Bitcoin Dips Below $90,000: How AI Fears are Shaping Crypto Sentiment

On December 11, 2025, Bitcoin slid back below the $90,000 mark in a move that shocked many traders. The drop came as risk appetite in global markets weakened, driven in part by fresh concerns over slow profits from artificial intelligence investments after a major tech firm reported weaker-than-expected results.

This price break wasn’t just another number on a chart. $90,000 has been a key psychological line for Bitcoin this year. Falling under it again stirred fear in both retail and institutional wallets.

Unlike typical market pullbacks tied to macro data or Fed moves, this slide reveals a surprising new driver: growing anxiety around AI’s real impact on markets. That shift is changing how traders think about risk, confidence, and the future of crypto.

Why AI Suddenly Became a Threat to Bitcoin Bulls?

Bitcoin’s fall below $90,000 on December 11, 2025, shocked many traders across the world. The main driver was not just weaker macro data. There was fresh worry about the profitability of artificial intelligence tech. Oracle, a major cloud firm, reported that heavy spending on AI hardware and software was not turning into profit soon enough.

This news hit technology stocks hard. The selling spilled over into crypto markets, pushing Bitcoin down as risk appetite dried up. The move showed how tied crypto now is to tech sentiment and AI hopes.

Investors had hoped AI growth would be a net positive for markets. Instead, slower profits from AI projects created fear. That fear spread fast. Tech indexes fell, and Bitcoin followed. Many traders saw this as a sign that Bitcoin is no longer driven only by crypto fundamentals. It now bends to AI‑linked risk signals just like stocks do.

Real-Time Evidence: Data Showing AI’s Impact on Trading Patterns

The link between AI sentiment and crypto movement is now visible in price data. Bitcoin hasn’t just dipped once; it has been volatile for weeks. At times earlier in December, BTC slid toward $88,000 before recovering slightly.

AI profit warnings from tech giants made crypto traders more cautious. When the broader market turns risky, many automated systems adjust their risk models instantly. These models are often enhanced by AI or machine learning tools that scan data feeds for signals.

When AI models saw cooling tech earnings, they reacted by selling risk assets quickly. These moves add speed and size to price swings. The result was cascading sales that human traders felt too. This has made volatility even sharper.

AI Panic vs Human Panic: Who Is Causing More Damage?

Human fear in markets is old news. Traders panic when prices fall. But now, algorithm‑based systems react even before many humans realize what is happening. These systems read news and earnings in real time. They then trade based on sentiment shifts they detect. This can accelerate sell‑offs. Human traders often follow these moves rather than lead them.

When AI or algorithmic models turn bearish, the market can flip quickly. This speeds up corrections. Humans add to the noise by selling emotionally, but algorithms often start the wave. The combined effect increases short‑term chaos. The pattern seen in December 2025 suggests that machine‑driven reactions are now a major force behind price swings in Bitcoin and other cryptos.

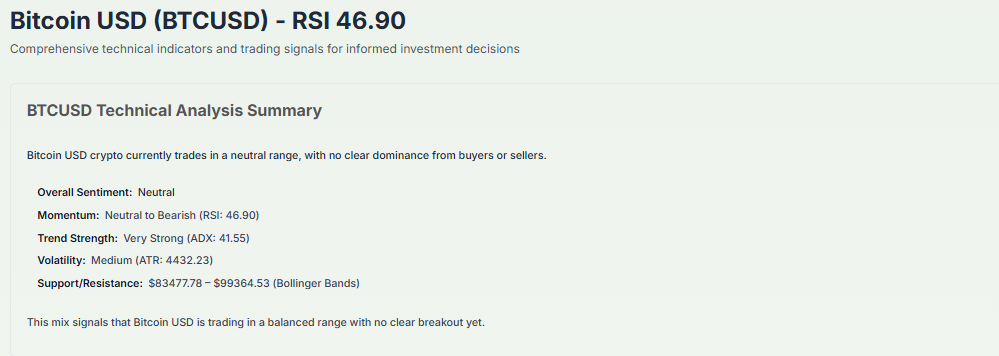

Bitcoin’s Technical Structure: What the $90K Breakdown Really Means

Technical traders pay attention to levels like $90,000. That price had acted as support in late 2025. When Bitcoin broke below it again, many stop orders triggered. These orders amplified the drop. Then, even basic technical models turned bearish for a short period. This created a feedback loop between tech indicators and market psychology.

The failure to hold $90,000 added fuel to sell signals used by automated trading systems. These systems often read technical breaks as reasons to reduce positions. That makes dips deeper and faster than they otherwise might be. Many analysts now view this level as a psychological turning point in the short term.

The New Narrative: “AI vs Bitcoin” Is Emerging in Crypto Circles

A new theme is gaining traction in crypto forums and analyst reports. Many now speak of an “AI vs Bitcoin” narrative. This does not mean that AI will destroy crypto. It means that AI‑linked market performance now influences Bitcoin’s short‑term prices more than before.

When tech stocks tied to AI weaken, Bitcoin tends to slide too. That is because many institutional traders no longer treat BTC as a separate asset class. Instead, they trade it alongside stocks based on broader risk signals. The rise of AI hype cycles has made this link even stronger. As tech companies grow dependent on AI for growth, fear around AI profits now has a ripple effect into crypto.

Analysts Split: Is AI Accelerating Volatility or Exposing Weak Markets?

Market experts are divided. Some say AI models help markets by adding liquidity. They argue that faster data interpretation can smooth out prolonged trends. Others think AI‑enhanced models can overreact to short‑term news. They believe this creates volatility that doesn’t reflect true fundamentals.

With Bitcoin now closely correlated to major stock indexes such as the S&P 500 and NASDAQ, any shock in tech stocks tends to spill into crypto. Analysts note this shift is stronger in 2025 than in past years. This growing correlation links BTC not just to crypto events but to global risk sentiment tied to tech and AI sectors.

AI‑Generated Fear: The Role of Deepfake Macro News

Another risk emerging is misinformation enhanced by AI. Deepfake news and misleading headlines can spread fast. Traders using algorithmic sentiment tools might react before humans verify facts. In markets already jittery about earnings and profits, false or exaggerated news can add to volatility. Academic research shows that media sentiment alone can influence Bitcoin prices within a short time.

This type of noise makes it harder to calibrate true sentiment. Trader tools picking up negative signals can push prices down even when fundamentals remain unchanged. This creates a new layer of risk in crypto sentiment analysis.

How Long Can the AI‑Led Bear Pressure Last?

The short‑term outlook remains uncertain. Some positive signals have appeared. Bitcoin did bounce above $91,000 after the December 8 price collapse. This suggests fear could be easing slightly.

However, AI‑linked models will likely continue scanning macro data, earnings reports, and tech news. If more profit warnings come from AI‑driven sectors, markets could weaken further. Metrics traders will watch include institutional flows, ETF demand for Bitcoin products, and macro indicators such as inflation and real interest rates.

Conclusion: Bitcoin’s Future in an AI‑Dominated Market

Bitcoin’s price now reflects more than crypto‑specific trends. It reacts to AI technology sentiment and broader global finance dynamics. The dip below $90,000 in December 2025 highlights how intertwined crypto is with tech market performance.

As AI continues shaping market behavior, Bitcoin’s path may become more linked to AI sector expectations. Traders and investors must now consider not just crypto fundamentals but also how AI narratives influence global risk appetite. The balance between tech optimism and caution could be a major factor in BTC’s next move.

Frequently Asked Questions (FAQs)

Bitcoin dipped under $90,000 on December 11, 2025, after weak profit forecasts from tech firms hurt market confidence. This made investors shy away from risky assets like Bitcoin.

Yes. Investors grew uneasy about slow profits from AI‑linked tech. That fear spread to markets and made buyers pull back, pushing Bitcoin prices lower in 2025.

Some analysts see a chance Bitcoin could climb back over $100,000 if risk sentiment improves and institutional demand rises, but the path remains uncertain in late 2025.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.