Bitcoin News Today: Bitcoin Nears $100K as Traders Weigh Macro Risks and Technical Rebound

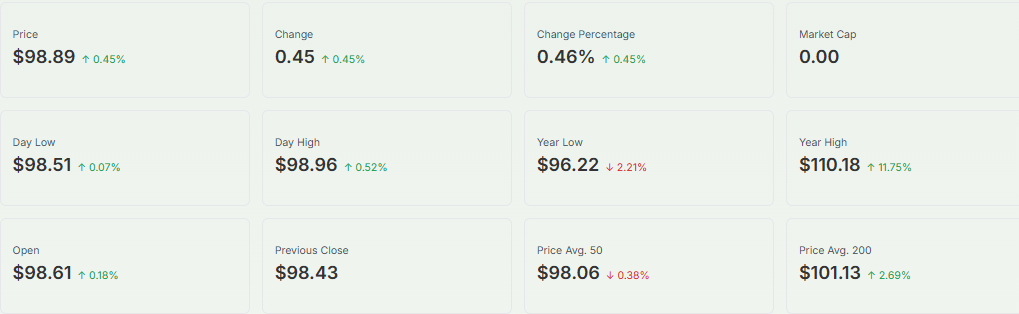

On October 21, 2025, Bitcoin traded near US$107,000 after touching a recent high above US$111,000. The market feels tense yet hopeful. Investors are watching the US$100,000 level closely. The rebound has caught attention, but risks still surround the market. Global trade issues and tighter rules add pressure. Liquidity worries also make traders nervous.

Still, technical charts hint at a possible breakout after weeks of sideways moves. Some traders see this as a turning point. Optimism is rising, but caution remains. If Bitcoin breaks above resistance, it could spark another strong rally. If it fails, prices may fall again. The next few days could shape Bitcoin’s next big move. Let’s have a look in detail.

Bitcoin’s Price Movement and Market Sentiment

Bitcoin has been showing sharp swings in mid-October trading. On October 21, 2025, the cryptocurrency hovered near US$107,000 after briefly rising above US$111,000 earlier in the week. According to Latestly, this pullback came as traders took profits following a strong rally.

Market sentiment remains mixed. The Fear and Greed Index sits around 65, reflecting mild optimism. Bitcoin’s market cap continues above US$2 trillion, keeping it dominant over other cryptocurrencies.

However, trading volumes have declined, showing hesitation among retail investors. Analysts note that a decisive close above US$117,000 could strengthen the bullish setup, while a dip below US$100,000 might trigger caution.

Technical Factors Driving the Rebound

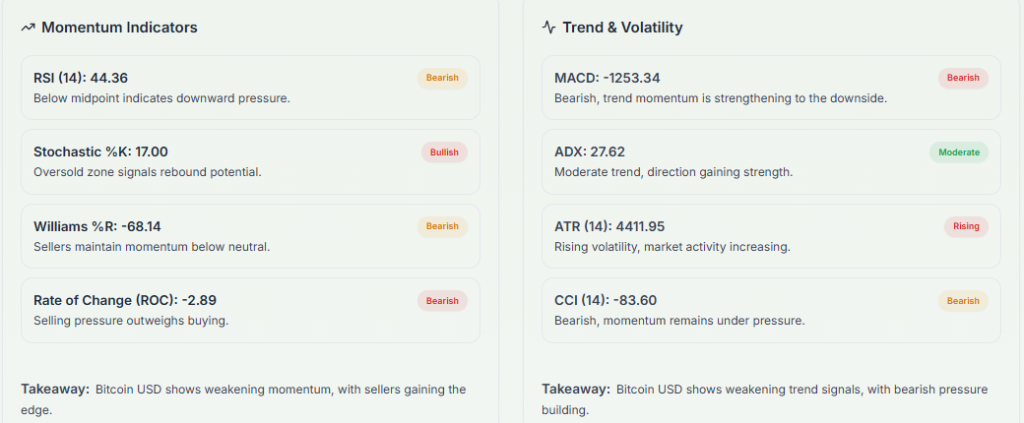

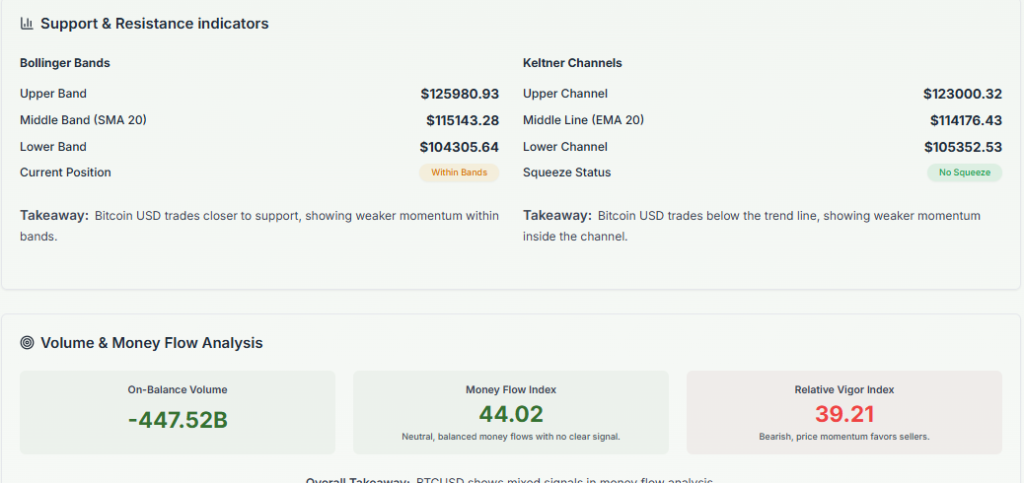

Technical charts show Bitcoin consolidating after its sharp rally. The 200-day moving average remains an important support zone near US$100,000. The Relative Strength Index (RSI) cooled from overbought levels but still signals moderate strength.

Traders watching the moving average convergence-divergence (MACD) indicator see early signs of recovery momentum. Analysts at CoinDesk reported that on-chain data show reduced leverage and lower liquidation risk after the correction. This suggests a healthier base for the next move.

Chart watchers believe that if Bitcoin closes above US$117,000, a breakout could push it toward new highs. However, a failure to hold current levels may invite further short-term corrections.

Macro and Economic Risks in Focus

Bitcoin’s rally doesn’t exist in isolation. Global macro conditions remain a major driver. The U.S. Dollar Index (DXY) strengthened slightly this week, weighing on crypto assets. According to Reuters, traders are cautious ahead of the Federal Reserve’s November meeting, where rate policy remains uncertain.

High inflation in major economies and slower global growth are shaping sentiment. The Federal Reserve’s next signal on rate cuts or policy tightening will likely influence Bitcoin’s direction.

Geopolitical tensions and regulatory updates, especially from the U.S. and Europe, add layers of uncertainty. Analysts agree that Bitcoin now reacts almost as strongly to macro headlines as to crypto-specific events.

Institutional and Retail Investor Strategies

Institutional investors continue to play a growing role in this cycle. ETF inflows during early October boosted Bitcoin’s price momentum. However, by mid-October, inflows slowed as some funds rebalanced portfolios.

Derivatives data from CoinGlass show moderate short interest and slight negative funding rates, signaling cautious sentiment. This mix could lead to sudden price swings if traders rush to cover shorts.

Retail activity tells a different story. Wallet transactions increased when Bitcoin crossed US$100,000, but slowed once volatility returned. Social discussions on platforms like X and Reddit remain active, showing renewed curiosity among smaller investors. Some traders now rely on AI Stock Research Analysis Tool integrations to study ETF flows and derivative patterns for predictive insights.

Expert Views and Market Outlook

Analysts remain divided on what’s next. Crypto strategist Katie Stockton told Bloomberg that Bitcoin’s pause is “a natural part of a long-term bullish structure.” Others, like Mark Newton from Fundstrat, warn that losing the US$100,000 level could lead to a steeper correction toward US$92,000.

Experts also mention that Bitcoin’s next move may align with the 2024 halving cycle effects still unfolding through 2025. Historically, prices consolidate before another sharp rise about a year after each halving. Overall, most forecasts point to a possible retest of all-time highs if the macro environment stabilizes.

Wrap Up

Bitcoin’s current phase is critical. The price hovers near US$107,000, caught between bullish enthusiasm and economic uncertainty. Technical charts hint at recovery potential, but macro risks keep traders alert. Institutional flows and ETF activity remain the main forces shaping direction. Whether Bitcoin breaks above US$117,000 or dips below US$100,000, the coming weeks could define the next major trend

Frequently Asked Questions (FAQs)

On October 21, 2025, Bitcoin trades near $100K because of higher investor demand, ETF inflows, and strong market interest, even with global risks affecting prices.

Analysts on October 21, 2025, say Bitcoin could rise above $100K if trading volume grows and global markets stay stable, but price swings may still continue.

Experts on October 21, 2025, suggest being careful. Bitcoin is near $100K, but global inflation, interest rates, and market changes can still cause quick drops.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.