Bank of Maharashtra share price in focus as govt plans 6% stake sale worth Rs 2,492 crore

The Bank of Maharashtra is back in the spotlight after the government announced a major stake sale on December 3, 2025. The plan is clear. The Centre wants to sell a 6% stake through an Offer for Sale (OFS) worth ₹2,492 crore. This move has put the bank’s share price at the center of market attention. Traders are watching every tick. Investors want to know what this means for the bank’s future.

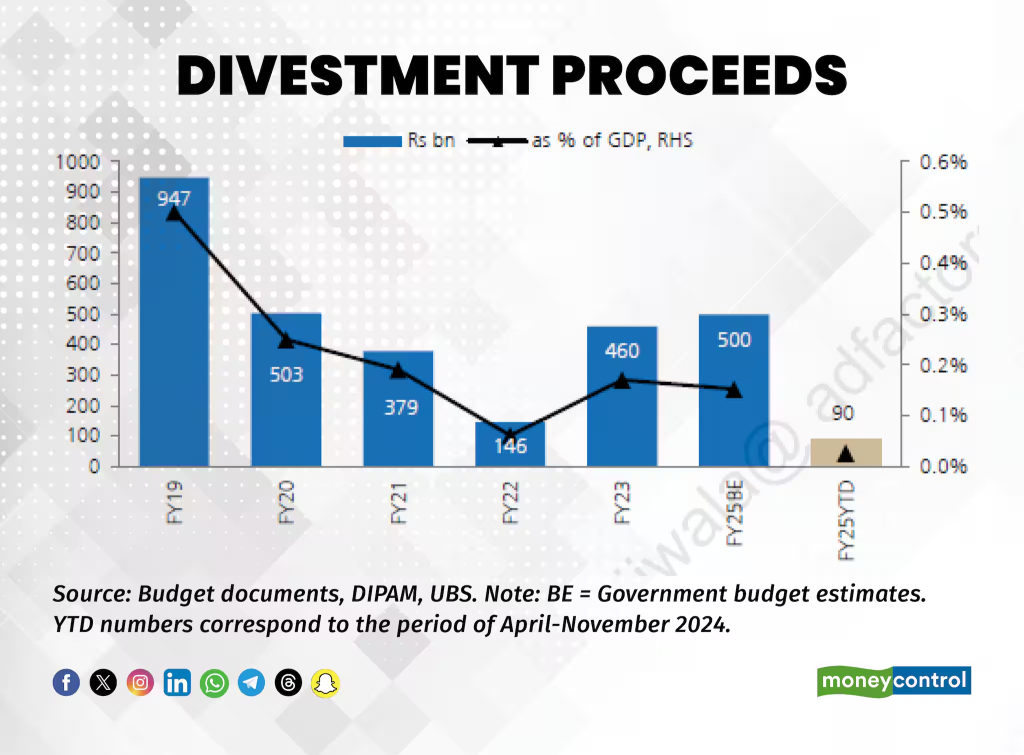

This is not a random divestment. The government is trying to meet its FY25 disinvestment goals. PSU bank stocks have been strong this year, and the Bank of Maharashtra is one of the best performers. It has a high CASA ratio, steady loan growth, and cleaner books. These facts make the OFS more interesting.

But the short-term impact is never simple. More shares in the market can put pressure on the price. Yet, strong fundamentals may support demand. This mix of opportunity and caution is why everyone is watching the stock so closely today.

Breakdown of the Bank of Maharashtra Stake Sale

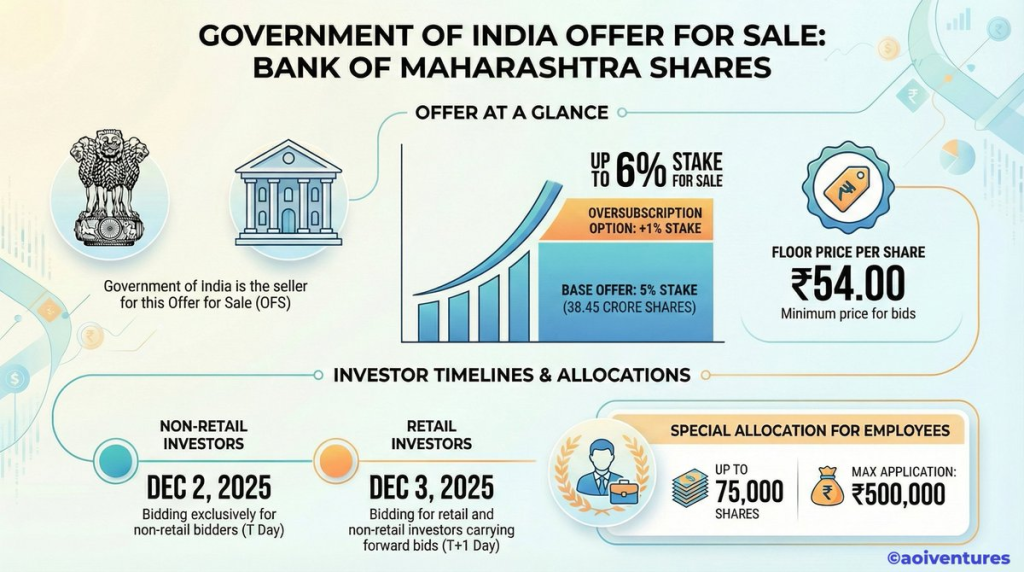

The government’s offer for sale (OFS) of Bank of Maharashtra shares began for non-retail investors on 2 December 2025. It involved a base offer of 38.45 crore shares, around 5% of the bank’s paid-up capital. An additional 1% was added under a green-shoe option, taking the total stake sale to roughly 6%.

The floor price was set at ₹54 per share, about 6.34% below the previous close of ₹57.66. This OFS aims to raise roughly ₹2,492 crore. The first day of bidding saw demand surge over 400% of the base issue size. This prompted the government to fully exercise the green-shoe option.

The divestment helps BoM meet minimum public shareholding norms. Post-sale, the government’s stake will drop below 75%, aligning with regulatory expectations for listed firms.

Government Strategy Behind the OFS

This OFS is part of the government’s FY25 disinvestment plan. Selling a portion of BoM reflects the policy to gradually reduce PSU holdings while boosting market liquidity. The timing also signals confidence in BoM’s performance. PSU bank shares have been resilient this year, and BoM’s fundamentals make it attractive. Analysts suggest that such divestments test market appetite before broader privatization moves.

While the OFS raises cash for the government, it does not inject fresh funds into BoM. The shift affects ownership structure and float but leaves the bank’s balance sheet untouched. Market behavior post-OFS will indicate how investors value this public-sector bank.

Bank of Maharashtra’s Recent Performance

Bank of Maharahtra share price has shown consistent growth. As of 31 March 2025, its total business, including deposits and advances, stood at ₹5,47,159 crore, up from ₹4,74,411 crore a year earlier.

Deposits rose 13.45% YoY to ₹3,07,152 crore. Low-cost CASA deposits grew 14.64% to ₹1,63,669 crore, pushing the CASA ratio to 53.29%. This helps the bank maintain low funding costs.

The loan book expanded by 17.84% to ₹2,40,007 crore. Growth was strongest in retail, MSME, and agriculture segments. Profitability improved as well. Capital adequacy ratios rose, providing buffers against risk. Gross NPA fell to 1.74% and net NPA to 0.18%, reflecting cleaner asset quality.

Short-Term Impact on Bank of Maharashtra Share Price

The OFS increases supply in the market, which may pressure prices in the short term. Initial reactions, however, were positive due to strong fundamentals. The surge in bids suggests robust interest from both retail and institutional investors. Historical trends show that well-performing PSU banks often recover quickly after stake sales, especially when fundamentals are solid.

Medium-Term Outlook for BoM

In the medium term, the OFS could improve stock liquidity and visibility. Reduced government holding may attract investors preferring semi-autonomous PSU banks. BoM’s strong deposit growth, high CASA ratio, and improving asset quality make it a stable investment. Analysts expect that, if these trends continue, long-term investor interest will increase.

This sale alone does not provide fresh capital, so growth will still rely on BoM’s banking performance. An AI stock research analysis tool could help track post-OFS flows, subscription trends, and sector comparisons to guide investment decisions.

Key Metrics for Investors to Watch

Investors should monitor the subscription numbers, especially in the retail and institutional segments. Post-OFS trading volume will indicate whether long-term accumulation or short-term profit booking dominates. Management updates on credit growth, NPA trends, and margins will remain critical. RBI policies affecting PSU banks may also influence share performance in coming months.

Conclusion: What the OFS Signals for BoM?

The 6% stake sale marks a pivotal moment for BoM. It changes ownership, increases public float, and aligns the bank with regulatory norms. Healthy fundamentals make it attractive for investors, despite short-term supply pressure. Ultimately, sustained growth and prudent credit management will determine whether BoM’s shares continue to gain market confidence in 2026.

Frequently Asked Questions (FAQs)

The floor price for Bank of Maharashtra’s 6% stake sale was set at ₹54 per share on 2 December 2025. It is slightly lower than the previous closing price.

The Bank of Maharashtra OFS opened on 2 December 2025 for non-retail investors. Retail investors could bid later. The subscription period typically lasts one to two trading days.

The 6% stake sale may put short-term pressure on BoM share price due to more shares in the market. Long-term effect depends on bank’s performance and investor demand.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.