Bitcoin News Today: Regulators Warn Consumers Over Crypto ATM Scams

On August 4, 2025, the Financial Crimes Enforcement Network (FinCEN) issued an urgent warning about rising fraud involving crypto ATMs. Scammers are targeting everyday people, often convincing them to buy bitcoin or other cryptocurrencies at kiosks and send the funds instantly. Once the money is sent, it’s nearly impossible to get it back.

Many victims are older adults who receive a call or message demanding immediate action. This latest alert reminds us how quickly fraud schemes adapt when technology is involved. The convenience of a crypto ATM hides a serious risk: a one-way ticket for scammers. Now more than ever, people must pause, think, and verify before inserting cash into these machines.

Nut-graf / Why does this matter?

Crypto-ATM scams are rising fast. Regulators and law enforcement now call them a major threat. On August 4, 2025, FinCEN issued a formal notice warning that kiosks that sell convertible virtual currency are being used in fraud and other illicit activity. The notice said these machines can help scammers move cash quickly and with little trace. That matters because crypto transfers are usually final. Once money leaves a wallet, reversal is nearly impossible. Customers can lose life savings in minutes.

What a Crypto ATM is and How it Differs from a Bank ATM?

A crypto ATM lets a person buy or sell cryptocurrencies. Machines sit in convenience stores, malls, and gas stations. Some are simple. Others require ID or a phone number. Unlike bank ATMs, crypto ATMs convert cash into digital coins. They do not offer chargebacks or the same fraud protections banks provide. That makes them attractive to scammers. Operators collect fees. But fees do not undo losses when fraud happens.

How the Crypto Scams Work? Common Scripts and Mechanics

Scammers use pressure and fear. A caller poses as a government agent, tech support, or a loved one in trouble. The victim is told to buy cryptocurrency at a kiosk. The caller supplies a QR code or wallet address. The victim scans and sends cash into the machine. The scammer then moves the crypto to other wallets. The transfer is fast. Recovery is rare.

Scammers also push victims to act immediately. That removes time for doubts or verification. Red flags include requests for secrecy, urgent timelines, and any demand to use a crypto ATM to “prove” identity or pay a fine.

Recent Data and Vvid examples

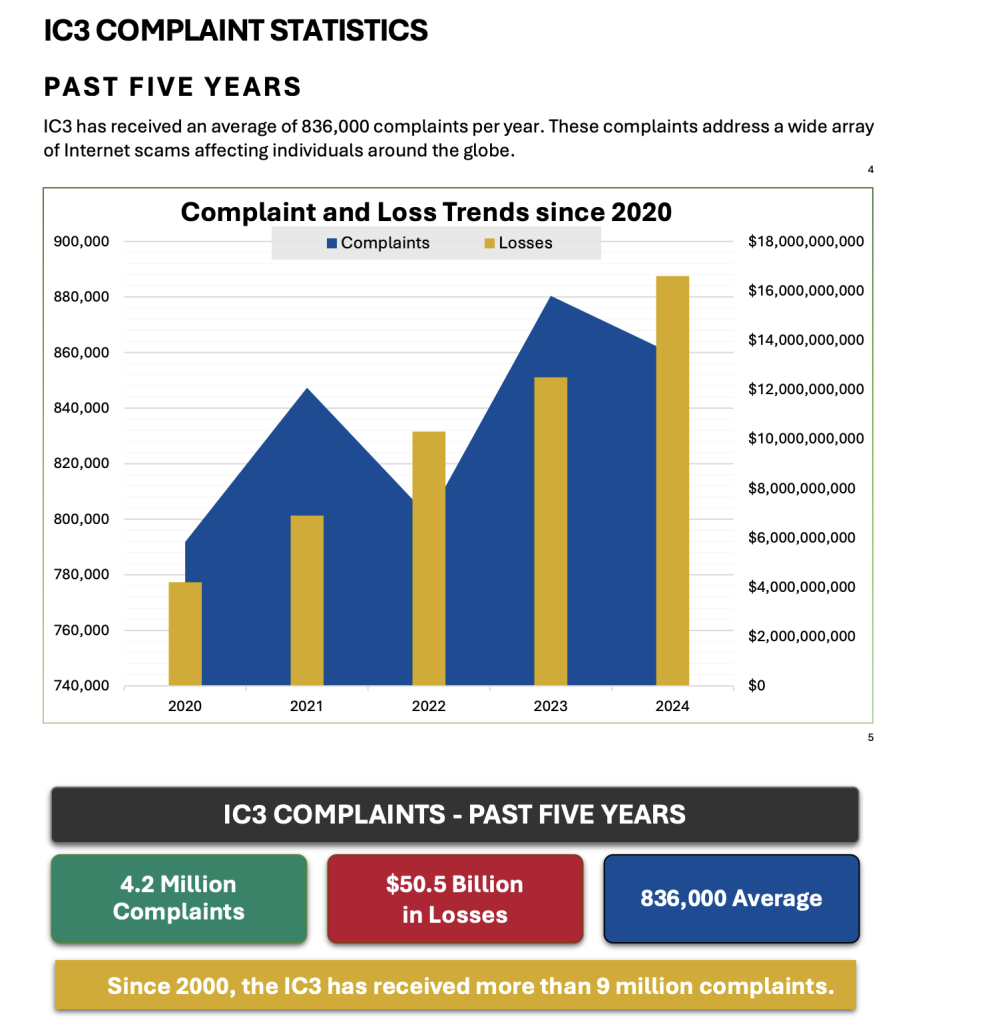

Federal crime reports show huge losses. The FBI’s internet crime report for 2024 found that investment fraud tied to cryptocurrency caused the largest losses, totaling billions. Older adults were hit especially hard. The IC3 annual report for 2024 catalogs complaints and shows that scams using cash couriers and crypto channels caused major harm.

In Australia, AUSTRAC’s probe found frequent crypto-ATM users were actually victims who had deposited large sums under pressure, including one person who lost over A$430,000. These cases show the human toll: ruined retirements, broken trusts, and long recovery processes.

Regulators’ Warnings and Actions

Regulators are stepping in. FinCEN’s August 4, 2025, notice lists red flags and asks financial firms to report suspicious activity. The FTC has also warned consumers about BTMs since September 3, 2024, and published data showing sharp increases in fraud tied to these machines.

Law enforcement is urging operators to tighten controls and to post stronger warnings for users. Some jurisdictions have begun stricter oversight of kiosk operators. The goal is to make illicit use harder and to give authorities better leads when crimes occur.

What Consumers Should Do?

Stop if a stranger asks for crypto payments. Hang up on callers who demand immediate action. Do not use a crypto ATM to pay a bill or “verify” identity for someone on the phone. Confirm requests by calling known numbers for banks, agencies, or family members.

Ask a store worker for help if unsure about a kiosk. Report fraud to local police and to federal complaint systems like the FBI’s IC3 or the FTC. Keep evidence: screenshots, receipts, and the wallet address used. Those details help investigators trace flows.

Industry Response and Proposed Fixes

Some kiosk companies now show on-screen warnings and require extra steps for large purchases. Others have begun collecting stronger ID details and monitoring for suspicious patterns. Regulators want more. Suggestions include mandatory transaction limits, forced delays for large transfers, and stronger KYC checks.

Lawmakers and enforcement agencies are also pushing for clearer operator accountability. Meanwhile, some firms explore automated pattern detection. One company mentioned using AI to flag unusual behavior on kiosks. Operators say they do not profit from scams and that they cooperate with investigations. Still, critics call for faster and tougher regulation.

Final Thoughts

Crypto ATMs are convenient. That convenience can be dangerous when scammers exploit it. Transfers are mostly irreversible. People must slow down, verify callers, and never let pressure decide financial choices. If fraud occurs, saving receipts and the wallet address is essential.

Report incidents to local police and file complaints with the FBI’s IC3 and the FTC so authorities can build cases and warn others. Timely reporting also helps regulators craft rules that protect the public.

Frequently Asked Questions (FAQs)

A crypto ATM scam happens when criminals trick people into sending money through Bitcoin ATMs. On August 4, 2025, FinCEN warned that these scams are rising fast.

Never send crypto to someone you don’t know. Always verify payment requests. FinCEN and the FTC 2025 advised people to stop and check before using any Bitcoin ATM.

Crypto ATMs are legal but risky. Once money is sent, it can’t be returned. Regulators in 2025 urge users to be cautious and follow posted security warnings.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.