Banks Discuss $38 Billion Financing Package for OpenAI Data Center Sites – FT

Major banks are holding talks in November 2025 about a huge $38 billion financing plan for new OpenAI data center sites, according to recent reporting. This number is striking. It shows how fast the AI race is growing and how much power modern AI models now demand. Every new generation of ChatGPT needs more compute, more chips, and far more energy. Normal data centers cannot handle this level of load anymore. That is why OpenAI is looking at large, purpose-built sites that can support massive training clusters.

These early discussions show how banks see AI as a long-term bet, not a short-term trend. They also show how OpenAI is preparing for the next stage of its technology roadmap. The company needs reliable space, strong energy supply, and advanced cooling to run future models. This scale of funding suggests that OpenAI is planning bigger projects than before. It could shape where AI power will be based over the next decade. And it signals that the global race to build AI infrastructure is only getting started.

Why OpenAI Needs Custom Data Hubs Now?

AI models are growing in size and in cost. Training the latest large language models demands huge clusters of GPUs and specialized cooling. Commercial cloud space alone cannot meet this scale without major upgrades. That pushes companies to plan dedicated sites.

These sites are built for power density, fast networking, and sustained workloads. Banks and investors see them as long-term infrastructure. The Financial Times highlighted fresh talks about a major financing package tied to that push on November 27, 2025.

How are the $38 billion talks structured?

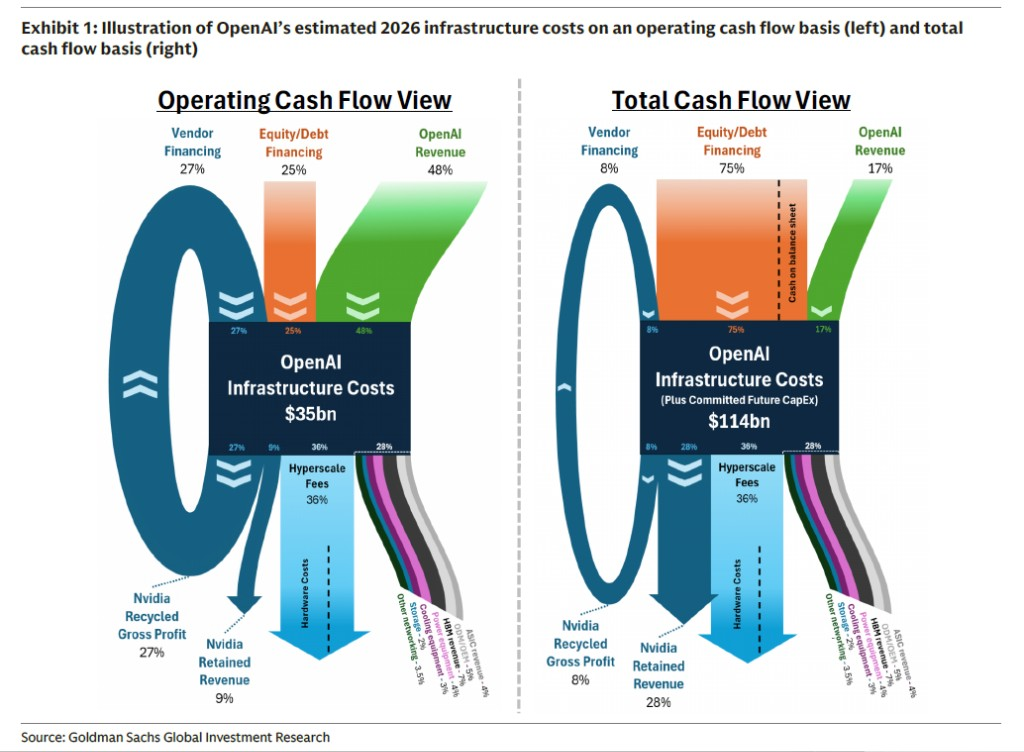

Sources tell reporters that a consortium of banks is negotiating roughly $38 billion in loans. The package would sit with partners such as Oracle and data center builder Vantage. The money is intended for new sites, land buys, power agreements, and the advanced cooling systems needed for sustained AI training.

Reuters reported these bank discussions on November 28, 2025, while Bloomberg and FT had similar coverage earlier in the autumn. These reports stress that the complex financing may include project loans routed through special-purpose vehicles to isolate risk.

Where the new Sites may be Placed and Why Locations Matter?

Site choice is driven by power and policy. Planners look for regions with stable grids and large renewable supplies. They want land near fiber backbones. Tax incentives and clear permitting rules also matter. Past Oracle-tied builds were reported in states such as Wisconsin and Texas, where energy and space match needs. Local grid planners and state governments are now central players in these negotiations. Bloomberg and earlier press reports identified U.S. locations under consideration as part of related financing plans.

Who’s on the Hook and who Benefits?

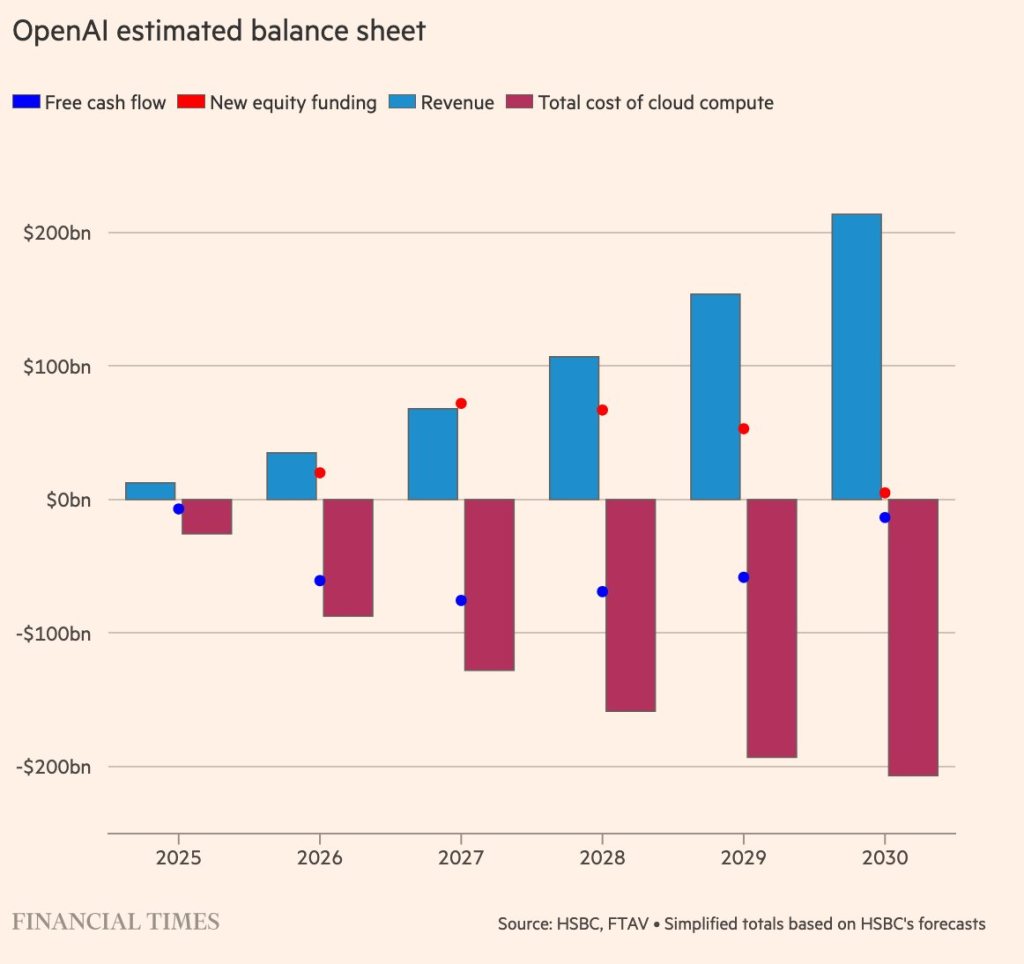

OpenAI retains a different balance sheet posture than its partners. Instead of borrowing directly for every site, OpenAI has leaned on partners and cloud vendors to carry debt. That strategy helps OpenAI scale fast while keeping its own liabilities low.

Financial Times reporting shows partners have amassed large borrowings already, with roughly $100 billion in debt linked to OpenAI infrastructure plans. Oracle, SoftBank, CoreWeave, and private capital firms are named among the active players. Lenders see potential returns from long contracts with cloud and AI customers.

Microsoft, Amazon, and the Shifting Commercial Landscape

Microsoft remains a key historical partner for OpenAI, but the landscape is evolving. In early November 2025, OpenAI signed a large cloud services deal with Amazon, reported as a seven-year agreement worth about $38 billion for AWS capacity. That deal signals a diversification of supply and a bidding war for long-term compute commitments.

At the same time, Oracle and other infrastructure providers are arranging financing to host the physical sites that run these deals. The result is a layered ecosystem where cloud contracts, chip supply, and real-estate finance intersect.

The Real Costs: Chips, Power, and Cooling

A modern AI training site is not just racks and servers. The most expensive line items are GPUs and accelerators, plus the continuous power to run them. Cooling systems must move terawatt-scale heat away from data halls. Supply contracts for NVIDIA-class chips and custom accelerators lock in costs years ahead. Analysts estimate that commitments across chips, cloud, and sites now run into the hundreds of billions over the coming decade. That explains why lenders are willing to underwrite very large packages while using project structures to spread risk.

Risks that could Un-Settle the Financing Plan

Lenders face real hazards. Grid constraints or delays in renewable builds can raise operating costs or force curtailments. Supply chain shortages for GPUs or power equipment would push timelines. Regulatory friction on cross-border data flows and national security reviews could slow site approvals. Finally, if OpenAI’s projected revenue growth stalls, long contracts and debt obligations may strain partner balance sheets. Market watchers and some banks have flagged these risks in recent coverage.

What does the Package mean for the AI Market and Investors?

A near-record financing package would formalize AI infrastructure as a distinct investment class. It will pull more capital from global banks and private credit funds into the sector. For enterprise customers, larger and closer compute hubs could lower latency and costs over time.

For chip and cloud suppliers, the deal creates predictable demand for years. Investors tracking AI infrastructure may consult an AI stock research analysis tool to model cash flows from long-term hosting contracts and the likely winners among hardware suppliers. Public markets will watch partner earnings for loan exposure and debt yields tied to these projects.

Near-term Milestones to Watch

Watch for formal loan documents or bond offerings tied to Oracle or Vantage. Also, watch state permitting decisions for new sites and announcements from major cloud vendors about capacity guarantees.

If banks launch syndicated deals, they will disclose lead arrangers and tranche sizes in filings. Any changes in OpenAI’s cloud contracting strategy could shift who ultimately pays and who benefits. Bloomberg and FT coverage in late 2025 will be the primary sources for those updates.

Closing Perspective

This financing talk is more than a single deal. It marks a transition. AI needs are reshaping real-world finance, energy planning, and industrial strategy. How banks structure this capital will affect which regions and companies control future AI compute. The next few months of filings and permits will show whether the $38 billion talks become firm commitments or another chapter in a fast-moving infrastructure story.

Frequently Asked Questions (FAQs)

OpenAI wants this funding to build stronger data centers that can support future AI models. These plans were reported in November 2025, as demand for faster compute keeps rising.

Major banks and technology partners joined early talks in November 2025. They are exploring how to support OpenAI’s large data center projects through loans, partnerships, and long-term agreements.

New data centers will give OpenAI more compute power. This will help train bigger models, improve speed, and support growing user needs across many AI tools and services.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.