Bitcoin (BTC) Price Breakout: Analysts Eye $100,000 as Momentum Builds

The price of Bitcoin (BTC) has leapt again and many in the crypto world are paying close attention. As of December 4, 2025, BTC is trading near $93,500, marking a strong rebound from recent dips.

This bounce has stirred fresh excitement among analysts. Some are now eyeing the long‑hailed psychological milestone: $100,000. The buzz isn’t just hype. Growing demand from big institutions. Renewed investor interest. And improving technical signals.

Still, the mood feels different this time. There’s cautious hope. Not blind faith. Readers want to know is this really real? Or another short‑lived spike?

Let’s dig into what’s fueling this surge. We’ll examine why some experts believe $100,000 is within reach. And why others urge caution.

Bitcoin’s Recent Price Performance

In recent weeks, Bitcoin (BTC) has shown renewed strength. After dropping below $90,000, BTC bounced back and surged past $93,000 by early December 2025.

This rebound follows a series of market swings, sharp dips followed by strong recoveries. The bounce has not been slow or gradual. Instead, BTC has moved quickly, with steep rises over short time frames. Volume has increased. Many investors returned after taking a step back. The mood now feels like waiting for the next big move.

In recent months, BTC has already touched highs near $123,000. That prior rally gives today’s surge extra weight. It shows the crypto still has energy to run if conditions remain favorable.

Drivers Behind the Bitcoin Price Momentum

One big driver is strong interest from big investors and institutions. A report in August 2025 showed that both retail and institutional buyers have been “stacking relentlessly.”

In fact, during July and August alone, corporate treasuries reportedly added over 140,000 BTC. Institutional demand this year has outpaced new supply by roughly six times. That imbalance shows that demand is not just high now it’s far exceeding how many new coins are entering circulation.

Another factor is the shrinking supply of liquid coins. As more BTC moves to long-term storage whether by firms or “HODLers” fewer coins are available for trade. That makes the remaining supply more valuable when demand picks up.

Macro conditions also play a role. Many investors are seeking assets that might shield them from inflation or volatile markets. Bitcoin, with its fixed maximum supply and growing institutional acceptance, fits that role.

Analyst Predictions on Bitcoin and Target Price

Several analysts now believe Bitcoin can push toward or even beyond $100,000. Some are more bullish, with higher targets.

For example, a November 2025 technical analysis predicted BTC could reach $108,000 by year-end, provided it breaks certain resistance levels. Other forecasts see a near-term rebound to $95,000-$100,000, if BTC’s current momentum holds.

At the same time, long-term speculative forecasts remain lofty. Some market watchers believe that if institutional flows continue and macro conditions stay favorable, Bitcoin could see bigger upside.

Yet not all are completely confident. Some remain cautious, pointing to prior cycle patterns and reminding that volatility and sharp corrections remain part of Bitcoin’s history.

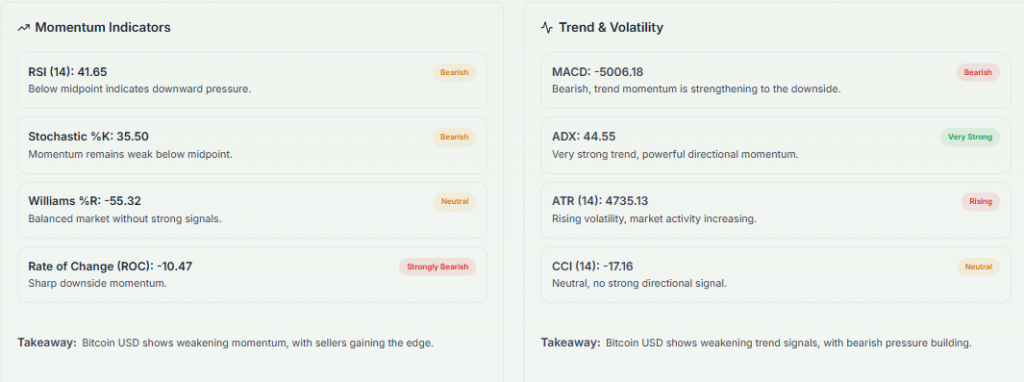

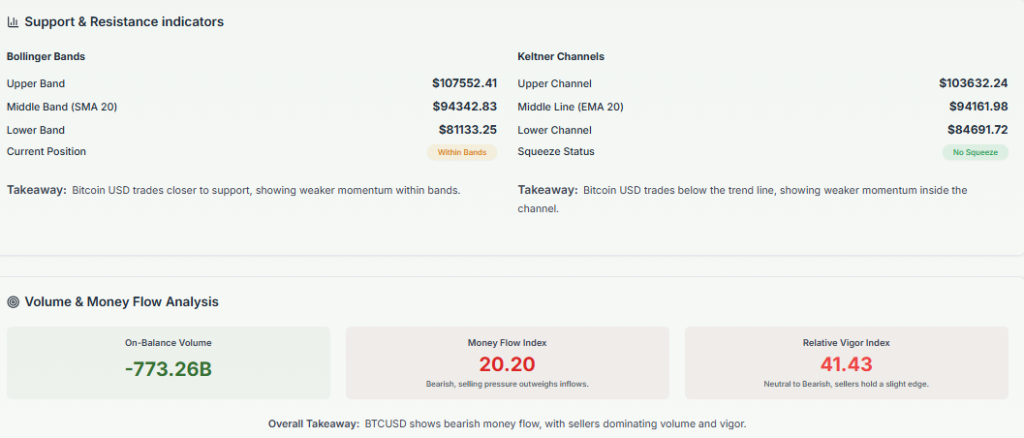

Technical Analysis Perspective

On the charts, Bitcoin’s setup looks interesting. As of late November 2025, technical indicators suggested a bullish recovery. Some analyses forecast BTC moving toward $108,000, with a key resistance around $95,000.

Other reports point to a possible rebound to $95,000-$100,000 over the next few weeks, as BTC had recently tested strong support near $87,500. Still, there are warning signs. Some technical metrics remain cautious, meaning BTC must overcome resistance carefully. A failure could trigger a pullback to support zones near $80,600.

Interestingly and showing how modern analysis evolves, a recent academic study used an AI tool (combining machine learning with traditional technical analysis) and found trading strategies that outperformed basic buy-and-hold strategies in back‑tests That suggests some investors are now using advanced tools in their BTC strategies, not just gut feeling or basic charts.

Risks and Challenges

Despite the optimism, risks remain. First, regulatory changes anywhere especially in major markets could shake investor confidence. Crypto remains under scrutiny worldwide.

Second, if demand slows or institutions shift focus, the tight supply + high demand balance could break. That could drag prices down. Historically, BTC has had sharp corrections after fast rises.

Third, macroeconomic events like interest rate decisions, inflation surprises, or currency shifts could hit crypto hard. Bitcoin doesn’t exist in a bubble. It moves in sync with global finance.

Fourth, psychological and sentiment-driven swings remain common. The public mood can shift fast. What feels like a sure trend today can reverse if fear returns.

Bitcoin: What Investors Should Watch

If you follow Bitcoin now, it’s smart to keep an eye on a few key signals.

- Watch institutional flow data: are big investors still buying or accumulating BTC?

- Track supply metrics how much BTC is leaving exchanges and entering cold storage.

- Monitor macroeconomic headlines rate changes, inflation data, and global economic stress.

- See how BTC performs around technical levels: Can it clearly break resistance near $95,000 or $100,000?

- Use advanced tools carefully. As one recent study shows, combining technical analysis with machine‑learning (or sentiment analysis) may give better insights than older methods

Closing Note

Bitcoin’s recent bounce, rising institutional demand, and tight supply suggest the stage is set for a serious push upward. Many analysts believe $100,000 is not just possible, maybe even likely if conditions stay stable.

Yet this ride is far from risk‑free. Regulatory shifts, macro turbulence, or sentiment reversals could all derail the rally. If you keep watch on market flows, supply data, macro trends, and technical signals and maybe use smarter tools you can better judge whether Bitcoin’s next move is toward $100,000 or back down toward support.

Frequently Asked Questions (FAQs)

Yes, some experts believe Bitcoin could reach $100,000 soon. Strong demand from big investors and tight supply help drive its rise. But nothing is guaranteed.

Bitcoin is rising because big funds and ETFs are buying more. Also, low interest rates and a weak dollar make it a more attractive investment.

Bitcoin could fall if rules change, large holders sell, or global markets wobble. Sudden interest‑rate shifts or negative news can also trigger a drop.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.