Big Banks Sound the Alarm With a Major Interest Rate 2026 Call

Australia’s interest rate outlook for 2026 is suddenly grabbing big headlines. In late 2025, the Reserve Bank of Australia (RBA) kept its cash rate unchanged at 3.60%, surprising many economists and borrowers. The move came as inflation started rising again, not falling as hoped.

Now, major banks like Commonwealth Bank and NAB are warning that the next big change might not be a cut but a rate hike as early as February 2026. This is a big shift from earlier forecasts that expected lower rates. Homeowners, investors, and small business owners are watching closely.

This article explores why banks are sounding the alarm, what could happen to rates in 2026, and what it means for everyday Australians.

What Triggered the Alarm? Key Signals Banks are Watching

Inflation turned hotter than many expected in late 2025. The RBA left the cash rate at 3.60% on 9 December 2025, but signalled the fight against inflation is far from over. That surprised markets. Big banks saw that and changed their models. They now worry that underlying price pressures will stay.

Household debt levels remain high after years of low rates. Wage growth rose, but productivity did not keep pace. Those trends make it harder to bring inflation down without slowing the economy. Consumer mood dropped sharply in mid-December 2025 as people feared higher costs and weaker spending. These facts pushed some banks to call for a fresh policy response in early 2026.

Australia’s Big Banks: What Each Is Forecasting for Interest Rates in 2026

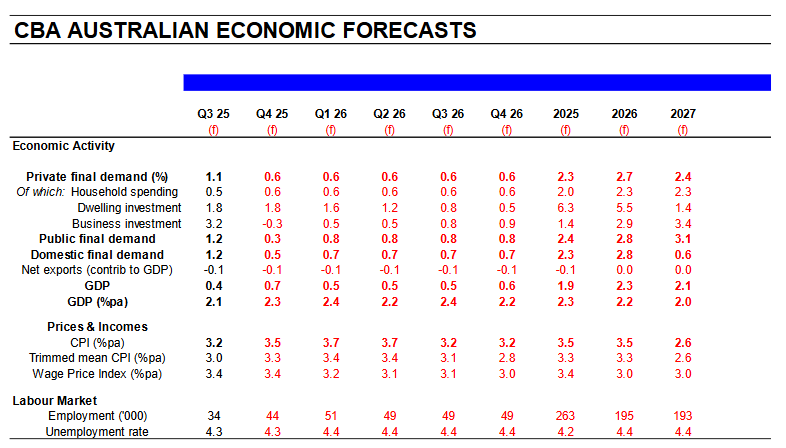

Commonwealth Bank now expects a rate rise in February 2026. The bank views this as a fine-tuning move to stop inflation from drifting up further. CommBank’s note flagged a lower tolerance at the RBA for upside inflation surprises.

NAB is more hawkish. It forecasts two 25 basis point hikes, in February and May 2026, and says a delay increases the chance of larger tightening later. ANZ and Westpac remain more cautious; ANZ leans toward no near-term hikes while Westpac has suggested cuts in some scenarios. The split shows real uncertainty. Markets must price a wide range of outcomes now.

Commonwealth Bank (CBA)

CBA updated its view after fresh inflation readings in November and December 2025. The bank thinks a single 25bp hike in February 2026 could be enough to nudge inflation expectations lower. That view is conditional on wages and growth not surprising to the upside.

National Australia Bank (NAB)

NAB warns that two hikes are likely. Their models show inflation risks and tight labour markets pushing the RBA to act twice in early 2026. NAB also tightened some fixed mortgage pricing in December 2025.

ANZ and Westpac

ANZ keeps a steadier tone and has not joined the hawkish chorus. Westpac’s published views differ across scenarios, with some economists still open to rate cuts later if inflation cools. This split among major banks adds volatility.

The RBA’s Dilemma: Inflation Control vs Economic Damage

The RBA faces a hard choice. It must keep inflation expectations anchored. At the same time, higher rates can slow jobs and growth. The December 2025 RBA statement left the cash rate at 3.60%. But the Bank noted inflation would likely stay above the 2-3% target for months. That comment hints the RBA may act if incoming data stays hot.

The lag from policy to the real economy matters. Even small rate moves now can hit mortgage wallets in 2026. Governor’s speeches in late 2025 signalled caution, not complacency. That leaves markets guessing about the timing and size of any moves.

Housing Market Impact: Why 2026 Could Be the Breaking Point

Many mortgages still have fixed terms that roll off in 2026. That will expose households to current variable rates. If the RBA hikes in February, repayments will rise. Some banks already nudged fixed rates up in December 2025. Housing demand is sensitive to even small rate moves. Lenders will tighten for some borrowers. Rental inflation also matters.

If rents climb, headline inflation will remain sticky. For a typical mortgage, two small hikes could add a meaningful monthly burden. That will shape consumer spending and home prices through 2026.

Business, Jobs, and Consumers: Who Gets Hit the Hardest

Small businesses carry a higher refinancing risk. Many rely on short bank lines and will face costlier borrowing if rates rise. Consumer confidence fell in mid-December 2025, which puts pressure on retail sales and investment.

Employers may slow hiring if demand weakens. The unemployment rate could rise modestly in 2026 if the economy cools. Credit demand could shrink while defaults edge up in riskier segments. Those shifts make policy choices harder for the RBA.

Global Factors Shaping Australia’s Interest Rate Path

Australia does not set rates in a vacuum. The US Fed’s path matters for global borrowing costs. If the Fed holds or cuts, that may ease pressure on the RBA. If the Fed tightens, global bond yields will push up Australia’s funding costs. China’s growth also matters.

A weaker China lowers commodity demand and export income. That could ease domestic inflation. Currency moves will influence import prices. The AUD’s swings in 2025 changed the imported inflation outlook. All these global forces feed into Australia’s 2026 rate path.

Best-Case vs Worst-Case Scenarios for Interest Rate 2026

In the best-case scenario, inflation eases after the December quarter’s print. The RBA only fine-tunes policy. One small hike in February 2026 would calm markets. Growth would stay positive. Jobs would hold steady. In the worst case, wages and services inflation remain high.

The RBA then tightens more. That causes a sharper spending slowdown, higher unemployment, and a hit to house prices. Probability leans toward a cautious path. Yet the split among bank forecasts shows both outcomes are possible. Use scenario planning now.

What Investors and Borrowers Should Watch in Early 2026?

Key data will guide decisions. The December quarter CPI, released in late January 2026, is the next big test for the RBA. Watch wage growth reports and monthly jobs data. Track bank pricing and bond yields.

Follow the RBA commentary and the Board meeting on 3 February 2026. Move quickly on refinancing offers that lock a lower rate. Consider stress-testing budgets for higher repayments. Tools like the AI stock research analysis tool can help model market reactions, but human judgment is still vital.

Conclusion: What the 2026 Rate Call Means in Practice

Big banks’ late-2025 pivot to a possible 2026 hike is a wake-up call. The RBA’s hold at 3.60% on 9 December 2025 did not end the policy debate. Early 2026 now looks pivotal. Households should plan for higher repayments. Businesses should stress-test cash flows.

Investors must price in more volatility. Acting early by checking mortgage deals, fixing rates selectively, or hedging exposures can reduce risk. The next few data releases will show whether the RBA moves in February or stays on hold for longer. Stay alert to clear signals.

Frequently Asked Questions (FAQs)

Australia may adjust interest rates in 2026. As of December 9, 2025, the RBA held the cash rate at 3.60%. Future changes depend on inflation and economic growth.

Big banks like CBA and NAB expect possible rate hikes in early 2026. Predictions vary. Some suggest one increase in February, while others see two moves depending on inflation.

Higher rates in 2026 could raise monthly mortgage payments. Fixed-rate loans ending may face higher variable rates, affecting household budgets. Banks and borrowers should plan.

Disclaimer:

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.