build-out work, and what it could mean for the firm and the broader hedge-fund industry.

Background: Balyasny’s Global Strategy

Balyasny Asset Management (BAM) is a well-known multi-strategy hedge fund. It was founded in 2001 by Dmitry Balyasny, Scott Schroeder, and Taylor O’Malley. The firm is based in Chicago. It has offices in London, Hong Kong, Singapore, and Tokyo, too. As of 2025, BAM manages about $28 billion in assets and employs over 2,300 professionals worldwide.

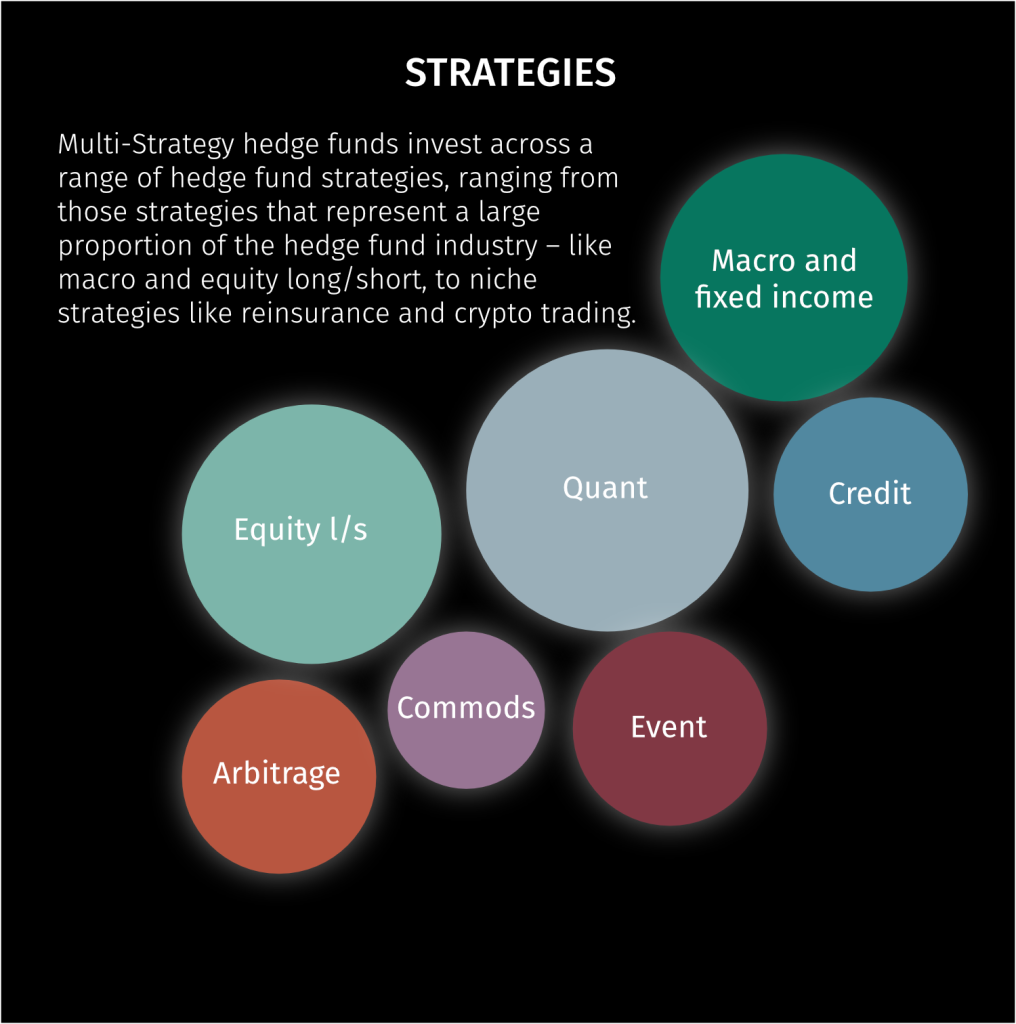

BAM uses a wide range of strategies. These include equity long/short, fixed income and macro, commodities, multi-asset arbitrage, and systematic approaches. Because of this mix, BAM can handle many kinds of market conditions and seize different opportunities. The recent expansion of its Asia macro operations shows BAM’s strong intent. It wants to build its global reach and use local insight to boost performance.

The $30 Million Hire: Who’s Leading the Charge?

In April 2025, BAM made a significant move by hiring Ron Choy, a seasoned yen rates portfolio manager, from BlueCrest Capital. The firm offered Choy a compensation package estimated at $30 million to lead its Asia macro trading team. This strategic hire is part of BAM’s broader initiative to strengthen its macro capabilities in the Asia-Pacific region.

Choy’s extensive experience in yen rates trading positions him as a valuable asset in navigating the complexities of the Japanese bond market and broader Asian macroeconomic trends. His leadership is expected to drive BAM’s Asia macro strategy, focusing on capitalizing on opportunities arising from interest rate movements, currency fluctuations, and economic policy shifts in the region.

Inside the New Asia Macro Team

Under Ron Choy’s guidance, BAM has built a focused Asia macro trading team. The group includes experts in interest rates, currencies, and fast-changing emerging markets. Their main goal is to create and run smart trading plans that use BAM’s research and strong risk controls.

The team works closely together. They share information quickly and react fast to market changes. BAM’s powerful systems help them adjust trades in real time.

By mixing local market knowledge with global views, the team aims to improve BAM’s results in Asia. Their success will also support the firm’s long-term growth around the world.

Why Asia Now? Market Timing and Opportunity

BAM’s decision to grow its macro operations in Asia matches major market changes. The region’s economy is shifting fast. Central banks are changing interest rates. Currencies move with high volatility. Trade rules and global supply chains are also evolving. These changes give macro traders strong chances to earn returns.

Japan is one key example. Movements in the yen and shifts in the Bank of Japan’s policy create openings for smart trades. Other Asian markets are growing too. They offer profit potential, but they also come with risk.

By entering Asia more deeply, BAM aims to use its skills and research to handle these challenges. The firm wants to capture new macro opportunities across the region while managing risks wisely.

Competitive Overview: Hedge Funds Betting Big on Asia

BAM’s expansion in Asia puts it against strong rivals. Hedge funds like Millennium, Citadel, and Point72 are also growing fast in the region. They see big chances in Asia’s macro markets. These firms hire top traders and spend heavily to win market share.

But BAM has a different style. It follows a multi-strategy model. Teams from around the world share ideas and research. This mix of views helps create new and smarter trading plans.

By using global teamwork, BAM hopes to stand out. Its goal is to offer fresh insights and better results in the Asia-Pacific macro trading space.

Strategic Implications and Long-Term Vision

BAM’s move into Asia’s macro markets is strategic. The firm wants better global balance and stronger results. A bigger base in Asia lowers the risk of relying too much on other regions. It also opens the door to fast growth in emerging markets.

BAM uses new technology to support this plan. Tools like artificial intelligence and data analytics help study huge amounts of market data. They show patterns that traders can use. This improves decisions and trading performance.

The firm also focuses on teamwork across all regions. This brings global ideas into local actions. With this mix of smart tech and global cooperation, BAM is ready for a changing market. Its long-term goal is steady growth and a strong role in the world’s macro trading space.

Market Reaction and Expert Commentary

The market reaction has been mostly positive. Analysts like BAM’s forward thinking. They see real growth chances in Asia. Hiring Ron Choy shows a strong commitment. A focused Asia macro team adds more skill and speed. Experts say this move matches Asia’s economic trends. BAM can now catch new trading chances early.

There are still risks. Politics and fast market changes can affect results. But BAM has many strategies and strong systems. This gives the firm a solid base in the Asia-Pacific macro space.

Closing Note

BAM is growing fast in Asia’s macro markets. This move is smart and planned. The firm sees strong chances in the region. It wants to improve global results too. Hiring experts like Ron Choy shows its focus.

BAM combines local insight with a global view. It also uses advanced technology to make better decisions. Asia can be complex. Each market works in a different way. But BAM seems ready for these challenges. The firm keeps changing with the market. It works as one team across regions. This shows a clear plan for long-term success.BAM wants to lead the hedge fund world. Its bold growth in Asia may help make that happen.

Frequently Asked Questions (FAQs)

BAM is expanding in Asia to find new market opportunities, faster growth, and fresh macro trading ideas. The firm sees rising opportunities in Asian economies in 2025.

Ron Choy is a yen-rate expert hired by BAM in April 2025. He helps the firm trade in Asian markets with strong skills and local knowledge.

BAM is hiring more traders and analysts in Asia. The firm builds small expert teams to handle FX and rate trades and improve performance in 2025.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.