Bitcoin News Today, Dec 9: Will 2025’s Wild Ride Leave BTC in the Red?

As of December 9, 2025, Bitcoin (BTC) finds itself at a delicate moment. After a wild 2025 including a record high above $126,000 earlier in the year its price has recently dipped to around $90,000.

Investors are now watching closely. There is less aggressive buying, and caution seems to rule the day. Some believe Bitcoin may end 2025 in the red. Others say this is just calm before another surge.

This article digs into what’s really driving BTC now from ETF flows to interest-rate shifts and asks the big question: After such turbulence, could Bitcoin close the year below where it started? Let’s explore.

Bitcoin Price Snapshot: Dec 9’s Tight Range Signals Investor Caution

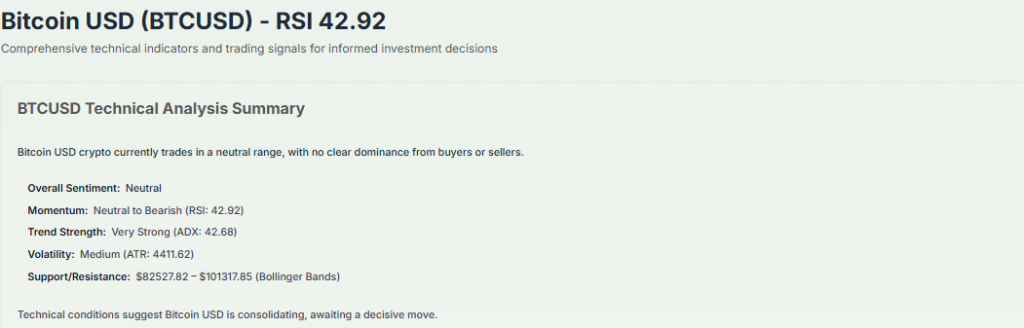

On December 9, 2025, Bitcoin traded near the low $90,000s after a sharp year of moves. Volatility has returned multiple times since the October peak above $126,000. The market shows thin intraday ranges and lower liquidity in many venues. Large holders paused visible accumulation, while some funds took advantage of the dip to buy blocks of coins. These dynamics keep price action contained and make directional conviction scarce.

Why BTC’s Micro-Consolidation Matters?

A tight trading band in December matters because it concentrates risk. When volume is low, even moderate selling can push prices far. Exchanges reveal fewer large buy orders close to the market. That makes liquidity gaps larger. Traders tend to hedge more. Hedging and cautious flows can mute rallies and magnify drops.

ETF Flow Slowdown: A Red Flag or Seasonal Pause?

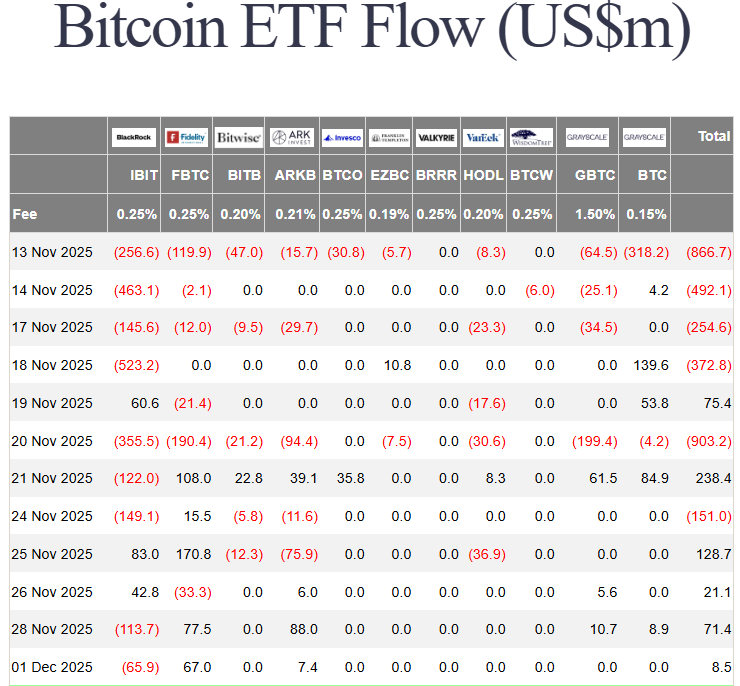

Spot ETF flows cooled in November and showed mixed signals in early December. Several large funds posted net outflows in recent weeks. That sapped one major source of demand. At the same time, some issuers and institutions report renewed buying during the first days of December. This tug-of-war in ETF flows creates a fragile short-term balance and raises the odds of a volatile break when a clear trade catalyst appears.

Macro Triggers: Four Forces That Could Break BTC’s December Stalemate

Fed Rate Path: Markets Betting on Cuts, BTC Waiting for Confirmation

Markets entered December pricing a possible Fed pivot. The Fed faces pressure to deliver rate cuts before year-end. Bitcoin reacts to changes in real yields because higher yields raise the opportunity cost of holding non-yielding assets. If the Fed delays or signals further caution, risk assets can correct quickly. Bitcoin has shown heightened sensitivity to U.S. policy statements this year.

Dollar Strength Returns: Why Bitcoin Traders Can’t Ignore DXY

The U.S. dollar index (DXY) still drives large parts of global liquidity. Sudden DXY strength tightens cross-asset funding and triggers rotations into cash. Bitcoin often moves ahead of equities when a DXY shock appears. A stronger dollar can squeeze crypto longs. Traders should watch DXY levels that correspond historically with major risk reductions.

Asia’s Trading Desk Moves and Overnight Volatility

Asia’s desks set the tone for many UTC session swings. High leverage on Korean and Japanese platforms caused fast price works during the year. Those desks now hold more leveraged long positions, which can amplify overnight reversals. When liquidity around New York closes and Asia opens, quick liquidations can create violent intraday moves. That pattern partly explains abrupt dips seen in late 2025.

Miner Behavior Post-Halving: The Unspoken Price Control

Miners faced squeezed margins after the 2024 halving and then again as difficulty rose. Mining costs climbed to record levels. Many miners increase sales during price spikes to cover operating costs. That selling pressure can cap rallies, especially in lower-volume months like December. Miner outflows act as a recurring supply source and can blunt sustained upside.

2025 Outlook: Could This Be Bitcoin’s Most Unpredictable Year Yet?

The Election-Year Pattern That Bitcoin Hasn’t Faced Before

2025 followed political shifts that influenced market risk appetite. Policy changes and trade decisions created abrupt liquidity shocks. A politically driven rule or tariff can trigger outsized crypto liquidations, as occurred in the fall. Election cycles also increase uncertainty about regulation and capital flows. That makes forecast windows shorter and risk premia larger.

The Great ETF Concentration Problem

ETF dominance concentrated assets under a few issuers this year. When a handful of funds control large shares of retail and institutional exposure, market structure changes. Concentration makes flows lumpy. Large rebalancings or redemptions by major ETFs can overwhelm natural liquidity. The result can be sudden volatility that is not tied to on-chain fundamentals but to product mechanics and ETF arbitrage constraints.

Bitcoin Halving Lag Effect: Is the 2021-Style Surge Off the Table?

Historical halving patterns show delayed price response. Post-halving moves often take months to materialize. In 2025, institutional participation was higher than in earlier cycles. That dampens speculative levered rallies. With more professional market-making and algorithmic hedging, the market could shift from a retail-led parabolic to a slower, institution-led accumulation. That makes a repeat of 2021’s rapid surge less likely without a major macro catalyst.

The Forgotten Risk: Layer-2 Congestion & Fee Spikes

Network usage and Layer-2 congestion remain practical risks. Periodic spikes in transaction fees or bridge failures reduce user convenience. Investors sometimes interpret such events as friction to adoption. Persistent performance problems on the network or on major rollups can sap confidence and delay inflows from retail users and merchants.

Will Bitcoin End 2025 in the Red? Analysts aren’t Talking About

Bearish Case: How BTC Could Slip Below Key Psychological Levels

A compound of ETF outflows, delayed Fed cuts, and increased miner selling can push Bitcoin lower. If liquidity dries, existing bids can collapse fast. Options market data shows growing demand for protective puts, which could become self-fulfilling in a liquidity crunch. In this scenario, Bitcoin might form a long top and finish the year lower than it began.

Neutral Case: The Slow-Bleed Year

A neutral trajectory keeps BTC trapped in a wide range most of the year. Slow inflows balance slow outflows. Traders lack conviction and prefer yield-bearing instruments. The market grinds sideways in a low-volatility regime, punctuated by short spikes. This outcome frustrates momentum traders but preserves core holder positions.

Bullish Case: The Delayed Explosion

If the Fed signals decisive and timely rate cuts and ETF demand resumes at scale, liquidity could flood back. Late-in-year alignment between policy easing and reduced miner selling might fuel a steep rebound. Long-dated option structures suggest some participants price a future where massive moves occur in either direction. If that alignment happens, a late-2025 or 2026 rally could be very sharp.

Bitcoin: What Smart Money Is Doing Right Now

Large institutional buyers show selective accumulation during dips. Some corporations and flagship holders added inventory at sub-$92k levels. Risk managers widen their stop bands and favor long-dated hedges. Options desks sell short-dated premiums while owning longer maturities. Some funds track stablecoin inflows as an early indicator of fresh retail capital.

Key Levels to Watch Before Year-End

December will revolve around a handful of technically important zones that acted as support or resistance through Q4. Liquidity above and below these pools will determine the size of any move. A break below multi-touch support could trigger a fast retracement.

Conversely, an impulsive move through concentrated sell walls could draw momentum buyers and ignite a rapid advance. Traders should watch ETF net flows, miner outflows, and Fed language for confirmation.

Closing

Bitcoin’s path at the close of 2025 depends less on headlines and more on flow dynamics. ETF demand, miner selling, and Fed signals set the stage. On December 9, 2025, price action reflected that tense balance. The market can pivot quickly when liquidity changes. Close attention to flows and risk metrics will reveal whether this year’s wild ride ends in a red close or a last-minute rebound.

Frequently Asked Questions (FAQs)

Bitcoin could end 2025 lower if ETF outflows rise and the Fed delays rate cuts. The market on December 9, 2025 shows mixed signals and higher caution among traders.

Bitcoin may reach a new high if liquidity improves and ETF demand returns. This depends on stronger market confidence, which remains uncertain as of December 9, 2025.

Yes, ETF flows affect price because they show real demand. When inflows slow, the market becomes weak. Recent December 2025 data shows uneven ETF activity and cautious investor behavior.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.