BHEL Stock Today: Analysts Highlight Key Catalysts and FY26 Roadmap

On 29 October 2025, India’s engineering heavyweight Bharat Heavy Electricals Ltd (BHEL) surprised the market with a strong turnaround. After underwhelming results in the prior quarter, the company reported a sharp jump in net profit for Q2 FY26, signalling that the long-awaited revival may finally be underway. Analysts are pointing not just to the numbers, but to the broader strategy: a robust order pipeline, improved execution of projects, and margin gains coming into view.

For investors keeping an eye on India’s power-equipment space, this moment matters. It’s not just about one quarter of good results; it’s about a roadmap to FY26 and beyond. Let’s unpack why BHEL’s latest showing matters, what analysts are watching for, and where the real risks still lie.

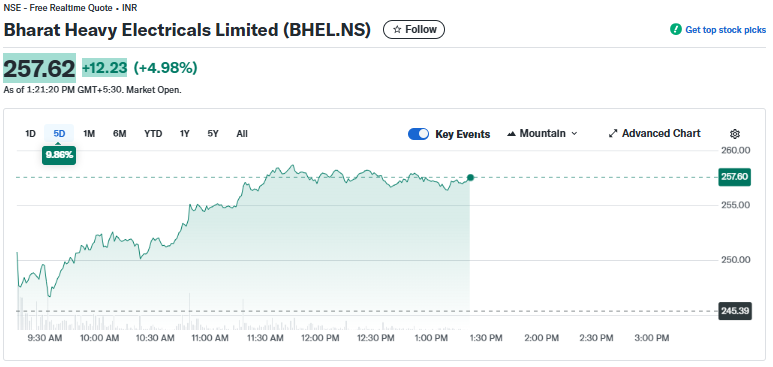

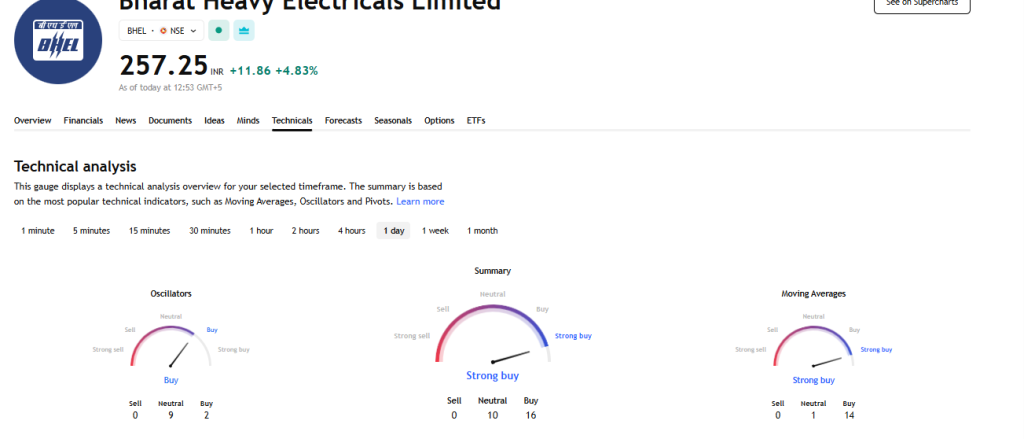

What Moved the Stock: Market Reaction and Technical Cues

BHEL’s stock jumped after the Q2 FY26 results hit the tape on 29 October 2025. Traders reacted to a sharp profit rebound and higher revenue. The bounce showed up across major exchanges with higher traded volume and a clear intraday lift. Technical charts showed renewed momentum after weeks of consolidation. Short-term traders flagged the breakout as a signal to add positions. Longer-term investors paused to check order-book details and execution timelines.

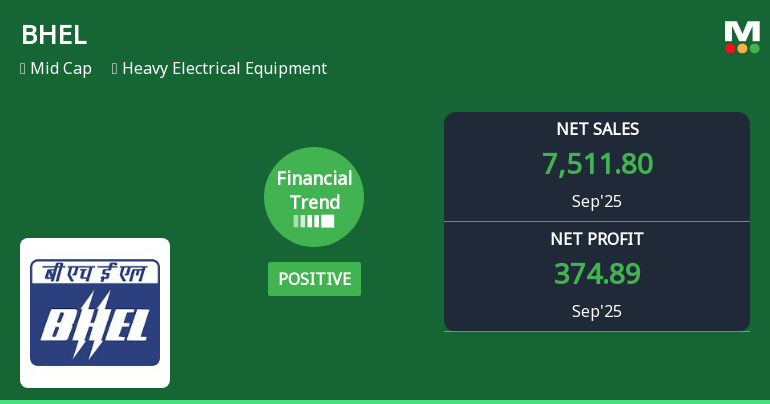

BHEL’s Latest Financials: The Numbers that Matter

The September quarter brought a big swing back to profit. Consolidated net profit for Q2 FY26 came in around ₹374-375 crore, compared with about ₹106 crore a year earlier. Revenue rose roughly 14% year-on-year to near ₹7,600-7,700 crore. Margins improved as execution on large orders gathered pace. The numbers showed that the business has regained operating momentum after a loss earlier in FY26. Analysts noted the improvement but urged caution on sustainable margin recovery.

Order Wins and Backlog: The Backbone of FY26 Growth

Big orders are central to BHEL’s recovery story. A headline order from Adani Power worth about ₹6,500 crore for steam turbines and associated equipment is a prime example. That contract and others bolster the company’s backlog. A larger backlog improves revenue visibility through FY26. Execution speed will determine how much of this backlog converts to revenue in the near term. Investor focus now rests on order-to-revenue conversion and timely commissioning.

Analysts’ Roadmap for FY26: The Main Catalysts to Watch

Analysts point to three catalysts for FY26. First, the timely execution of large projects. If BHEL meets schedules, revenue should grow steadily. Second, margin improvement from a mix shift to higher-value equipment and better cost control. Third, fresh order inflows in thermal, renewables-related equipment, and exports.

Broker notes and consensus models show a range of target prices, reflecting the uncertainty around execution timing. Investors should watch management’s guidance and quarterly execution updates closely.

Execution Risk: Why the Timeline Matters?

The greatest risk is not the order size. It is execution speed and cash conversion. Large contracts can take quarters to turn into billed revenue. Delays push revenue and margins into later periods. Supply chain hiccups and commodity costs can squeeze margins.

Working capital can rise during heavy project phases. These factors may blunt FY26 upside if they surface. Historical swings in quarterly results show how sensitive BHEL’s profit profile can be to timing.

Policy and Sector Tailwinds: Positive Backdrop for Equipment Makers

India’s power and infrastructure push supports demand. Analysts have flagged large investment plans in power sector modernization and grid upgrades through FY25-FY30. Such capital expenditure frameworks create a favorable demand environment for manufacturers like BHEL.

Government procurement cycles and state utilities’ capex calendars will shape order cadence. Continued policy support for domestic manufacturing will matter for competitive positioning.

Valuation and Street Expectations: How the Market Prices Risk?

Estimates and price targets vary widely. Some forecasts put a one-year consensus target in the low-to-mid-200s INR range, while optimistic models exceed that. The spread reflects different assumptions about margin recovery and execution speed.

Valuation today embeds both the recovery narrative and the risk of slippage. Investors should compare consensus earnings per share and price-to-earnings multiples against peers. Keep an eye on analyst revisions after each quarterly report.

Bhel Stock: What to Watch Next?

Upcoming items that will move the stock include the next quarterly update, management commentary on order execution, and fresh large-ticket order announcements. Watch for updates on the Adani Power contract schedule and any new export wins.

Also, monitor working capital trends in quarterly filings. Broker notes and revisions will provide additional direction. For deeper modeling, some investors will run scenarios using an AI tool to stress-test revenue timing and margin outcomes.

Practical Stance for Investors: Short, Medium, and Long Lenses

Short-term traders may trade momentum and technical breakouts. Medium-term investors should seek confirmation of consistent order execution over two to three quarters. Long-term holders who believe in India’s power capex cycle may view current results as the start of a multi-year recovery, provided execution remains on track. Diversification and position sizing are prudent given the known execution and working capital risks.

Conclusion: Balanced View on Upside and Risk

The October 29, 2025, results mark a clear improvement for BHEL. The company posted strong quarterly numbers and has a healthier order pipeline. That sets up a plausible FY26 recovery.

Execution, however, will determine how much of this promise is realized. Investors should weigh the improving fundamentals against the operational risks. Watch quarterly updates, management guidance, and order-book conversion to judge whether the recovery is durable.

Frequently Asked Questions (FAQs)

On October 29, 2025, BHEL stock rose after strong Q2 FY26 profit, new large orders, and better project progress improved investor confidence.

BHEL’s FY26 outlook looks steady. Analysts expect higher revenue, more project orders, and better profit margins if the company keeps strong execution.

BHEL can be a fair long-term choice if it keeps steady growth and project delivery, but risks in profit and costs still remain.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.