BEL Share Gains as Defence Stocks Rally on Rafale Jet Proposal

Bharat Electronics Limited (BEL) has caught the attention of investors this week as its share surged following news of a new Rafale jet proposal. Defence stocks across the market also saw a notable rally. We can see how government defence plans can quickly influence stock prices.

BEL, being a leading player in defence electronics, stands to gain from contracts related to the Rafale jets. The company supplies radar systems, communication equipment, and other critical components used in modern fighter jets.

For investors, this is more than just a price jump. It reflects growing confidence in India’s defence sector and the “Make in India” push for indigenous manufacturing. We notice that such government-backed projects often provide long-term growth opportunities for companies like BEL.

We can analyze stock movements, market trends, and potential contracts, and understand why the defence sector is gaining momentum. This surge not only boosts investor sentiment but also highlights the strategic importance of defence manufacturing in India’s economy.

Bharat Electronics Limited (BEL): Company Profile

Bharat Electronics Limited (BEL) is a prominent Indian public sector enterprise specializing in defence electronics. Established in 1954, the company operates under the Ministry of Defence and is headquartered in Bengaluru. BEL’s primary focus is on designing, developing, and manufacturing a wide range of advanced electronic products for the Indian Armed Forces, paramilitary forces, and other government agencies.

The company’s product portfolio encompasses radar systems, communication equipment, electronic warfare systems, sonars, and avionics, among others. BEL has established itself as a key player in the Indian defence sector. It contributes significantly to the country’s self-reliance in defence technology.

In recent years, BEL has secured several high-value contracts which supported its position in the market. For instance, in June 2025, the company announced new defence orders worth ₹585 crore, bringing its total order inflow for the month to nearly ₹3,500 crore. This order book reflects BEL’s growing capabilities and the increasing demand for indigenous defence solutions.

Defence Sector Rally

The Indian defence sector has seen a sharp rally in recent months. The main reason is the government’s push for defence upgrades and self-reliance. The “Atmanirbhar Bharat” plan is designed to cut foreign imports and boost local production.

This shift has raised investor interest in defence stocks, including BEL. Companies like Hindustan Aeronautics Limited (HAL), Bharat Dynamics Limited (BDL), and Astra Microwave Products have also gained. Some of these stocks jumped as much as 10%.

Experts believe the defence sector offers strong growth for the long term. Short-term ups and downs may happen, but the bigger trend looks positive. The optimism also fits India’s goal to build more defence systems at home and rely less on imports.

Rafale Jet Proposal: Details & Implications

A major update in the Indian defence sector is the Air Force’s plan to buy 114 Rafale fighter jets made in India. The deal is valued at over ₹2 lakh crore. It is a partnership between French company Dassault Aviation and Indian firms like Tata Advanced Systems.

The project will have over 60% local content, matching the government’s goal for self-reliance. Dassault and Tata plan to make the fuselage in Hyderabad. This will be the first time such a part is built outside France.

For BEL, the plan brings big chances. BEL is a top supplier of avionics and electronic warfare systems. Its skills in radar, communication gear, and other key parts make it an important partner in the Rafale program.

Stock Performance Analysis

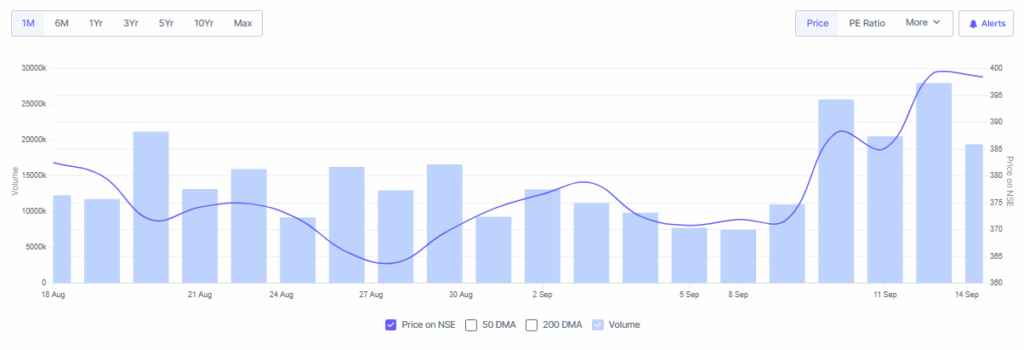

The Rafale jet proposal has boosted BEL’s stock performance. On September 15, 2025, BEL shares went up 5% after the company announced a ₹0.90 dividend for FY 2024-25. This payout shows investor trust in BEL’s stable finances and growth.

Charts and signals also point to a positive trend for the stock. A weekly stochastic crossover, seen in the week ending September 12, 2025, has often led to gains of about 8.42% within seven weeks. This pattern suggests strong upward momentum and adds to the positive mood around BEL.

Expert Opinions & Market Commentary

Experts are hopeful about BEL’s future after the Rafale jet proposal. On September 15, 2025, Dharmesh Shah of ICICI Securities advised buying BEL shares. He pointed to the company’s strong order book and the gains it may see from the Rafale program.

Analysts also stress the Rafale deal’s importance for India. It will boost air power and help grow local defence production. The tie-up between Dassault Aviation and Indian firms is viewed as a key move toward self-reliance and cutting foreign imports.

Final Words

Bharat Electronics Limited is a key player in India’s defence electronics field. It has a strong history of supplying advanced systems to the Armed Forces. The Air Force plan to buy 114 ‘Made in India’ Rafale jets gives BEL a chance to grow its role further.

The defence sector is showing positive signs, and BEL’s large order book adds to its strength. Its part in the Rafale program can drive steady growth. Investors and observers should keep an eye on these updates, as they will shape BEL’s performance and the future of the defence sector in India.

Frequently Asked Questions (FAQs)

BEL shares are rising due to strong financial performance, including a 47.4% increase in profit before tax in Q1 FY25. Additionally, the company’s robust order book and recent contract wins, such as the ₹585 crore defence orders, have bolstered investor confidence.

Analysts have set a price target for BEL shares ranging from ₹424 to ₹430, citing strong financial results and a positive outlook for the defence sector.

BEL reported a profit after tax of ₹969.91 crore in Q1 FY25,.This reflect a 22.62% year-over-year increase which indicates the company is currently in profit.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.