BHP Axes 750 Jobs While ASX Drops Ahead of Fed Decision

Australia’s mining giant BHP has confirmed that it will cut 750 jobs, a move that has sent ripples through the industry and communities that rely on it. At the same time, the Australian share market has slipped lower, with investors on edge ahead of the US Federal Reserve’s key policy decision. These two events may seem separate, but they are closely tied to the bigger story of global uncertainty.

Job cuts at a company like BHP do not just affect workers. They influence confidence in the mining sector, the health of regional economies, and even the outlook for government revenues. On the other hand, the ASX decline highlights how much global factors, like interest rates in the US, can shape local markets.

We see a pattern here. Local corporate decisions and international financial moves interact in ways that affect all of us. Understanding how job losses at BHP connect with a falling ASX and a nervous wait for the Fed helps us see the bigger economic picture. In times like this, clear analysis matters more than ever.

BHP’s Job Cuts

BHP will cut about 750 jobs and mothball the Saraji South site in Queensland. The company said the move follows sustained weak prices for coking coal and a sharp rise in state royalties. The site will enter care and maintenance from November. Many workers will face redundancy or redeployment across the BHP Mitsubishi Alliance operations.

BHP called the affected operations low margin and unsustainable under current costs. Local unions and community leaders expressed shock and anger. The company blamed the royalty structure and falling coal demand for the move.

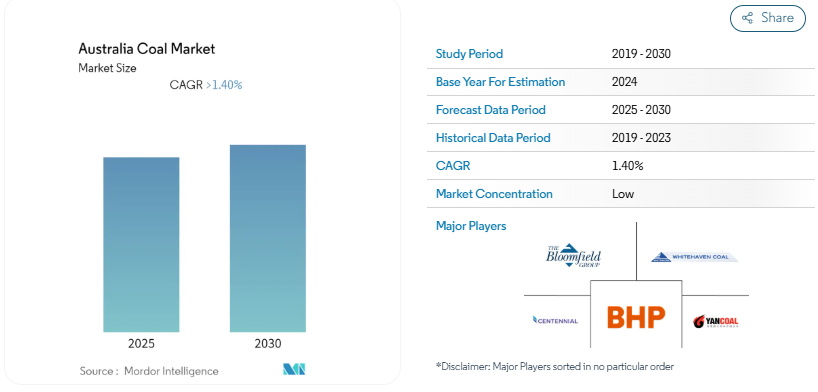

Industry Impact of BHP’s Move

The decision changes the tone in Australia’s coal sector. Other miners have warned that high royalties and tight margins squeeze their plans. Job fears now extend beyond Saraji South. Service firms and contractors in central Queensland face fewer contracts. Training centres and local suppliers also feel the strain. Some smaller miners may delay projects.

On the flip side, BHP says cutting low-margin operations can protect the health of its core business. Analysts note the action is a sign of cost pressure, not a collapse of long-term demand for metallurgical coal.

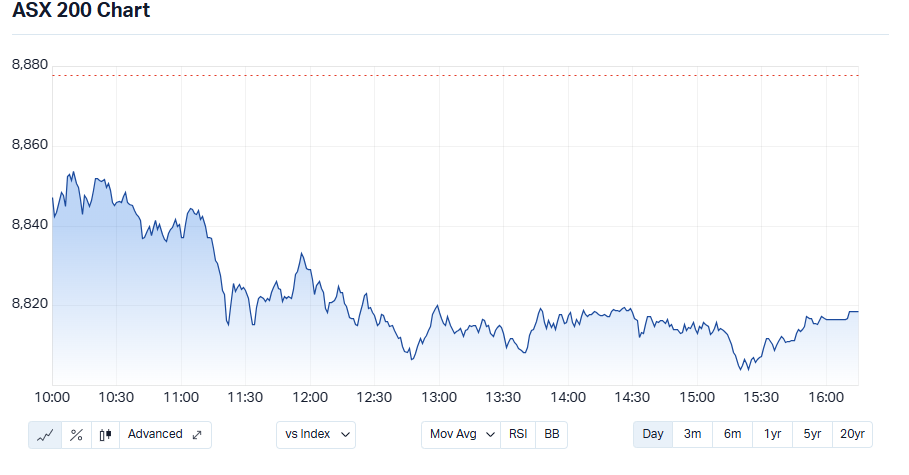

ASX Market Reaction

The ASX fell as news of the job cuts arrived. Mining stocks led the drop. Markets were already cautious because a major US central bank decision was due. Investors sold miners and other cyclical names. Benchmarks slipped after a weak session on Wall Street.

Futures had pointed lower ahead of the Fed announcement, and local traders chose safety. Commodity-linked stocks felt extra pressure because the BHP move fed fears about earnings and margins. Some financial commentators called the reaction measured. They said the market was pricing both local corporate pain and global monetary uncertainty.

The Federal Reserve Factor

The US Federal Reserve’s decision matters for the ASX. Markets watch Fed moves for clues about interest rates and dollar strength. A change in US policy can shift flows into and out of equities, including Australian shares. If the Fed signals looser policy, risk assets may rally. If it keeps policy tight, markets can stay fragile. Traders also watch how a stronger or weaker US dollar affects commodity prices. A firmer dollar often pushes commodity prices down, which pressures miners’ profit margins. That link helps explain why local shares moved before the Fed published its decision.

Broader Economic Implications

Job cuts at large miners hit regional economies hard. Towns that rely on mining jobs see fewer paychecks and lower local demand. That can slow retail sales, housing activity, and small-business income. State tax receipts tied to royalties may move, too, but in this case, the royalty rise is itself part of the issue.

High royalties can push operations to the margin. When firms mothball sites, the shortfall can sometimes outweigh extra royalty income. That dynamic raises political stakes in Queensland and Canberra. Social costs and retraining needs now compete with fiscal arguments about who benefits from higher royalties.

Investor Outlook

Near term, volatility looks likely. The Fed decision will set a tone. If markets calm, miners could bounce if commodity prices stabilise. If global uncertainty persists, miners face more pressure. Some investors may shift to defensive names like healthcare and utilities. Others will watch for bargains in beaten-down miner stocks.

For long-term holders, BHP’s move signals stronger cost discipline. That could support margins when prices recover. Yet reputational risk and the social cost of layoffs may weigh on sentiment. Analysts advise watching quarterly guidance from major miners and any policy responses from state or federal governments.

Bottom Line

BHP’s decision to cut 750 jobs is a hard reminder that mining profits can be fragile. The move has local costs and wide market effects. The ASX drop shows how local corporate news and global central bank action can combine to unsettle markets.

Going forward, investors will watch commodity prices, company updates, and central bank signals. Policymakers will weigh the trade-off between revenue from royalties and the health of mining jobs. Businesses and communities will now face a tense period of adjustment.

Frequently Asked Questions (FAQs)

On September 16, 2025, BHP announced plans to cut 750 jobs. The company attributed the unprofitability of some operations to weak coal prices, higher Queensland royalties, and rising costs.

The ASX dropped on September 16, 2025, after BHP’s job cuts. Mining stocks fell as investors worried about profits, while markets also waited for the US Federal Reserve’s decision.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.